- Bitcoin consolidates between $87,630–$89,600 as bulls and bears assess the next move.

- RSI and MACD show fragile momentum, signaling a cautious recovery attempt for BTC.

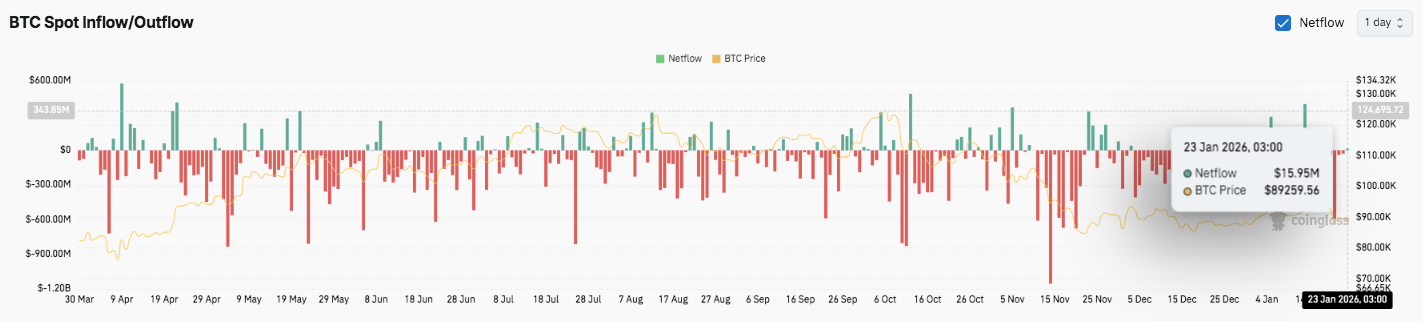

- Leverage eases to $59.64B, while spot inflows hint at slowing selling pressure.

Bitcoin traded near $89,133 on the four-hour chart as it steadied after a steep drop from the recent $97,971 peak. The sell-off broke the earlier run of higher highs and forced price into a tighter, more defensive structure.

Traders now watch this consolidation range for signs of either renewed demand or another wave of selling. Besides the price action, derivatives positioning and spot flow behavior suggest the market has not regained full confidence yet.

BTC Holds a Tight Range After the Breakdown

Bitcoin continues to build a base between key levels that traders often use to define the next swing. The market now sits between $87,630 as a near-term floor and $89,600 as the first recovery hurdle.

Hence, this zone has become the decision point for short-term direction. A push above $89,600 could encourage follow-through buying if bulls defend the level. Consequently, the next upside checkpoints sit at $91,204 and $92,801, where sellers previously showed strength.

If Bitcoin clears the $91,200–$92,800 region, traders may treat it as a shift back toward a healthier rebound structure. Additionally, the $95,000–$96,000 zone stands out as a key supply pocket before the prior top. A return to $97,971 would place Bitcoin back into trend continuation territory.

Bitcoin still faces downside pressure if the base weakens. The first major support sits at $87,630, and traders often view it as the line that protects the current bounce attempt.

However, a break below $86,800–$86,900 could increase selling momentum. The next critical level sits near $84,436, which marks a deeper support zone that may attract dip buyers.

Momentum signals also remain fragile. RSI near 38.6 shows weak strength, even as it attempts a small recovery. Moreover, MACD has started to curl higher, which suggests selling pressure may be fading.

Leverage Cools While Spot Flows Stabilize

Open interest trends show leverage remains high but has started to ease after peaking above $70 billion. The latest reading near $59.64 billion points to reduced risk-taking following recent volatility. Significantly, a new open interest rebuild could signal another major move.

Spot flow data also shows selling dominated for extended periods. Yet inflows have started to reappear in brief spikes. The latest net inflow near $15.95 million suggests distribution may be slowing, as buyers return cautiously.

Technical Outlook For Bitcoin (BTC) Price

Key levels remain well-defined heading into the next trading sessions, as Bitcoin consolidates after the recent sell-off from the $97,971 swing high.

- Upside levels: $89,600, $91,204, and $92,801 stand out as immediate hurdles. A clean breakout above this resistance cluster could open the door for a stronger recovery toward $95,000–$96,000, with a full trend reset only becoming likely above $97,971.

- Downside levels: $87,630 remains the first support that bulls must defend to avoid renewed weakness. A break below $86,800–$86,900 would increase sell pressure and expose the market to the critical base at $84,436, which acts as the key “line in the sand” level. The technical picture suggests BTC is compressing inside a post-breakdown range, where a decisive move could drive volatility expansion in either direction.

Will Bitcoin Go Up?

Bitcoin’s short-term direction depends on whether buyers can hold $87,630 long enough to reclaim $89,600–$92,801. If momentum improves and flows remain stable, BTC could build a rebound toward $95,000.

However, failure to defend support keeps BTC vulnerable to another drop toward $84,436. For now, Bitcoin remains at a pivotal zone, and technical confirmation will define the next leg.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.