- BlackRock’s $1B Bitcoin sale deepens bearish momentum below key $106K support.

- Rising open interest to $73B shows confidence but raises liquidation risks.

- Strong exchange outflows hint at long-term accumulation despite short-term weakness.

Bitcoin remains under intense selling pressure after failing to sustain key support levels near $106,000. The world’s largest cryptocurrency continues to trend lower as institutional movements intensify, with reports indicating that BlackRock sold about 9,000 BTC valued at roughly $1 billion earlier today. This significant sell-off has added to the bearish momentum that started after Bitcoin’s rejection from its $126,000 peak earlier this month.

Market Trend and Technical Outlook

Bitcoin’s 4-hour chart shows a consistent formation of lower highs and lower lows, signaling a clear downtrend. The asset currently trades below all major exponential moving averages (20, 50, 100, and 200), confirming both short and mid-term bearish sentiment.

Immediate resistance lies between $110,000 and $113,000, where the 20 EMA and 0.236 Fibonacci level align. Failure to reclaim this zone could push prices toward $102,000.

Moreover, the 0.382 to 0.5 Fibonacci range, between $113,000 and $116,000, is densely packed with resistance from higher EMAs. A close above $118,000 the 0.618 Fib would be required to indicate any sustained reversal. Meanwhile, $105,927 remains the critical short-term support. A decisive break below it could accelerate losses toward $100,000.

Investor Behavior and Derivatives Activity

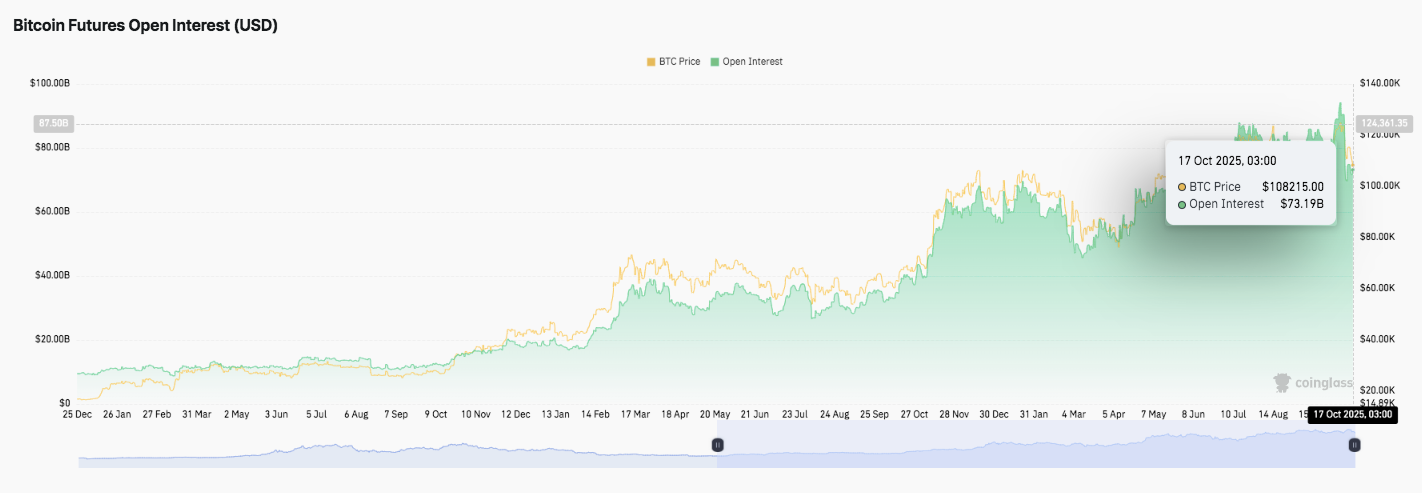

Despite the correction, market participation in Bitcoin futures remains strong. Open interest has climbed steadily throughout 2025, rising from under $20 billion in January to above $70 billion by mid-October.

As of October 17, total open interest stood at $73.19 billion, reflecting heightened speculative activity. This level of leverage often signals confidence among traders but also increases liquidation risks if prices decline sharply.

Exchange Flows Indicate Long-Term Holding

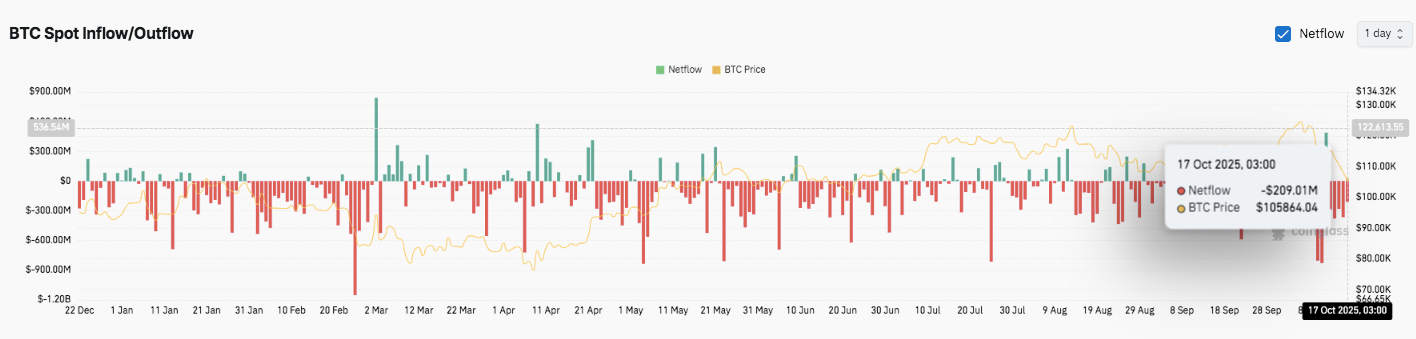

Data from exchange inflow and outflow charts show that Bitcoin outflows have dominated since February. Large withdrawals in April, June, and early October suggest that many investors prefer self-custody over exchange storage. On October 17, $209 million in outflows were recorded as prices hovered near $105,864. This pattern points toward long-term accumulation despite short-term price weakness.

Technical Outlook for Bitcoin Price

Key levels remain clearly defined heading into late October:

- Upside levels: $110,700 (0.236 Fib), $113,700 (0.382 Fib), and $116,100 (0.5 Fib) are the nearest resistance zones. A breakout above these could extend toward $118,500 and $121,900, where the 0.618 and 0.786 Fibonacci retracements align with long-term moving averages.

- Downside levels: Immediate support sits near $105,900, followed by $103,000 and $102,000, marking the lower boundary of the recent consolidation range. A sustained break below $102,000 could trigger a deeper pullback toward $100,000 psychological support.

- Resistance ceiling: The 200 EMA near $115,300 remains the key level to flip for any medium-term bullish reversal.

The technical setup suggests Bitcoin is compressing within a declining channel, signaling volatility buildup before the next decisive move.

Will Bitcoin Rebound or Extend Its Correction?

Bitcoin’s price prediction for October depends on whether bulls can defend the $105,900–$103,000 demand zone long enough to reclaim short-term EMAs. A strong close above $111,000–$113,000 could validate a short-term recovery, targeting $118,500 next.

However, persistent rejection at the 20–50 EMA cluster would confirm the continuation of the bearish structure. Elevated open interest and institutional selling, including BlackRock’s $1 billion liquidation, point toward heightened volatility ahead. For now, Bitcoin remains at a critical juncture holding key support could spark a rebound, but failure would expose the next downside phase toward $100,000.

Related: Dogecoin Price Prediction: Musk’s Tweet Reignites Hype But Resistance Holds

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.