- Bitcoin price today trades near $107,880, defending the $106K–$107K support despite heavy selling earlier this week.

- On-chain data shows a whale transfer of $320M in BTC, raising concerns about renewed distribution risk.

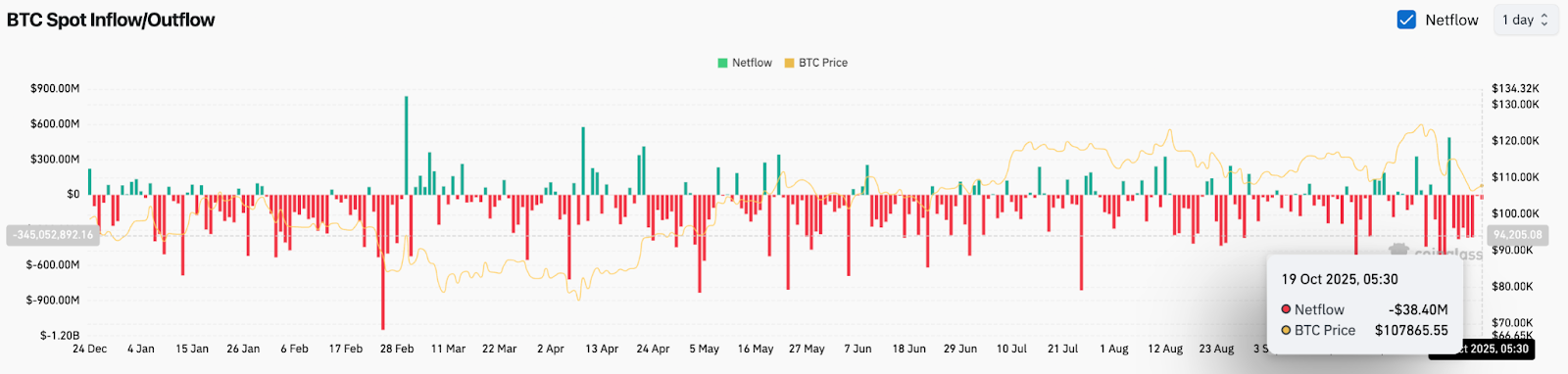

- Net outflows have eased to $38.4M, while Bollinger’s market signal hints at a possible rebound toward $116K–$119K.

Bitcoin price today trades near $107,880, slightly higher after defending its $106,000–$107,000 support zone. The rebound comes as traders weigh whale movements, net outflows, and Bollinger’s rare market warning that previously preceded a major cycle reversal.

Bitcoin Price Holds Critical Trendline Support

Bitcoin price action has stabilized above the $106,000 floor, where a confluence of the 200-day moving average and ascending trendline meets the mid-channel support zone. The daily chart shows repeated defenses of this green zone since May, keeping the broader bullish structure intact despite heavy selling earlier this week.

Parabolic SAR dots and the Supertrend indicator remain bearish, with resistance aligning near $119,000–$120,000, while the upper resistance zone at $126,000 caps medium-term upside potential. RSI has recovered from near-oversold territory to 45, hinting at early relief momentum. A daily close above $110,000 would mark a short-term structural recovery.

Analysts view $104,000 as the make-or-break level for Bitcoin price action. Holding above it keeps the uptrend valid, while a decisive break lower could open deeper retracement toward the $98,000 region.

Whale Transfers Stir Fresh Market Caution

On-chain data caught attention after insider tracking showed a major Bitcoin whale moving $320 million (3,000 BTC) to a new address. As analyst Ted Pillows noted, the same address transferred 2,000 BTC to Coinbase just days ago before Bitcoin dropped $8,000 in a single day.

Market watchers fear another distribution round could add pressure around current levels. Whale selling patterns have historically aligned with local tops, especially when accompanied by declining net inflows. Traders now monitor whether the latest transfer signals profit-taking or internal rebalancing after the recent drawdown.

While whale movements create near-term uncertainty, order book data shows limited panic selling, suggesting that retail positions remain largely intact. The broader question for traders is whether the $107K zone can absorb these large-volume transfers without triggering renewed liquidation cascades.

On-Chain Data Shows Easing Outflows

Exchange data from Coinglass indicates a $38.4 million net outflow on October 19, marking a shift from last week’s $1.6 billion in heavy withdrawals. The cooling outflow trend signals early stabilization in exchange activity and may hint at bottom-building after aggressive distribution earlier in the month.

Bitcoin price today remains closely correlated with these flow trends. Sustained outflows typically support recovery as investors move assets to self-custody. However, sporadic whale deposits, such as those seen this week, can quickly reverse sentiment if selling resumes.

Analysts note that consistent daily net outflows above $100 million would confirm renewed accumulation. For now, the balance between whale movements and cooling exchange flows keeps Bitcoin in a consolidation phase.

Bollinger Band Signal Draws Trader Attention

A fresh comment from John Bollinger, creator of the Bollinger Bands, reignited debate around Bitcoin’s cycle position. Bollinger said it “may be time to pay attention soon,” referencing emerging “W” bottom patterns in Ethereum and Solana — the same setup that preceded Bitcoin’s previous doubling in price.

While Bollinger did not explicitly include Bitcoin in his signal, traders interpret his remark as a potential early hint that major altcoins are bottoming, often a precursor to Bitcoin’s next leg. Historically, similar remarks by Bollinger have marked critical inflection points.

If Bitcoin price reclaims $119,000, it would confirm alignment with the Bollinger Band mid-line, typically viewed as the early confirmation of renewed bullish control.

Technical Outlook For Bitcoin Price

Bitcoin price prediction for the short term remains neutral to cautiously bullish.

- Upside targets: $110,000, $116,000, and $119,000 if momentum holds.

- Downside levels: $106,000, $104,000, and $98,000 as key defense zones.

- Supertrend reversal: Confirmed only above $119,000.

Technical indicators show early rebound signals, but confirmation requires follow-through above the 20-day EMA. Until then, price action remains range-bound with mild upward bias.

Outlook: Will Bitcoin Go Up?

Bitcoin’s near-term outlook depends on whether buyers can defend the $107K base while digesting whale-driven uncertainty. On-chain data shows outflows stabilizing, suggesting that selling pressure may be subsiding.

If the $106K–$107K demand block holds through the week, Bitcoin could retest the $116K–$119K resistance band, with upside potential toward $122K if momentum accelerates. Conversely, a close below $104K would likely trigger a deeper correction to the $98K region before recovery attempts resume.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.