- Bitcoin price today holds $113,298 after rejection near $114,850, with $113K acting as key support.

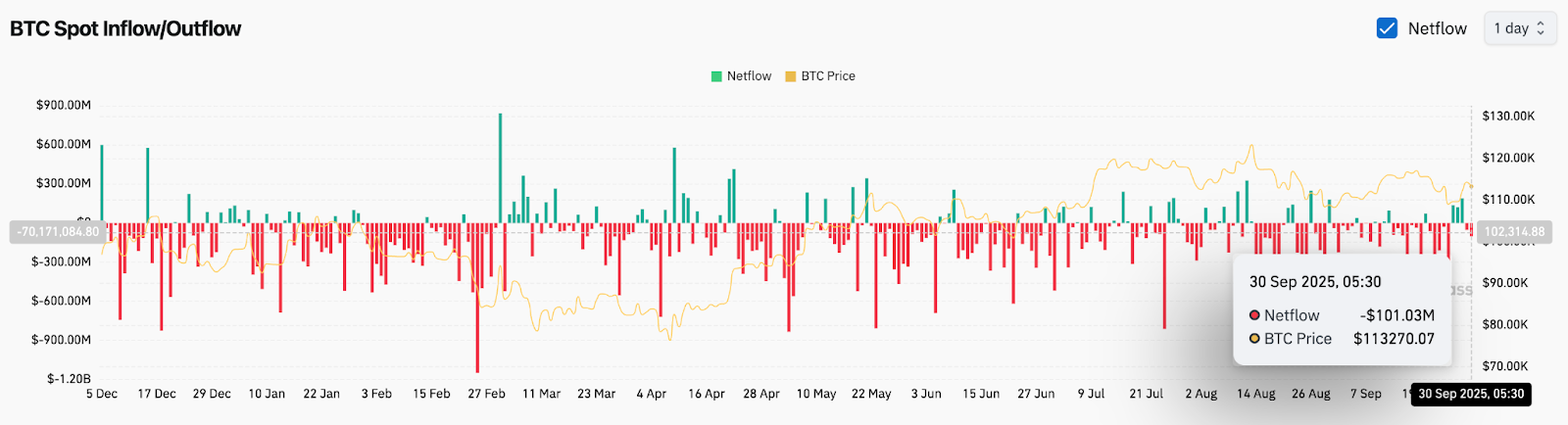

- Whale outflows topped $101M on Sept. 30, signaling fragile demand despite broader channel support.

- Analysts eye $116K and $120K resistance levels, with upside targets extending to $125K if breakout holds.

Bitcoin price today is trading at $113,298, slipping after rejection near $114,850 while holding support above $113,000. The market focus is on whether buyers can reclaim $116,000 and retest the $120,000 ceiling or if persistent exchange outflows will weigh on momentum.

Bitcoin Price Holds Channel Support

Bitcoin price action remains locked within a rising channel that has guided the trend since March. The daily chart shows support anchored around $111,800–$113,000, where the 50-day EMA and channel base converge.

Related: Pi Price Prediction: Pi Faces Pressure As Governance Allegations Weigh On Sentiment

Resistance sits stacked near $116,000 and $120,000, with the latter marked as a weak high. The 20-day EMA at $113,365 is currently being tested, and a decisive close above this line would open the path to $118,000. On the downside, failure to hold $113,000 could expose deeper support levels at $108,000 and $106,400.

Momentum indicators remain neutral. RSI is mid-range, while MACD is flattening after the September pullback. This signals a consolidation phase where breakout confirmation will determine the next leg.

Whale Outflows Show Fragile Demand

On-chain data highlights a cautious stance from whales. Spot exchange flows on September 30 showed a net outflow of more than $101 million, extending a trend of persistent withdrawals across September. While outflows typically signal accumulation, the lack of consistent inflows has left price action dependent on fragile demand.

Futures open interest remains steady, suggesting traders are waiting for a decisive break before adding risk. Analysts note that until Bitcoin price secures a clean close above $116,000, conviction is likely to stay muted.

Sentiment Boost From Public Endorsements

Market sentiment saw a spike after YoungHoon Kim, a public figure recognized for intellectual achievements, declared he had converted all assets into Bitcoin, calling it the only hope for the future economy. The statement, amplified by Bitcoin Magazine, attracted widespread attention and fueled optimism on social platforms.

Related: Shiba Inu Price Prediction: Analysts Track Resistance Flip Ahead Of October Volatility

While such endorsements can energize retail participation, analysts stress that institutional flows remain the dominant driver. With inflows muted and ETF-related headlines quiet, Bitcoin’s rally potential depends on technical confirmation rather than social sentiment alone.

Technical Outlook For Bitcoin Price

Bitcoin price prediction for the short term highlights key levels. Upside targets sit at $116,000, $118,000, and $120,000, with a breakout above the $120,000 ceiling opening room toward $125,000. Downside risks lie at $113,000, $111,800, and deeper at $108,000–$106,400 if support breaks.

Trendline support remains firm above $111,000, keeping the broader bullish channel intact. Failure to defend this zone would flip sentiment bearish and re-open the $101,000–$104,000 liquidity pocket.

Outlook: Will Bitcoin Go Up?

Bitcoin’s outlook for October hinges on whether buyers can reclaim the $116,000 level before sellers push the price back toward $111,000. On-chain data shows steady whale outflows, while sentiment has been bolstered by high-profile endorsements.

Related: Cardano Price Prediction: ETF Approval Odds Hit 91%, Analysts Weigh Impact

As long as Bitcoin price today holds above $111,800, analysts expect the broader uptrend to remain intact. A clean breakout above $116,000 would strengthen the case for a push toward $120,000 and potentially $125,000. Conversely, losing $111,000 would shift focus back to the $106,000–$108,000 support band. For now, Bitcoin remains in consolidation mode within its bullish cycle.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.