- Bitcoin rises to top global assets, surpassing commodities and major tech companies.

- Institutional demand and ETFs fuel Bitcoin’s growth and increasing market prominence.

- Bitcoin nears key milestones, showing strong momentum and potential for future growth.

Bitcoin has become the eighth-largest world asset by market capitalization. Valued at $1.786 trillion, Bitcoin ranks ahead of traditional commodities like silver and companies like Meta Platforms.

According to IntoTheBlock, Bitcoin ranks among the top global assets, behind gold, Apple, NVIDIA, Microsoft, Alphabet (Google), Amazon, and Saudi Aramco. Gold leads with a market cap of $17.526 trillion and a unit price of $2,610. Tech companies dominate the top, with Apple valued at $3.428 trillion, NVIDIA at $3.401 trillion, and Microsoft at $3.085 trillion.

Bitcoin is valued higher than silver, which has a market cap of $1.746 trillion, and Meta Platforms, valued at $1.400 trillion. Saudi Aramco edges out Bitcoin with a valuation of $1.792 trillion.

Institutional Interest Drives Bitcoin’s Growth

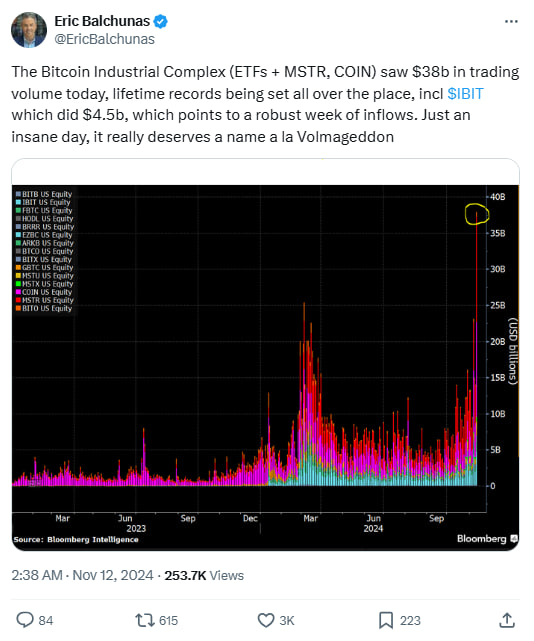

Bloomberg’s Senior ETF Analyst Eric Balchunas noted that institutional interest and the rising adoption of Bitcoin exchange-traded funds (ETFs) have fueled the surge in Bitcoin’s market cap.

BlackRock’s iShares Bitcoin Trust (IBIT) recorded a $4.5 billion trading volume, signaling heightened institutional participation. Additionally, the wider Bitcoin ecosystem, including ETFs, MicroStrategy, and Coinbase, achieved a record-breaking $38 billion in trading volume.

Bitcoin’s Path to $100,000

Bitcoin’s recent rally has seen its price climb to $91,642.63, representing a 1.22% increase over the past 24 hours and a 3.90% gain over the last seven days. With a circulating supply of 20 million BTC, its market cap now stands at $1.813 trillion.

The crypto asset reached an all-time high of $88,000 earlier this year, leaving it within striking distance of the six-figure milestone.

Despite its impressive growth, Bitcoin remains smaller than gold, which boasts a market cap nearly 10 times larger. The Kobeissi Letter, a financial markets commentary, pointed out this contrast, noting the potential for Bitcoin to grow further in the coming years.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.