- Bitcoin dropped 3.38% to $61,083 after Iran launched missile attacks on Israel, escalating Middle East tensions.

- The cryptocurrency market saw $142 million in liquidations, with 95.77% occurring in long positions following the crisis.

- Bitcoin’s RSI at 49.00 and bearish MACD signal indicate growing downward momentum amid geopolitical instability.

Bitcoin’s value sharply declined after reports emerged of Iran launching missile attacks against Israel. Bitcoin dropped to $61,083 before recovering slightly to $61,396, marking a 24-hour drop of 3.38%. The sudden sell-off mirrors escalating geopolitical tensions that could potentially lead to a broader regional conflict.

Iran launched a missile barrage on Israel, worsening the ongoing hostilities with Hezbollah and Hamas, which have been active for nearly a year. This new attack threatens to further destabilize the Middle East, raising concerns for a potential regional war.

The Iran blitzkrieg comes just five days ahead of the first anniversary of October 7, 2023, attacks when Hamas stormed into Israel, abducted civilians from a music festival, and carried out indiscriminate killings.

Beyond the immediate economic impact, the missile strikes forced millions of Israelis to seek refuge in bomb shelters as air raid sirens sounded across the country. Israel is expected to retaliate as tensions have been mounting following their previous military actions against Hezbollah leadership in Lebanon.

Read also: Crypto Market Experience Significant Pullback Following Iran’s Attack on Israel

Liquidations Surge as Market Responds

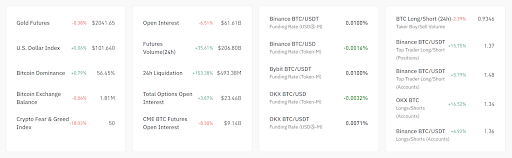

Coinglass data shows a surge in liquidations in the cryptocurrency market following the attacks. Total liquidations within the last hour reached $142 million, with a whopping 95.77% coming from long positions. Total liquidations over the past four hours hit $362 million as investors scrambled to adjust their positions.

Bitcoin’s price movements reflected the overall market volatility. Bitcoin is valued at $61,937.28, down 2.32% over the past 24 hours. The market capitalization stands at $1.22 trillion, with a 24-hour trading volume of over $44 billion.

Bitcoin’s Technical Analysis Shows Downward Pressure

Technical indicators suggest that Bitcoin might continue to face selling pressure in the short term. The Relative Strength Index (RSI), currently at 49.00, points to slightly bearish momentum, a notable shift from the recent overbought conditions when the RSI stood at 61.52.

The Moving Average Convergence Divergence (MACD) also indicates a bearish outlook. The MACD line sits at 1,297, while the signal line is slightly higher at 1,331, with the histogram showing negative momentum at -34. The bearish crossover further supports the notion of building downward momentum for the cryptocurrency.

Impact on Broader Cryptocurrency Market

The missile crisis affected not only Bitcoin but also triggered volatility across the entire cryptocurrency market. Investors are now more cautious, fearing that further geopolitical instability could lead to more sudden sell-offs.

The broader market saw substantial liquidations, mostly in long positions, highlighting the market’s sensitivity to external events. As Bitcoin hovers near $61,000, traders are watching key support levels, waiting to see how the conflict in the Middle East might further impact the digital asset market.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.