At press time, the Bitcoin price is at $112,999, which is up from $110,500 last week. The rebound occurs because BTC is defending its channel support, while the stock market is regaining confidence. Traders are keeping an eye on whether inflows and macro correlations can push the price back up to $115,000.

Bitcoin Defends Bull Market Support

The daily chart shows that BTC is at the lower end of its rising channel, and the bull market band around $107,800–$108,000 gives it extra support. This level has repeatedly stopped declines, keeping the overall uptrend going.

Resistance now sits at $113,200–$113,500, where the 50-day EMA intersects with recent rejection levels. A break above this zone would confirm momentum toward $115,000 and potentially $117,500. Below $110,500, downside risk opens toward $107,500 and the 200-day EMA near $104,400.

EMA alignment still favors buyers, but momentum remains fragile. Price is squeezed between the 20-day EMA at $112,280 and the 200-day base at $104,372, setting up a pivotal battle in the days ahead.

On-Chain Flows Signal Accumulation

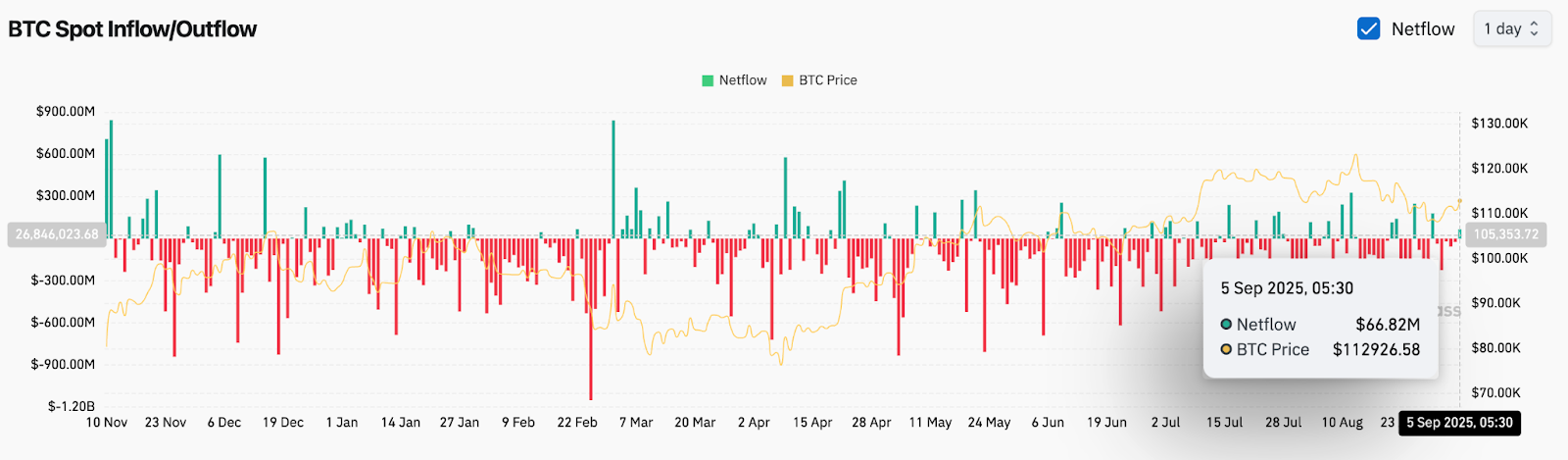

On-chain spot data recorded $66.8 million in net inflows on September 5, reversing weeks of persistent outflows. The return of positive flows suggests traders are gradually rebuilding positions at current levels.

However, inflows remain modest compared to March peaks above $600 million. Analysts warn that conviction remains thin, and sustained inflows above $200 million would be needed to fuel a stronger breakout. Still, the shift toward net buying provides early support for the $110,000 floor.

Nasdaq Correlation Spurs Confidence

Macro sentiment has added a fresh catalyst. Crypto strategist Crypto Rover highlighted the Nasdaq’s surge and its recurring pattern of leading Bitcoin higher. Past cycles show BTC typically lagging equities by several weeks before resuming its rally.

The correlation narrative is boosting bullish positioning, with many traders eyeing $120,000 as the next potential magnet if the Nasdaq uptrend persists. Broader risk appetite across equities may provide a tailwind, even as crypto-specific inflows remain tentative.

Technical Outlook For BTC Price

Key resistance levels are stacked overhead. Clearing $113,500 would unlock $115,000, followed by $117,500 and $123,600 at the channel top. Failure to break these caps could keep BTC consolidating inside its current band.

On the downside, immediate support sits at $110,500. A deeper failure could retest $107,800 and $104,400, both critical for maintaining the long-term bull market structure.

Outlook: Will Bitcoin Go Up?

Bitcoin’s near-term outlook hinges on whether modest inflows and Nasdaq correlation can push it through $113,500 resistance. Technical compression suggests a decisive move is approaching, with the broader channel trend still intact.

As long as BTC holds above $110,500, analysts see upside targets at $115,000 and $117,500. A breakdown below $107,800, however, would weaken the bullish case and shift focus back to $104,400. For now, the bias remains cautiously optimistic with macro tailwinds supporting price stability.

BTC Forecast Table

| BTC Price Levels | Outlook |

| Resistance | $113,500, $115,000, $117,500, $123,600 |

| Support | $110,500, $107,800, $104,400 |

| On-Chain Flows | $66.8M net inflows, modest accumulation |

| Macro Narrative | Nasdaq correlation supports bullish case |

| Bias | Cautiously bullish above $110,500 |

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.