Bitcoin price is trading near $110,830 at press time, consolidating around the $110,600–$111,000 zone after repeated defenses of the channel support. Traders are watching closely as technical compression, CME gap levels, and cautious inflows shape the near-term trajectory.

Bitcoin Price Holds Channel Support

The daily chart shows BTC moving within an ascending channel that has defined structure since April. The lower boundary at $110,600 aligns near the 20-day EMA, while immediate resistance stands at $113,000, marked by the 50-day EMA.

Fibonacci retracement levels highlight $117,300 (0.618) and $120,050 (0.786) as critical breakout targets if momentum turns higher. On the downside, $107,300 remains the first key support, with the 200-day EMA near $104,400 acting as the long-term floor. Momentum indicators reflect a bearish trend with the RSI at 44.

CME Gap at $110,680 Draws Market Attention

Market focus has turned to the unfilled CME gap at $110,680, highlighted by analyst Crypto Rover. This level has acted as a magnet for price consolidation, and BTC is currently trading in line with it. Historically, unfilled CME gaps have often been revisited, making the zone a key reference for traders.

If BTC price continues to hold above this level, a technical rebound toward $113,000–$115,000 is plausible. However, failure to maintain support could expose the $107,300 zone, with broader risks toward $104,400 if selling accelerates.

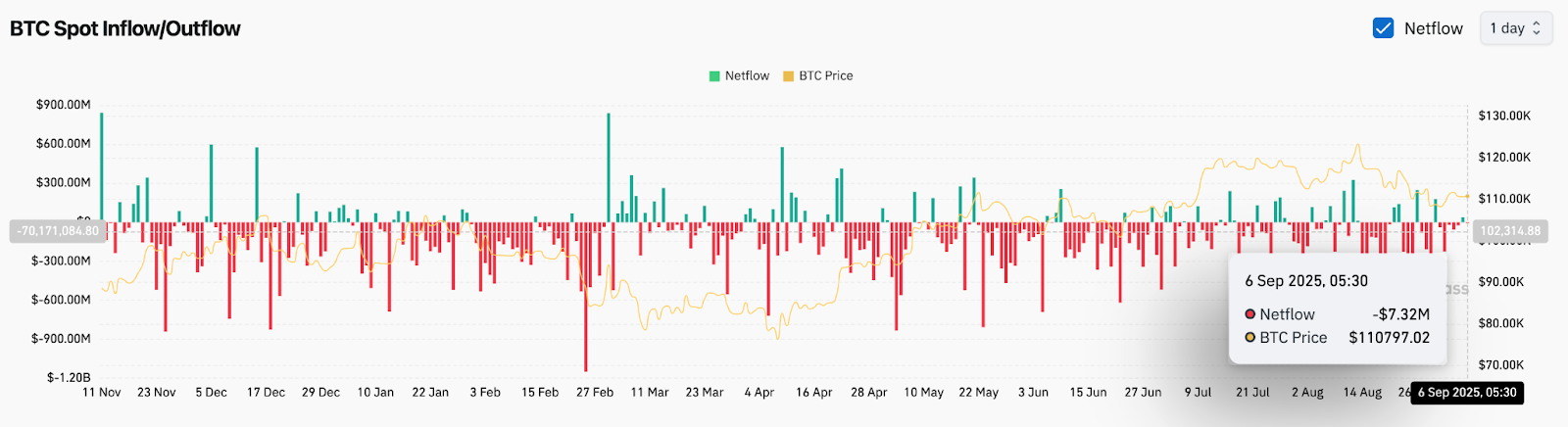

On-Chain Data Shows Modest Outflows

Exchange netflows on September 6 showed a $7.32 million outflow, according to Coinglass. While the figure is relatively small compared to August’s heavier outflows, it reflects continued caution among traders.

Investors appear to be withdrawing BTC to self-custody, while the overall activity remains muted compared to previous inflow-driven surges that supported rallies toward $120,000. A substantial increase in inflows would be needed to signal a strong accumulation phase.

Sentiment Turns Neutral As Traders Wait

The Crypto Fear & Greed Index printed a neutral reading of 49 on September 6, reflecting indecision after weeks of volatility. This positioning suggests neither extreme optimism nor panic is driving sentiment.

Historically, neutral sentiment near key technical supports often precedes larger directional moves. Analysts note that a shift into the greed zone could fuel upside momentum toward $117,000 and $120,000, while a slide into fear may coincide with retests of the $107,000 zone.

Related: Bitcoin Price Prediction: BTC Rebounds To $113K As Analysts Eye Nasdaq Correlation

Technical Outlook For Bitcoin Price

Bitcoin price levels remain well-defined. On the upside, clearing $113,000 would invite momentum traders and set up targets at $117,300 and $120,000. A breakout above $120,000 could extend toward $123,600, the upper boundary of the channel.

On the downside, losing $110,600 would place pressure on $107,300, with $104,400 as the next major line of defense. As long as BTC trades within the broader ascending channel structure, deeper risks remain limited.

Outlook: Will Bitcoin Go Up?

Bitcoin’s immediate path is tied to whether it can hold above the CME gap at $110,680 and reclaim the $113,000. Neutral sentiment and modest outflows suggest traders are waiting for confirmation before committing to larger positions.

Analysts remain cautiously constructive. If BTC holds above $110,600, the setup favors an upside push toward $117,000–$120,000. Losing that base, however, would likely see sellers test $107,000 before any recovery attempt.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.