- Bitcoin trades near $101,550 on Nov. 5 after an 11.8% weekly drop, keeping the market in risk-off mode.

- Failure to close the week back above $108,000 keeps the door open to a deeper move toward the $98,000 to $102,000 zone.

- Heavy BTC inflows to exchanges and liquidity strain from the U.S. shutdown are limiting dip buying across crypto.

Bitcoin extended its slide this week and traded near $101,550 on Nov. 5, keeping traders focused on whether the market can defend the six figure area. The move followed a 5.29% daily loss and an 11.82% decline over the past week, even though Bitcoin still saw billions of dollars in daily trading volume.

The tone across desks shifted to caution because sellers are sending more BTC back to exchanges while macro uncertainty is slowing fresh spot demand. This keeps Bitcoin vulnerable to another leg lower if buyers do not step back in.

Related: Why are Bitcoin and crypto market down today?

Bitcoin Slips Below Weekly Trend As $108,000 Stays Out Of Reach

Analyst Rekt Capital observed that Bitcoin has closed below the 21-week exponential moving average (EMA), converting it into new resistance. The asset has now deviated below the $108,000 level for the fifth consecutive week.

Analysts Track $98,000 To $102,000 As Maximum Pain Reversal Zone

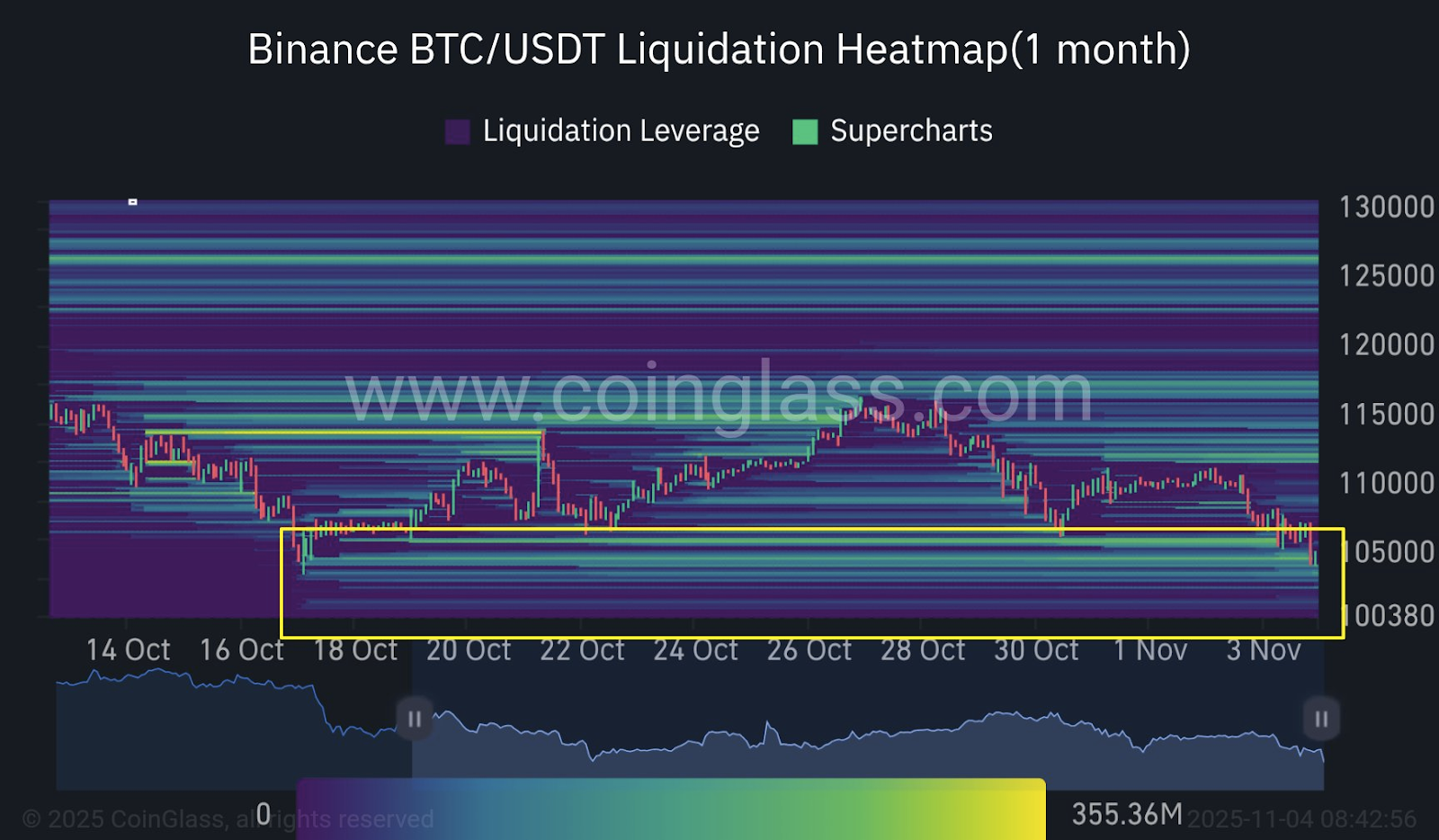

Charting service Stockmoney Lizards said Bitcoin is getting close to what it called a reversal zone. Exchange order books show heavy sell orders while sentiment has tilted to bearish. The team noted that in past cycles, similar patterns of selling at support were followed by sharp candles in the opposite direction once sellers were exhausted. The group pointed to the $98,000 to $102,000 pocket as an area where forced selling and capitulation could trigger a rebound. This means traders watching that band may get a short term bounce even if the larger trend is still under pressure.

Exchange Inflows Show This Is The Heaviest Sell-Side Wave Of The Cycle

On-chain research platform Checkonchain reported that Bitcoin’s price is “leaking lower” as investors grow anxious about whether the cycle top was reached at $126,000. The data indicates billions of dollars in BTC returning to exchanges daily. Despite this, the price has largely held above the $100,000 level, which analysts describe as remarkable given the magnitude of supply returning to the market.

The report suggests this cycle’s sell-side pressure is the largest ever recorded. The ongoing selling appears to stem from profit-taking and liquidity redirection rather than panic. Still, market participants are watching for signs of stabilization as liquidity inflows attempt to absorb this wave of supply.

Macroeconomic Factors Add Strain

According to CryptoQuant, the recent U.S. government shutdown has disrupted liquidity flows, amplifying pressure across digital assets. Although temporary relief is expected once the situation resolves, the analytics firm warns that confidence and capital recovery may take longer.

Consequently, Bitcoin’s ability to reclaim the $108,000 resistance remains critical in determining whether the current decline stabilizes or deepens into a broader correction.

Bitcoin Price Today – Analysis

- Levels: The immediate resistance sits at $108,000, with the wider range ceiling still at $125,000. On the downside, analysts are tracking $102,000 and the round number $100,000, with a deeper zone at $98,000. A weekly close below $100,000 would weaken the bull structure and invite more range trading.

- Momentum: Momentum has turned down on the weekly chart after repeated failures at $108,000, which tells traders that breakouts are not sticking. Until momentum flips back up, rallies into resistance are likely to be sold.

- Liquidity and Flows: Liquidity remains thin because spot buyers are not absorbing the extra supply coming from exchanges. That means volatility can expand quickly if another wave of selling hits.

Related: Bitcoin Price Prediction: Exchange Outflows Hit $162M as BTC Loses Trendline Support

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.