- Bitcoin holds above $108K, defending key support amid sideways price consolidation.

- Rising derivatives open interest highlights growing institutional positioning and potential volatility.

- Persistent exchange outflows signal accumulation as investors move BTC into self-custody.

Bitcoin continues to trade in a narrow range near $108,000 as market participants weigh the next decisive move. The cryptocurrency faced resistance around $111,934, coinciding with the 38.2% Fibonacci retracement, signaling hesitation among buyers after recent gains. Despite the sideways movement, trading activity in derivatives remains elevated, indicating that institutional traders are positioning for potential volatility in the coming sessions.

Price Holds Above Key Support

Bitcoin has maintained stability above the $108,000 mark, which aligns with the 23.6% Fibonacci retracement. This level acts as a short-term pivot where buyers continue to defend against further declines. A sustained close below this threshold could open the path toward $106,000, followed by the recent low of $103,046.

Conversely, a rebound from this area could set up a retest of resistance near $111,934 and $114,686. The 20-day and 50-day exponential moving averages (EMAs) remain clustered between $109,000 and $113,000, serving as dynamic resistance levels that must be cleared for momentum to shift decisively upward.

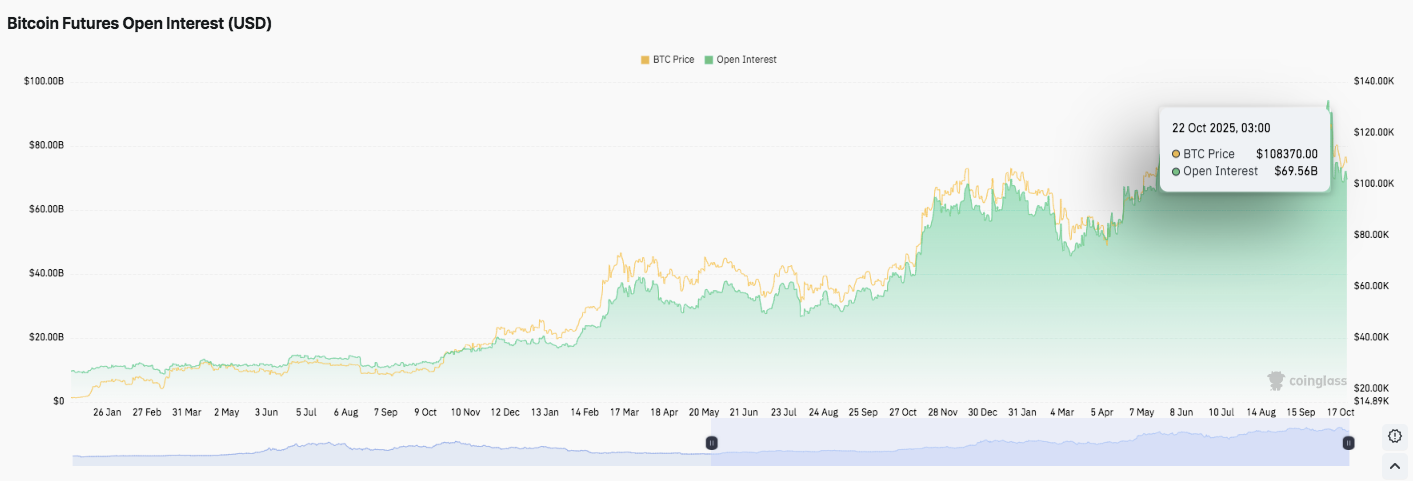

Rising Open Interest Signals Institutional Activity

Derivatives data show that Bitcoin’s open interest has been increasing steadily since midyear, reaching $69.56 billion by October 22. This marks one of the highest readings in 2025 and reflects renewed institutional engagement. Analysts note that such increases often precede major price movements, as leveraged positions magnify volatility when market direction becomes clear.

Related: Pi Price Prediction: ISO20022 Compliance Narrative Meets Key Resistance

The strong correlation between price and open interest highlights growing speculative exposure. Sustained open interest above $65 billion indicates that large traders remain confident about Bitcoin’s long-term trend despite short-term consolidation.

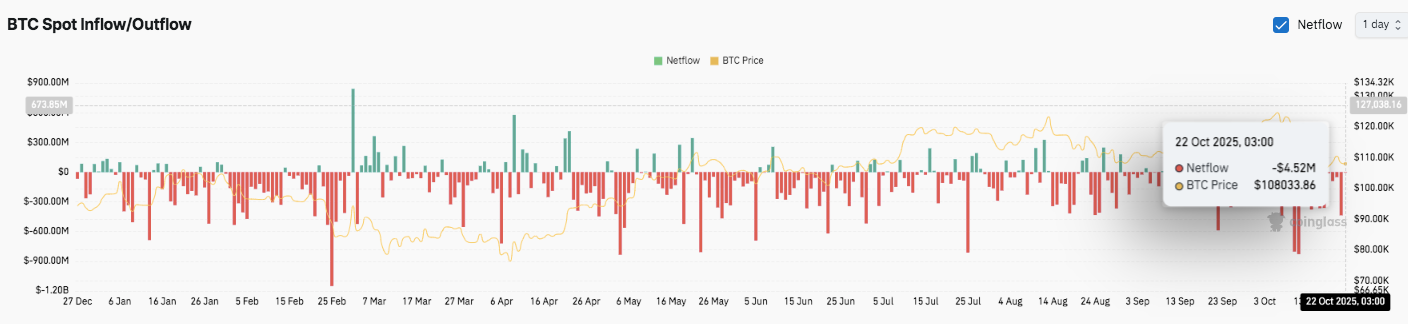

Exchange Outflows Indicate Accumulation

Meanwhile, Bitcoin’s spot netflows show persistent outflows throughout October. On October 22, exchanges recorded a modest $4.52 million outflow as prices hovered near $108,033.

This trend suggests investors are moving assets into self-custody, reducing circulating supply on trading platforms. Earlier in the year, exchange inflows temporarily disrupted this pattern, but selling pressure soon eased. The consistent withdrawals now point to a market inclined toward accumulation rather than distribution.

Technical Outlook for Bitcoin Price

Key levels remain clearly defined heading into late October. Bitcoin (BTC) continues to consolidate within a narrow band, trading between $108,000 and $114,000.

- Upside levels: $111,934, $114,686, and $117,433 stand as immediate hurdles. A breakout above the $115,000 zone could extend the rally toward $121,345 and potentially retest $125,000, aligning with the 61.8%–78.6% Fibonacci retracement range.

- Downside levels: Immediate support lies at $108,000, followed by $106,000 and $103,046 the recent swing low. A drop below $106,000 would expose BTC to a deeper retracement near $101,500.

- Resistance ceiling: The 200-day EMA around $113,500 remains the key level to flip for mid-term bullish momentum. Sustained closes above this mark could shift sentiment back in favor of buyers.

The technical setup suggests BTC is compressing between converging EMAs, forming a tightening price range. This pattern often precedes sharp directional moves.

Will Bitcoin Break Out or Correct Lower?

Bitcoin’s next decisive move will depend on whether buyers can defend the $108,000 floor long enough to reclaim $112,000–$114,000. Rising open interest near $69 billion indicates that traders are positioning for volatility.

Related: Solana Price Prediction: SOL Faces Pressure as Hong Kong Approves Spot ETF

If bullish momentum strengthens alongside continued exchange outflows, BTC could retest $117,433 and $121,345. However, losing the $108,000 level could invite selling pressure toward $106,000 and $103,000.

For now, Bitcoin remains at a critical juncture. The compression between moving averages and historical seasonality in Q4 suggest an imminent volatility expansion making this consolidation phase pivotal for the next directional breakout.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.