- Bitcoin stays fragile below $74,500 as rebounds face steady selling pressure

- Open interest reset near $46B signals leverage unwind, not fresh short attacks

- Spot flows show cautious dip-buying, but conviction remains weak above $69K

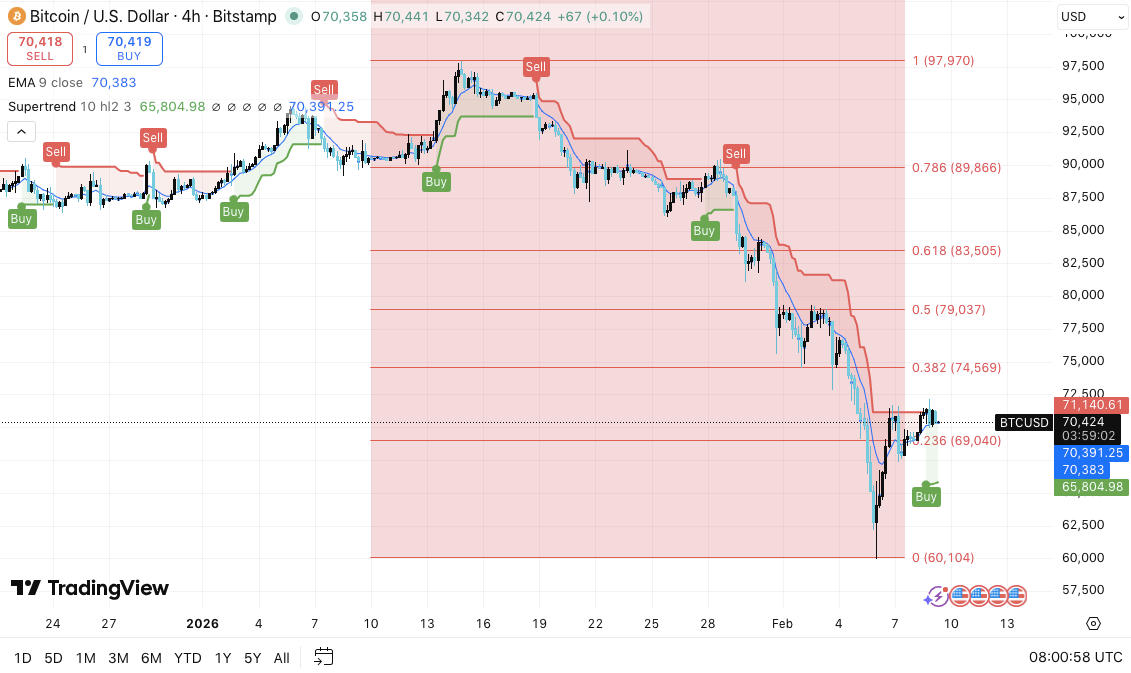

Bitcoin continued to trade under pressure on the 4-hour chart as traders assessed the damage from January’s sharp decline. The pullback followed a rejection near $97,900, which marked a local peak and shifted short-term sentiment.

Since then, price action has reflected hesitation rather than confidence. Market participants now appear focused on whether the recent rebound can develop into something more durable.

Short-Term Structure Remains Fragile

The 4-hour chart shows Bitcoin holding inside a corrective phase despite a bounce from the $60,100 area. That level marked the lowest point of the recent cycle and sparked a technical rebound. However, the recovery stalled below $69,040, which now acts as a key pivot. Besides that, price remains capped below short-term trend indicators, reinforcing caution.

The rebound lacked strong momentum, which suggests traders treated the move as relief rather than a trend change. Hence, the market still lacks confirmation of sustained buying interest. A clean push above $74,500 would improve the short-term structure. Until then, rallies may continue to face selling pressure near known resistance zones.

Several resistance levels continue to define the upside path. The $74,569 region marks the first major hurdle, followed by $79,037. Moreover, the $83,505 level stands out as a trend-defining barrier that previously supported price. A move toward $89,866 would require a clear shift in momentum and participation.

Related: Cardano Price Prediction: ADA Holds $0.27 As Hoskinson’s $3B Loss Highlights Cycle Stress

On the downside, $69,040 serves as immediate support. Additionally, the $65,800 to $66,000 zone remains important due to its alignment with trend support. A break below that range would increase the risk of a return toward $60,100. Consequently, short-term risk remains skewed until buyers reclaim higher ground.

Derivatives and Spot Flows Signal Caution

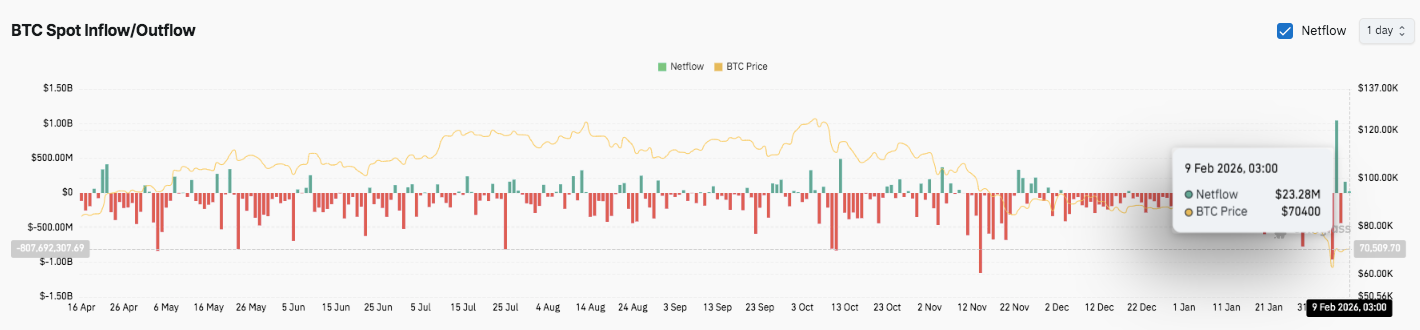

Open interest data adds context to the price action. Leverage expanded during earlier advances, then unwound sharply during pullbacks. The latest drop toward $46 billion suggests long positions exited the market. However, it does not signal aggressive new short exposure. Significantly, this reset keeps positioning relatively balanced.

Spot flow data also reflects caution. Net outflows dominated recent sessions, especially during sell-offs. However, a modest inflow near $70,400 hints at early dip-buying interest. Still, accumulation remains limited. Therefore, Bitcoin’s near-term outlook depends on whether buyers can build conviction above resistance levels.

Technical Outlook for Bitcoin Price

Key levels remain clearly defined for Bitcoin as price consolidates after a sharp corrective move.

Upside levels include $74,500 as the first recovery hurdle, followed by $79,000 and $83,500, which aligns with the 0.618 Fibonacci retracement. A sustained breakout above $83,500 would signal improving structure and open the path toward $89,800 if momentum strengthens.

Related: Solana Price Prediction: SOL Defends $87 After 20% Surge While ETFs Continue To Exit

On the downside, $69,000 acts as immediate support. Below that, the $65,800–$66,000 zone serves as a critical demand area tied to trend support. The major downside level remains $60,100, which marks the recent cycle low.

The technical structure suggests Bitcoin is stabilizing after a deep pullback rather than starting a fresh uptrend. Price continues to trade below key resistance levels, indicating sellers still control the broader 4-hour structure.

However, compression between $69,000 and $74,500 points to a buildup of short-term pressure. A decisive move beyond this range could trigger volatility expansion in either direction.

Will Bitcoin Regain Momentum?

Bitcoin’s near-term outlook depends on whether buyers can defend $69,000 and reclaim $74,500 with conviction. Stronger spot inflows and improving open interest would support a push toward $79,000 and higher.

Failure to hold $69,000, however, risks a renewed test of $65,800 and potentially $60,100. For now, Bitcoin remains in a pivotal consolidation zone. Directional confirmation, rather than anticipation, will likely define the next major move.

Related: Aster (ASTER) Price Prediction: ASTER Rebound Meets Supply Zone as Leverage Continues to Drop

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.