- Bitcoin trades near $113,700 after rejecting $124,000, with $113K trendline support in focus.

- On-chain flows show $185M net outflows, signaling accumulation despite recent correction.

- BlackRock CEO Larry Fink calls Bitcoin a “legitimate alternative asset,” reinforcing institutional demand.

Bitcoin price today trades near $113,700, consolidating after a sharp pullback from the $124,000 resistance zone. The selloff found footing near the $113,500 level, aligning with the 100-day EMA and a critical trendline support that has contained every major correction since May. Bulls now face a test to reclaim $116,500 and restore momentum before deeper downside levels come into play.

Bitcoin Price Tests Lower Channel Support

On the daily chart, Bitcoin remains within a broad ascending channel that stretches from April. Price recently rejected the $124,400 resistance area, where the Supertrend flipped bearish, triggering short-term profit-taking. The 20-day EMA sits at $116,630, while the 50-day EMA near $115,600 and the 100-day EMA at $113,560 now act as clustered support levels.

Momentum indicators highlight a cooling trend. RSI has eased toward 47, signaling neutral momentum after last week’s overbought stretch, while MACD lines continue to flatten below zero, hinting at reduced buying pressure. For now, the $113,500–$113,000 range remains the line in the sand. Holding this floor would keep the broader uptrend intact, while a breakdown could expose the 200-day EMA at $108,000.

On-Chain Flows Show Renewed Accumulation

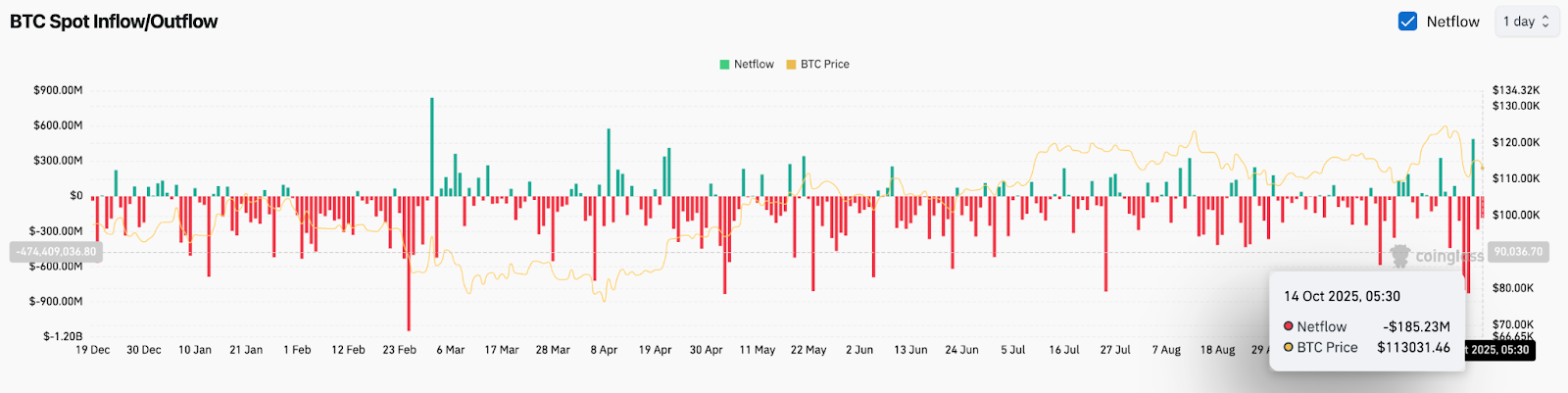

Spot exchange data from Coinglass reveals a $185.23 million net outflow on October 14, indicating that investors are moving coins off exchanges, a typical sign of accumulation. Despite the recent correction, sustained outflows reflect growing confidence among long-term holders.

Historical patterns show that similar outflow streaks often precede price stabilization phases, as supply tightens on the spot market. This dynamic could limit downside risk, especially as ETF-related buying and corporate treasuries continue to absorb circulating supply.

BlackRock CEO Calls Bitcoin “A Legitimate Alternative Asset”

In a widely watched interview on CBS’s 60 Minutes, BlackRock CEO Larry Fink described Bitcoin as “a legitimate alternative asset like gold for diversifying portfolios.” Fink’s remarks mark a notable shift in tone, emphasizing crypto’s evolving role within institutional strategies.

He stated, “There is a role for crypto in the same way there’s a role for gold. For those looking to diversify, this is not a bad asset.” His comments arrive as BlackRock’s spot Bitcoin ETF continues to see steady inflows, reinforcing the perception of Bitcoin as a credible store of value amid global uncertainty.

The endorsement from the world’s largest asset manager adds further legitimacy to Bitcoin’s long-term narrative, potentially countering short-term technical weakness. Analysts suggest that such institutional validation could serve as a floor for market sentiment during periods of volatility.

Outlook: Will Bitcoin Go Up?

The immediate path for Bitcoin hinges on the defense of the $113,000 floor. On-chain data shows steady accumulation, while institutional sentiment has turned favorable following Larry Fink’s endorsement.

If price holds above $113,000 and reclaims $116,500, analysts expect renewed momentum toward $120,000 and $124,000. Losing this zone, however, could extend the correction to $108,000 before fresh bids emerge. Overall, Bitcoin remains in a healthy consolidation phase within its larger bullish cycle, awaiting confirmation of the next leg higher.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.