- Bitcoin consolidates near $114K as traders await breakout above key resistance zones

- Futures open interest hits $73.3B, signaling rising institutional and leveraged activity

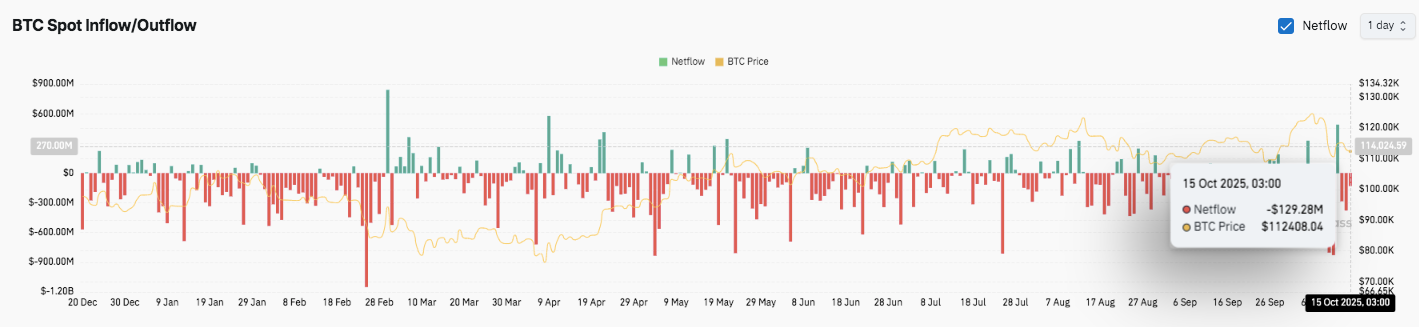

- Persistent $129M exchange outflows suggest strong long-term accumulation despite volatility

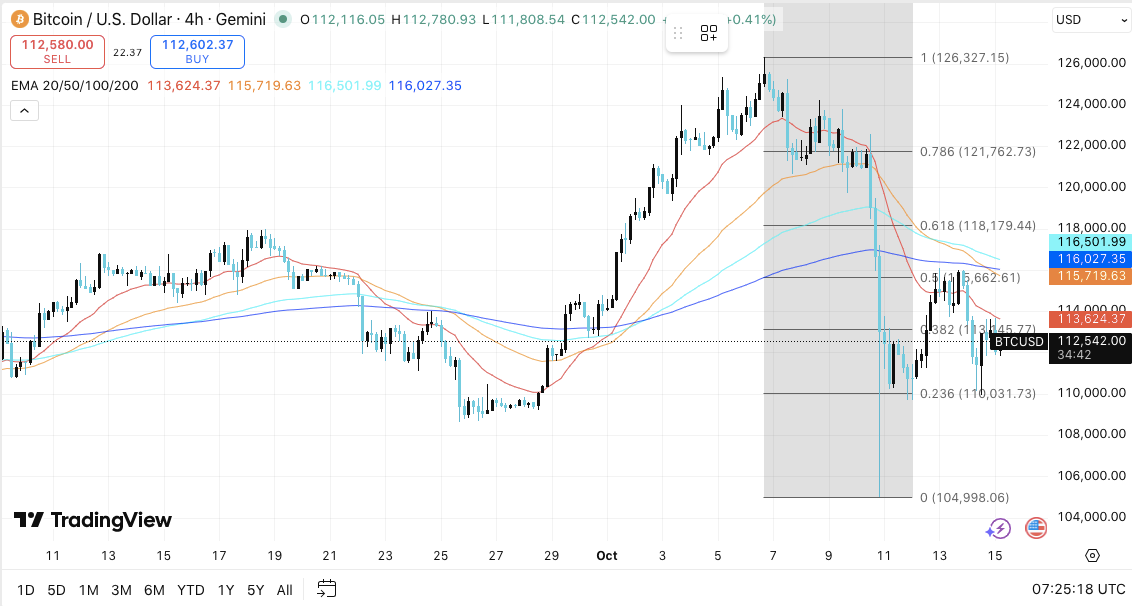

Bitcoin is consolidating near $114,000 after facing rejection from $126,327 earlier this month. The 4-hour chart reveals a corrective structure forming between $110,000 and $115,000, signaling a pause in the recent uptrend.

This range-bound movement follows a strong rally in early October and now reflects an equilibrium between buyers and sellers. Traders are closely monitoring the $110,000 support zone, which remains the key line of defense against deeper corrections.

Consolidation Between Key Fibonacci Zones

The retracement from $126,327 to $104,998 defines crucial Fibonacci levels that now guide short-term price reactions. The 0.236 retracement at $110,031 acts as immediate support, while the 0.382 level at $113,445 caps most intraday rebounds. The $115,662 zone, which aligns with the 50-day exponential moving average, represents a mid-range pivot that may decide Bitcoin’s next direction.

Moreover, the 0.618 retracement near $118,179 coincides with the 100-day EMA, forming a strong resistance cluster. A clean break above this zone could trigger renewed bullish momentum, while sustained rejection may push the price back toward $110,000.

Futures Market and Institutional Positioning

Besides spot movements, Bitcoin’s derivatives market shows a sharp rise in speculative interest. Open interest in Bitcoin futures has surged to $73.33 billion, one of the highest levels since early 2025. This growth mirrors the pattern seen before major rallies in previous cycles, indicating heightened institutional involvement and leveraged positioning.

Consequently, market volatility may increase as traders prepare for large directional moves. However, such elevated leverage also amplifies risk, as any sudden reversal could accelerate liquidations.

Exchange Outflows Reflect Accumulation

At the same time, Bitcoin’s spot netflow data continues to show persistent outflows from exchanges. On October 15, 2025, about $129 million exited trading platforms even as prices hovered around $114,000.

These outflows often indicate long-term accumulation and reduced short-term selling pressure. Hence, while speculative leverage rises in futures, long-term investors appear to be quietly building positions off exchanges.

Technical Outlook for Bitcoin Price

Key levels remain tightly defined heading into mid-October.

- Upside levels: $113,445 (0.382 Fib), $115,662 (0.5 Fib and EMA-50), and $118,179 (0.618 Fib confluence). A breakout above this band could extend toward $121,762 the 0.786 retracement and key invalidation level for bears.

- Downside levels: $110,031 (0.236 Fib support) followed by $105,000 and $104,998 both aligning with the recent correction base. Sustained closes below $110,000 could invite further downside pressure toward $101,000.

- Resistance ceiling: The $116,000–$118,000 range, where EMA-100 and the 0.618 retracement intersect, is the crucial barrier to flip for renewed bullish continuation.

The technical structure suggests Bitcoin is coiling within a corrective wedge, consolidating between $110,000 and $115,000. This compression mirrors prior mid-cycle pauses that preceded volatility expansion.

Will Bitcoin Go Up?

The short-term action of Bitcoin depends on regaining the midpoint pivot and EMA resistance of $115,700. The fact that the open interest remains high and the holding is above $110,000 may pave the way to a breakout to $118,000 to $121,000.

Nonetheless, the inability to maintain beyond the $113,000 intraday area means that it may slide further back to the $105,000 support level. The market is on a knife-edge following a record high futures leverage and continuous spot outflows. Bitcoin is currently in a critical consolidation zone in which a momentum confirmation will determine the subsequent leg.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.