- Bitcoin falls 1.62% to $91,064, breaking below the 20 and 50-day EMA cluster as tariff war fears rattle risk assets during thin holiday liquidity.

- Spot exchange outflows hit $145.89 million while $108 million in long positions get liquidated over 24 hours.

- Supertrend support at $88,496 becomes the key level to defend as price tests the lower boundary of its ascending channel.

Bitcoin price today trades near $91,064 after breaking below the 20 and 50-day EMA cluster in a selloff triggered by renewed tariff concerns. The move came during thin holiday liquidity with U.S. markets closed, amplifying the downside as leveraged longs got flushed.

Tariff Headlines Drive Risk-Off Move

The catalyst came from geopolitical headlines rather than crypto-specific news. Fresh threats of tariffs on the European Union rattled global markets, sending investors toward safe havens. Gold surged to a new all-time high near $4,700 per ounce while risk assets retreated.

Matt Howells-Barby, VP at Kraken, noted that crypto has displayed asymmetric downside risk since October, with markets punishing negative news more severely than rewarding positive catalysts. The pattern repeated on Monday as BTC dropped 3.5% from its weekend highs.

Some traders expect a “TACO” scenario where Trump eventually dials back the tariff threats, similar to last year’s pattern with China. But volatility will likely persist as the World Economic Forum in Davos generates headlines on trade policy.

Spot Outflows Signal Distribution

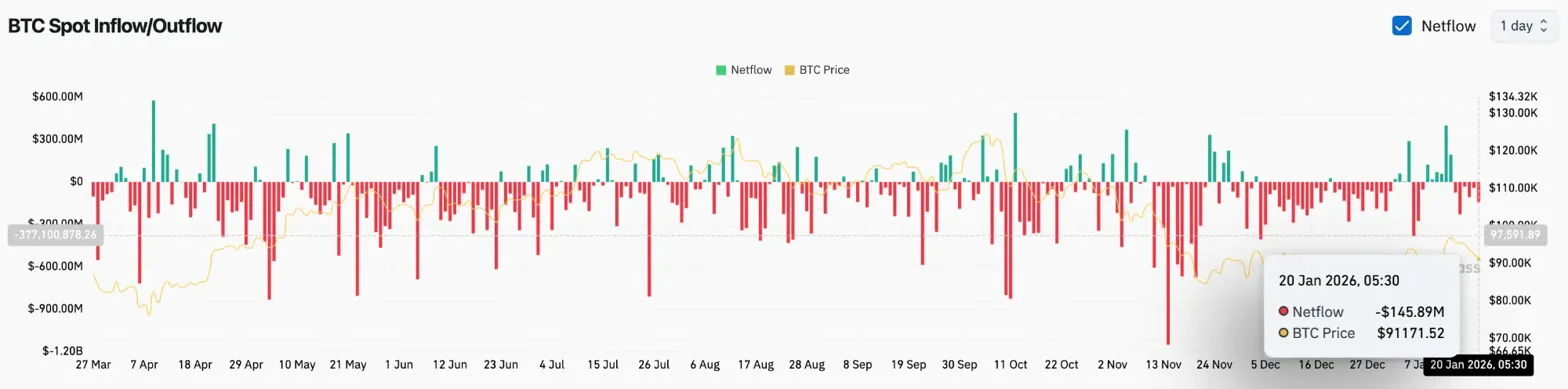

Exchange flow data confirms that holders are moving coins to exchanges. Coinglass recorded $145.89 million in net outflows on January 20, one of the larger single-day distributions in recent weeks.

When spot flows turn negative during selloffs, it signals that holders are preparing to sell rather than accumulating dips. This dynamic adds supply to order books and can extend corrections if buyers fail to absorb the pressure.

Related: Oasis Price Prediction 2026: ROFL “Trustless AWS” & Franklin Templeton Pilot Target $0.04-$0.06

The outflow contrasts with the accumulation pattern seen earlier this month when ETF inflows supported price above $95,000. That bid has weakened as macro concerns override institutional demand.

Longs Get Flushed At EMA Support

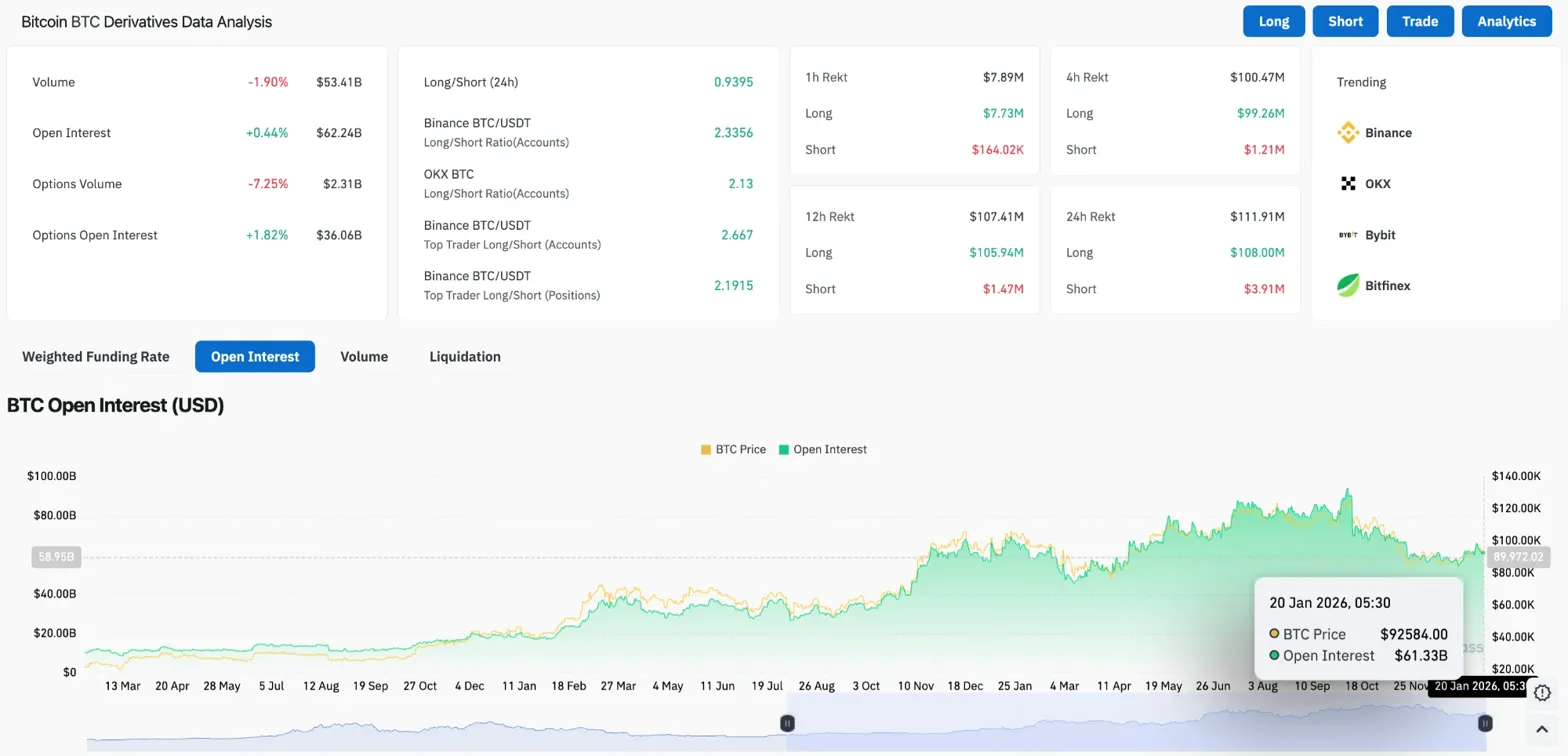

Derivatives markets absorbed significant damage. Over 24 hours, $108 million in long positions were liquidated compared to just $3.91 million in shorts. That 27:1 ratio shows how one-sided positioning had become above $92,000.

Open interest held steady at $62.24 billion, up 0.44% despite the liquidations. The long/short ratio dropped to 0.93, tilting slightly toward shorts for the first time in weeks. Top traders on Binance remain net long at 2.33, but retail sentiment has shifted defensive.

Bitfinex analysts note that selling pressure from long-term holders has eased to roughly 12,800 BTC per week, down from a cycle peak above 100,000 BTC. However, a dense supply zone between $93,000 and $110,000 continues to cap rallies where previous buyers look to exit.

Price Breaks Below The 20/50 EMA Cluster

On the daily chart, Bitcoin sliced through the 20-day EMA at $92,388 and the 50-day EMA at $92,293 in a single session. This cluster had supported price since the early January recovery and its loss shifts the short-term structure bearish.

The ascending channel from the December low near $80,000 remains intact for now. The lower boundary converges with Supertrend support near $88,496, creating a confluence zone that bulls must defend.

Key levels now:

- Immediate resistance: $92,293 to $92,388 (20/50 EMA cluster)

- Major resistance: $95,754 (100 EMA)

- Trend resistance: $99,258 (200 EMA)

- Channel support: $88,500 to $89,000

- Supertrend support: $88,496

- Breakdown target: $85,000

A close below $88,496 would flip the Supertrend bearish and break the ascending channel, opening the door to a retest of the December low near $80,000.

Outlook: Will Bitcoin Hold Channel Support?

The setup favors caution in the near term. Macro headwinds, thin liquidity, and broken EMA support create a challenging environment for bulls. The next test comes at Supertrend support near $88,500.

- Bullish case: Price bounces from $88,500 and reclaims the EMA cluster above $92,300. A close above $95,000 would signal that the correction has ended and target the 200 EMA at $99,258.

- Bearish case: A daily close below $88,496 breaks both the Supertrend and channel support, targeting $85,000. Losing $85,000 exposes the December low at $80,000.

Bitcoin faces a critical test at channel support. Until tariff headlines stabilize and buyers reclaim the EMA cluster, rallies will likely face resistance from trapped longs looking to exit.

Related: Dogecoin Price Prediction: DOGE Weakens as Support Fails and Outflows Persist

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.