- Bitcoin nears key resistance as traders anticipate upside beyond $112,000 level

- Rising open interest signals renewed speculative momentum ahead of Fed conference

- Consistent exchange outflows highlight strong investor confidence and BTC accumulation

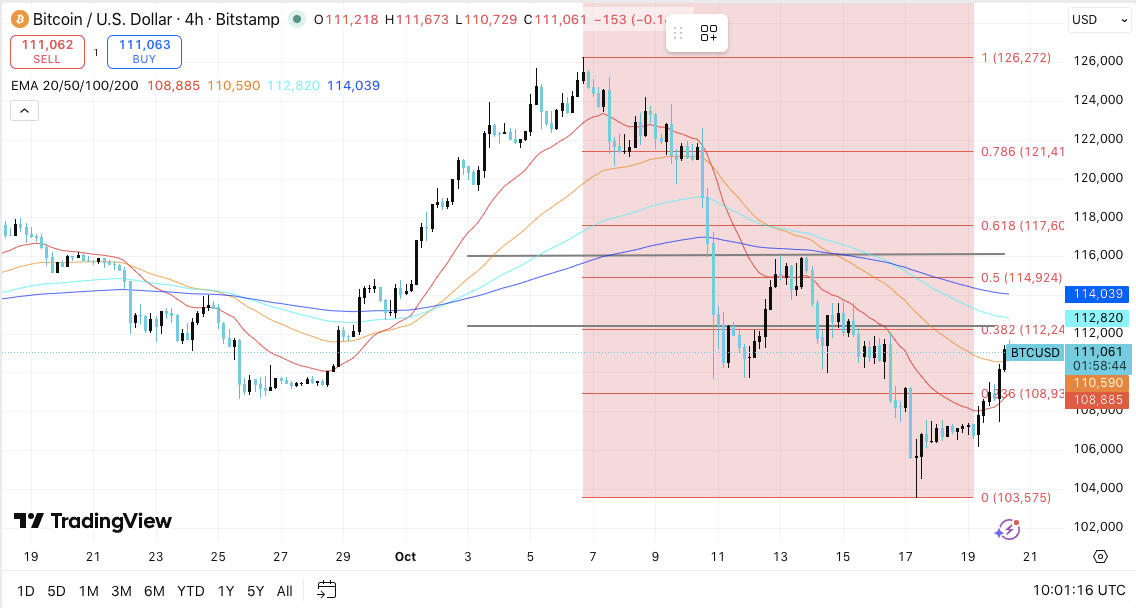

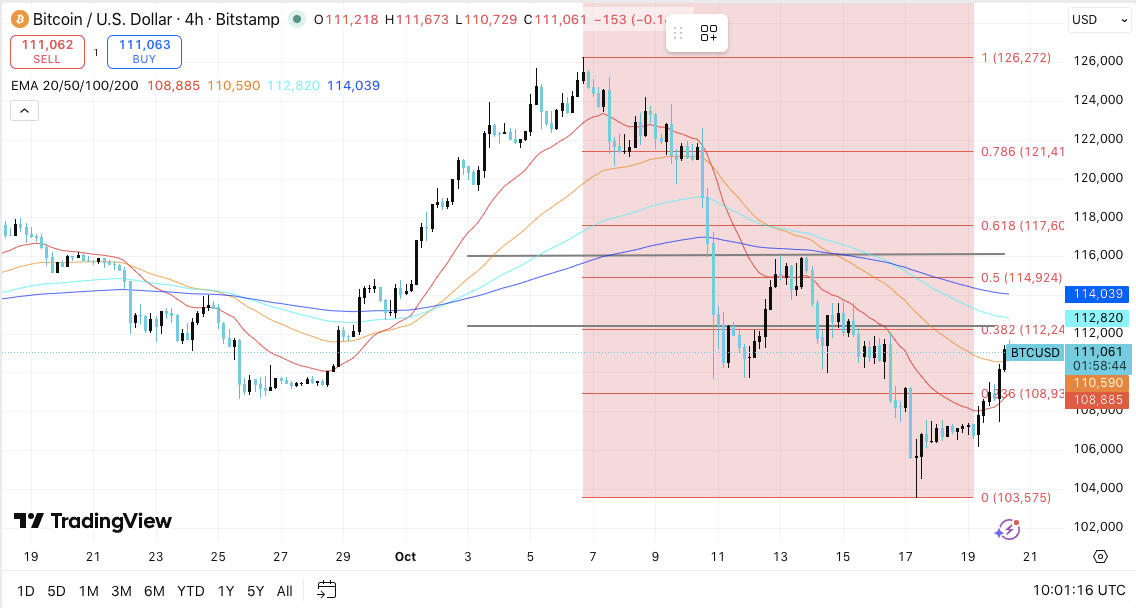

Bitcoin (BTC) is showing renewed strength after bouncing from its recent local bottom near $103,575. The rebound, which coincides with a rise in futures open interest and exchange activity, suggests growing confidence among traders ahead of the upcoming Federal Reserve Payments Innovation Conference on October 21. The event is expected to address digital asset policy and innovation, drawing attention from both institutional and retail investors.

Bitcoin Attempts to Flip Key Resistance Zone

Bitcoin has climbed above its short-term exponential moving averages, signaling a shift in near-term sentiment. The price is now testing resistance near $111,000, just below the 38.2% Fibonacci retracement at $112,240. A strong close above this level could trigger further upside toward $114,900 and $117,600. These targets align with the 100-day and 200-day EMAs, zones that often act as critical resistance in corrective phases.

Support remains well-defined at $108,900, where the 0.236 Fibonacci retracement and 20-day EMA converge. If Bitcoin loses this zone, it could retreat toward $106,000 or even revisit the $103,500 area, which previously marked the local bottom. Hence, this level will be vital for sustaining the current bullish momentum.

Related: Dogecoin Price Prediction: First Spot ETF Filing Puts $0.30 Dream Back On The Table

Momentum Builds as Open Interest Surges

Bitcoin futures open interest has increased steadily, reaching $70.25 billion as of October 20. This rise highlights renewed speculative activity and growing market participation.

Moreover, open interest and price have tracked closely through 2025, with both trending upward before minor pullbacks. The steady increase in leverage indicates traders are positioning for heightened volatility, possibly anticipating major moves after the Fed’s digital asset discussions.

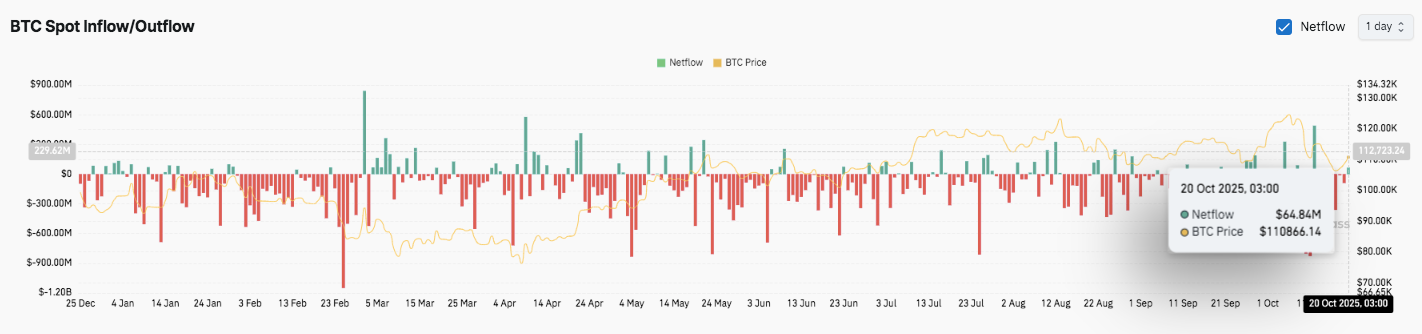

Exchange Flows Reflect Investor Confidence

On-chain data shows consistent outflows from exchanges through most of 2025, suggesting investors continue accumulating BTC in self-custody. Over the past month, negative netflows have dominated, reinforcing the accumulation trend.

However, a temporary inflow of $64.84 million on October 20 signals short-term profit-taking as Bitcoin traded near $110,866.14. Sustained outflows often precede price recoveries, while brief inflows typically signal tactical repositioning.

Related: Bittensor Price Prediction: TAO Targets $500 as Bullish Momentum Builds

Technical Outlook for Bitcoin (BTC/USD)

Key levels remain sharply defined as Bitcoin enters a critical phase of recovery following its recent rebound from $103,575.

- Upside levels: $111,000 and $112,240 are immediate hurdles, followed by $114,900 and $117,600 as higher resistance targets. A breakout and daily close above $112,240 would likely confirm continuation toward the $117,000 zone, marking a short-term bullish extension.

- Downside levels: $108,900 serves as immediate support, reinforced by the 20-day EMA. Below this, $106,000 and $103,575 represent deeper support zones that define the structural base of the current cycle.

- Resistance ceiling: The $114,000–$115,000 range, coinciding with the 200-day EMA, remains the key level to flip for confirming medium-term bullish control.

The technical setup indicates Bitcoin is transitioning from a corrective phase into a potential recovery channel. The price has broken above a descending trendline, signaling improving sentiment. However, moving averages are yet to align fully in favor of bulls, leaving BTC in a neutral-to-bullish consolidation zone.

Will Bitcoin Extend Its Recovery?

Bitcoin’s short-term outlook depends on whether buyers can maintain strength above $108,900. Sustained momentum could push BTC toward the $114,900–$117,600 range, where stronger resistance awaits. Conversely, losing the $108,000 threshold could trigger a pullback to $106,000 or even the recent low at $103,575.

With open interest climbing past $70 billion and exchange outflows suggesting accumulation, market participants appear positioned for volatility expansion. As October unfolds, Bitcoin’s next decisive move will hinge on whether the $112,000–$115,000 zone flips into support, paving the way for a broader bullish continuation.

Related: Ethereum Price Prediction: UK ETP Launch Sparks Optimism With Bulls Eyeing $4,500

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.