- Bitcoin trades about 47% below its $126,000 peak from October 2025.

- Analysts project 2026 targets between $42,000 and $290,000.

- A $1,000 investment today could range from about $630 to $4,350.

Bitcoin trades near $67,000 after a significant correction from its October 2025 high. Analysts remain divided on whether 2026 will bring recovery or further declines. That outlook determines what $1,000 invested today could be worth by the end of this year.

Bitcoin’s Current Position

Bitcoin reached an all-time high above $126,000 in October 2025. Since then, the price has fallen nearly 50%, dropping to about $60,000 on February 6 before stabilizing near $67,000. At current levels, Bitcoin remains about 47% below its peak.

Market structure shows continued pressure. Bitcoin trades below its 20-day exponential moving average at $75,381, the 50-day at $82,691, the 100-day at $88,984, and the 200-day at $94,877. Futures open interest has declined from $95 billion in October to about $44 billion, according to Coinglass.

At the same time, whale wallets holding more than 1,000 BTC accumulated roughly 53,000 coins last week, worth about $3.65 billion.

Bearish Scenarios for 2026

Several analysts warn that the correction may not be over. Markus Thielen of 10X Research and Steven McClurg of Canary Capital have projected a possible move toward $50,000 if selling pressure continues.

Veteran trader Peter Brandt has suggested a more bearish price, predicting that Bitcoin could fall closer to $42,000 if it follows prior cycle patterns. Brandt referenced his “banana chart” model, which compares historical peak-to-trough declines.

Notably, Japanese research firm XWIN Research argues Bitcoin may already be entering an early bear market phase. The firm cited capital flow data showing that more than $300 billion entered crypto markets in 2025 while overall market capitalization declined. The Crypto Fear & Greed Index recently stood at 14, a level classified as extreme fear.

$1,000 BTC Worth

If Bitcoin falls to $50,000 in 2026, $1,000 invested today at $67,000, which buys about 0.015 BTC, would be worth roughly $750. A decline to $42,000 would reduce that value to about $630.

Bullish Projections for $1,000 BTC in 2026

Other analysts see potential recovery. Bernstein maintains a $150,000 Bitcoin target by the end of 2026. At that level, $1,000 invested today would grow to about $2,250.

Market commentator Mr. Crypto Whale has projected a possible move toward $215,000 during a renewed rally phase by May. That price would value a $1,000 investment at roughly $3,200.

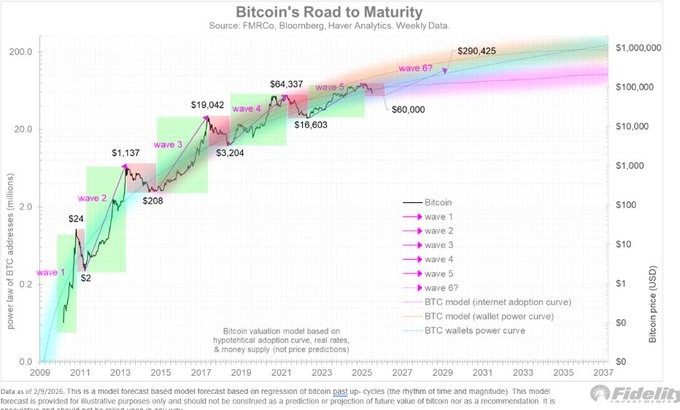

Fidelity’s director of global macro, Jurrien Timmer, has outlined a long-term model suggesting Bitcoin could reach $290,456 during a mature expansion wave. At that level, 0.015 BTC would be worth approximately $4,350.

Institutional and Macro Factors

Institutional flows, which remain mixed, could tell what $1000 invested today would be. Spot Bitcoin exchange-traded funds recorded $145 million in inflows on Monday and $166 million on Tuesday before another $276 million in outflows yesterday. The mixed netflows followed months of outflows totaling more than $6 billion between November and January.

Macro policy may also shape 2026 outcomes. CME futures markets imply at least two Federal Reserve rate cuts this year. State Street strategist Lee Ferridge has, however, suggested the possibility of three cuts. Lower rates often increase demand for risk assets.

Interestingly, Galaxy Digital CEO Mike Novogratz said the industry is moving beyond heavy speculation toward institutional adoption and tokenized assets. He also expressed confidence that the CLARITY Act, a proposed U.S. crypto market structure bill, will eventually pass.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.