- Bitcoin price today trades at $111,844, holding above $111,600–$111,800 support but capped under $113,500 resistance.

- $1.58B in leveraged shorts sit near $115K, with analysts warning of a potential liquidation-driven rally.

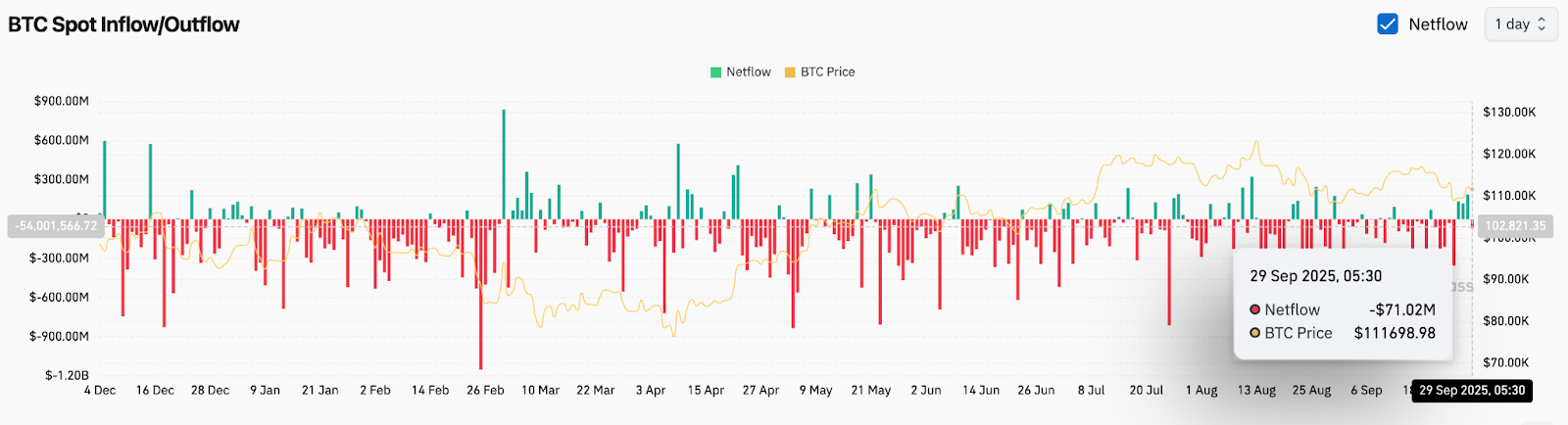

- Net outflows of $71M signal accumulation, though volatile flows show demand remains inconsistent.

Bitcoin price today is trading near $111,844, stabilizing after repeated tests of the $111,600–$111,800 support band. Sellers remain active at the $113,200–$113,500 resistance area, where the 20-day EMA is currently capping upside momentum. Market focus is now on whether Bitcoin can break toward $115,000, a level that could trigger large-scale short liquidations.

Bitcoin Price Defends Key Support

The daily chart shows Bitcoin consolidating within a broad ascending channel, with support holding along the rising trendline near $111,800. The 50-day EMA at $113,269 and the 20-day EMA at $112,772 are acting as near-term barriers, keeping BTC pinned under resistance.

Momentum indicators reflect a neutral setup. The RSI sits at 46, showing neither strong buying pressure nor oversold conditions. A failure to hold above $111,600 would expose BTC to the 100-day EMA at $111,780 and deeper downside toward the 200-day EMA at $106,336.

$1.58 Billion In Shorts At Risk Above $115K

Liquidity maps highlight the significance of the $115,000 mark. Data from Coinglass shows that nearly $1.58 billion worth of leveraged short positions are clustered around this level. A push into this zone could unleash a wave of forced liquidations, potentially fueling a rapid extension higher.

Analysts caution that this setup makes $115,000 both a magnet and a potential inflection point. If buyers generate sufficient momentum, liquidation cascades could accelerate gains toward the $120,000–$124,000 range, which is the next major resistance cluster on the chart.

On-Chain Flows Show Net Outflows

On-chain data adds weight to the bullish argument. Net flows on September 29 registered an outflow of $71 million, reflecting reduced exchange supply. Sustained outflows often signal investor accumulation, lowering immediate selling pressure in the spot market.

However, flows remain volatile. Previous weeks have shown alternating inflows and outflows, suggesting demand has not yet reached a consistent trend. Without stronger inflows from institutional buyers, upside attempts could struggle to gain sustained traction.

Technical Outlook For Bitcoin Price

In the near term, Bitcoin price prediction hinges on whether buyers can reclaim $113,500 and push toward $115,000. Upside acceleration above that threshold could trigger liquidations and extend gains toward $120,000 and $124,000.

On the downside, failure to hold the $111,600–$111,800 support zone would expose BTC to the 100-day EMA near $111,780 and the 200-day EMA at $106,336. A breakdown below $106,000 would shift the broader bias back to bearish and invite deeper corrections toward $96,000.

Outlook: Will Bitcoin Go Up?

The immediate test for Bitcoin price today lies in the $113,200–$113,500 resistance cluster. A decisive break and follow-through toward $115,000 could unlock a liquidation-driven rally, pushing BTC toward the $120,000 zone.

As long as BTC stays above $111,600 support and maintains its rising channel, the bullish cycle remains intact. Analysts highlight that $115,000 will act as the defining battleground between cautious buyers and leveraged shorts in the coming sessions.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.