- Bitcoin consolidates above key Fibonacci support, keeping the broader bullish structure

- Falling futures open interest points to leverage reset, not capitulation or trend reversal

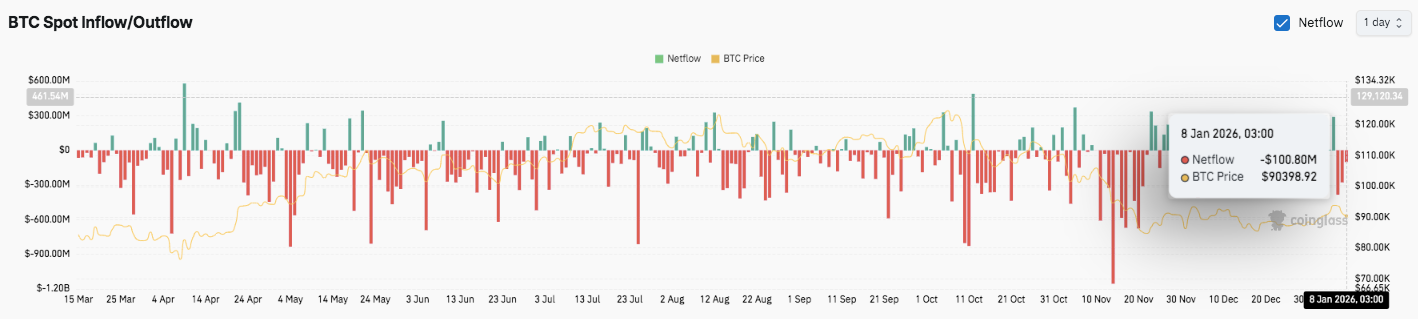

- Persistent spot outflows near resistance show hesitation as traders wait for conviction

Bitcoin’s short-term outlook remains constructive, although recent price action shows signs of cooling momentum. After pushing toward the $94,000 to $95,000 zone, BTC has shifted into a pullback phase.

Market data suggests this move reflects consolidation rather than trend exhaustion. Traders appear to be reassessing risk following repeated rejections near local highs. Hence, the focus has moved toward whether key support levels can preserve the bullish structure.

Recent trading behavior indicates that buyers still control the broader 4-hour trend. Price continues to hold above the Ichimoku cloud, which reinforces the prevailing bullish bias. However, momentum indicators show reduced upside strength. Consequently, Bitcoin may require additional time to build support before attempting another upward extension.

Technical Structure Holds Above Key Support

From a structural perspective, Bitcoin remains above several important technical zones. The $90,500 to $90,300 range has emerged as a critical area. This zone aligns with the 0.618 Fibonacci retracement and prior consolidation activity. As long as price stays above this region, bulls retain near-term control.

Additionally, the $89,200 to $89,000 range provides secondary support. This area sits near the 0.5 Fibonacci level and aligns with Ichimoku cloud support. A deeper pullback toward $86,400 would still preserve a higher-low structure. However, such a move would weaken short-term confidence.

Related: Cardano Price Prediction: Support At $0.39 Faces Breakdown Risk As Sellers Retain Control

On the upside, resistance remains clearly defined. The $92,300 to $92,500 zone represents the immediate barrier. Moreover, the $94,600 to $95,000 range continues to act as a strong supply area. Previous rejections there suggest sellers remain active.

Futures Positioning Signals Cautious Reset

Besides price structure, derivatives data offers important insight. Bitcoin futures open interest expanded steadily during the recent rally. This trend reflected growing leverage and speculative participation. Significantly, open interest has declined alongside the current price pullback.

This divergence suggests traders have reduced exposure after the failed breakout attempt. Liquidations and risk trimming likely contributed to this decline. However, open interest remains elevated near $63 billion. This level signals ongoing institutional engagement rather than market exit.

Spot Flows Reflect Muted Demand

Spot market flows further support a cautious narrative. Data shows persistent net outflows, indicating assets continue leaving exchanges. Several large outflow spikes coincided with local price pullbacks. Additionally, inflows have remained brief and inconsistent.

The most recent data point shows roughly $100 million in net outflows. This pattern suggests limited accumulation appetite near resistance. Overall, spot flows indicate Bitcoin remains in a waiting phase. Market participants appear to seek stronger conviction before committing to the next directional move.

Technical Outlook for Bitcoin (BTC)

Bitcoin’s technical structure remains constructive, with price compressing between well-defined support and resistance zones. Short-term momentum has cooled following rejection near recent highs, yet the broader setup still favors range continuation rather than trend failure.

- Upside levels: Immediate resistance sits at $92,300–$92,500, where prior rallies stalled. A clean breakout could open a move toward $94,600–$95,000, the recent swing high and major supply zone. Acceptance above this ceiling would strengthen bullish continuation signals.

- Downside levels: Key support rests at $90,500–$90,300, aligned with the 0.618 Fibonacci retracement and prior consolidation. Below that, $89,200–$89,000 acts as secondary support near cloud and trend alignment. A deeper pullback exposes $86,400, the last higher-low level preserving bullish structure.

- Resistance ceiling: The $94,600–$95,000 zone remains the critical level to flip for renewed upside momentum on the 4H timeframe.

Technically, Bitcoin is consolidating within a tightening range after an impulsive advance. This compression reflects profit-taking and position unwinding rather than broad distribution. Derivatives data supports this view, as open interest has eased while remaining historically elevated.

Will Bitcoin Push Higher?

Bitcoin’s near-term direction depends on whether buyers can defend $90,300 and reclaim $92,500 with volume. Sustained strength above resistance could revive upside momentum toward $95,000. However, failure to hold $89,000 would weaken the structure and shift focus toward $86,400.

For now, Bitcoin trades in a pivotal zone. Volatility compression suggests a larger move may be forming, but confirmation from price acceptance and flows will decide the next leg.

Related: Dogecoin Price Prediction: DOGE Holds Ground as Market Enters a Critical Consolidation Phase

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.