- Bitcoin is clinging to the $90,000 psychological level as repeated rejections below key EMAs keep the structure bearish.

- Heavy ETF outflows and negative spot flows confirm distribution, not accumulation, during recent rebounds.

- A breakdown below $90,000 risks accelerating losses toward $86,900, while bulls need $95,100 reclaimed to regain control.

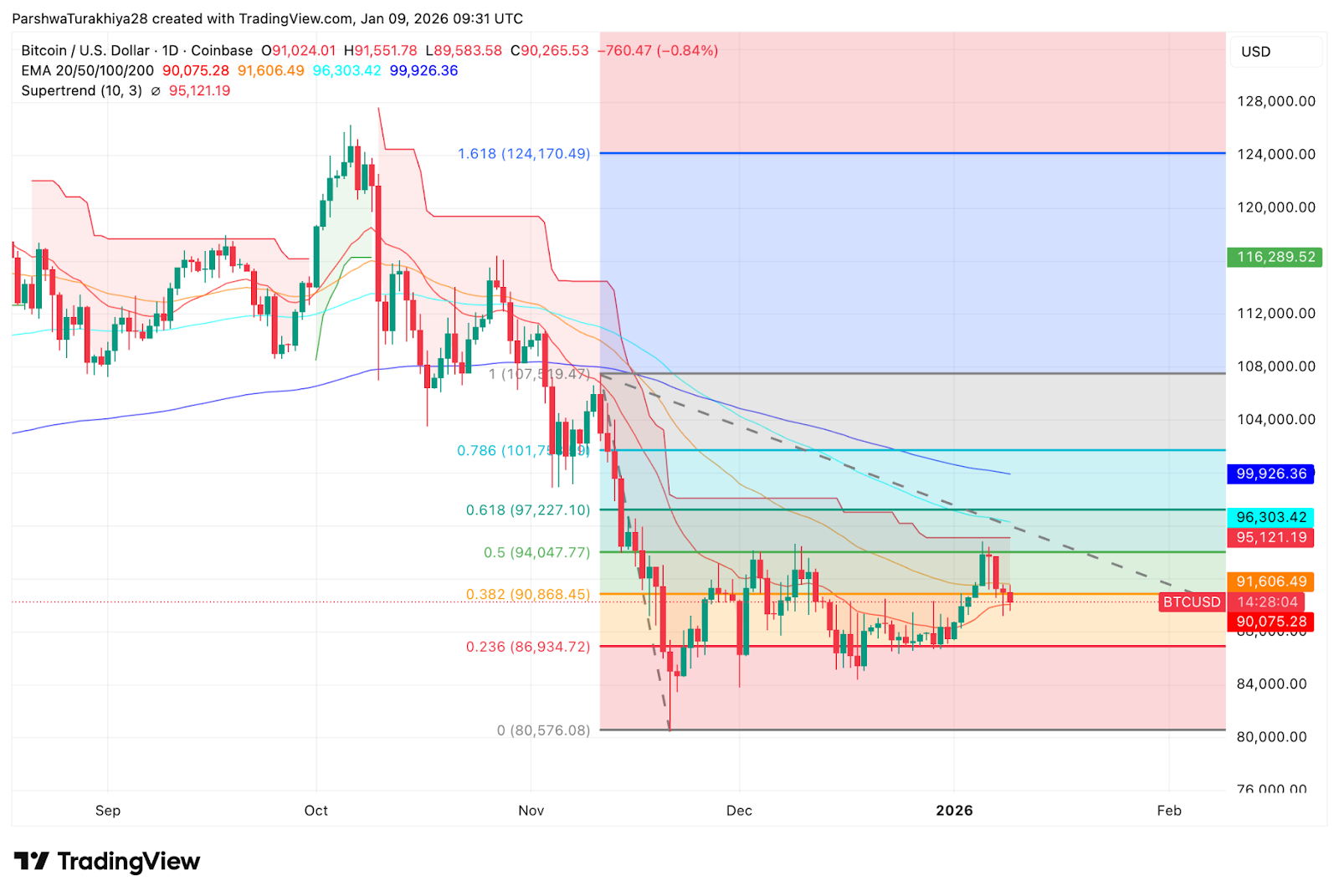

Bitcoin price today trades near $90,300 on January 9, 2026, holding just above the $90,000 psychological support as selling pressure persists. The market remains under strain following repeated failures to reclaim key moving averages, while spot and ETF flows continue to point toward distribution rather than accumulation.

Trendline Rejection Keeps Structure Weak

On the daily chart, Bitcoin continues to trade below a descending trendline that has capped every recovery attempt since late November. That trendline rejection earlier this week reinforced the bearish structure and forced price back into the lower Fibonacci retracement zone.

Bitcoin remains below the 20, 50, and 100-day EMAs, which are now clustered between $90,100 and $96,300. The 200-day EMA near $99,900 remains well above price, signaling that the broader trend has not reset.

The Supertrend indicator continues to print bearish, with its trigger level near $95,100 acting as dynamic resistance. As long as price stays below this zone, sellers retain structural control.

Fibonacci Levels Define Key Risk Zones

Bitcoin is currently hovering near the 0.382 Fibonacci retracement at $90,868, a level that has acted as short-term support over the past two sessions. This zone is critical. A sustained break below it would expose the 0.236 level near $86,935, which aligns with the December swing low.

Above price, resistance builds quickly. The 0.5 retracement near $94,050 and the 0.618 level around $97,227 form a layered supply zone where previous rallies have stalled. These levels must be reclaimed to change the short-term bias.

Until that happens, price remains vulnerable to further downside tests.

Lower Timeframe Momentum Remains Defensive

The 30-minute chart confirms the lack of follow-through from buyers. Bitcoin continues to form lower highs, with descending resistance pressing down near $92,500. Each bounce into that zone has been sold aggressively.

RSI remains below the neutral 50 level, reflecting weak momentum. MACD has rolled back into negative territory after a brief recovery attempt, signaling fading bullish pressure.

Short-term traders appear cautious, prioritizing capital preservation rather than positioning for upside.

ETF And Spot Flows Confirm Distribution

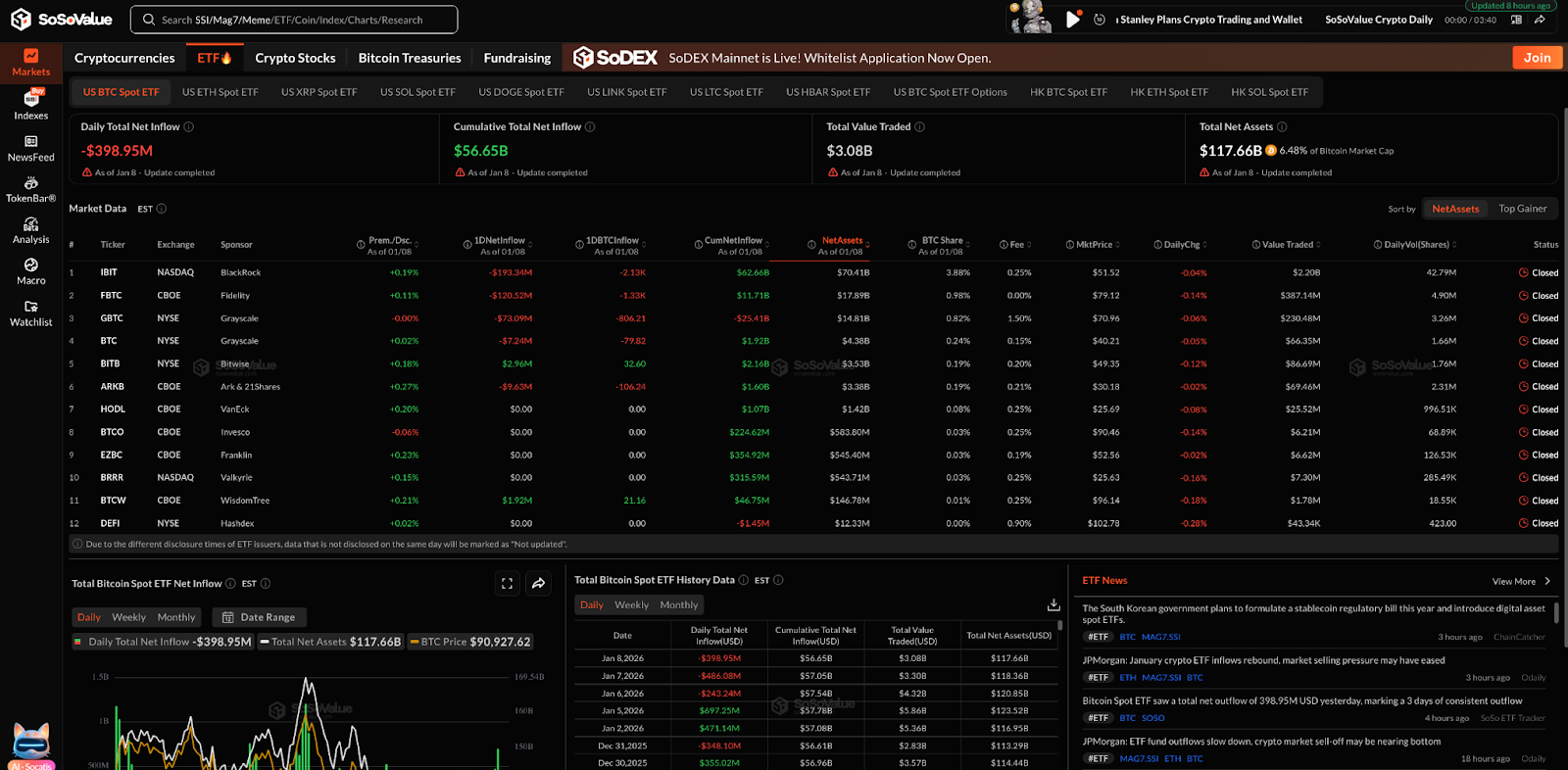

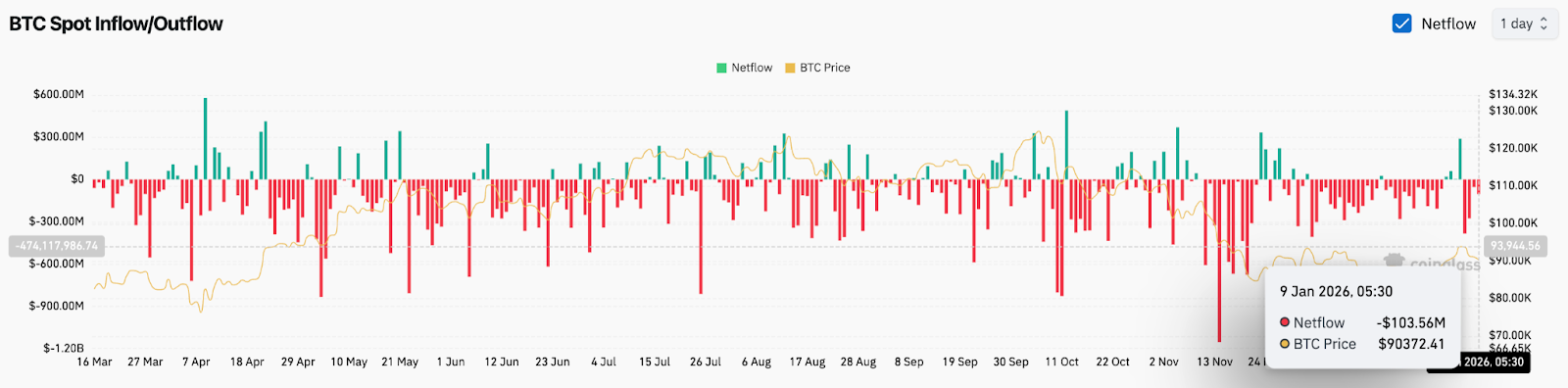

Flow data reinforces the bearish structure.

On January 8, 2026, U.S. spot Bitcoin ETFs recorded $398.95 million in net outflows, marking a third consecutive session of redemptions. Major products, including BlackRock’s IBIT and Fidelity’s FBTC, both posted net outflows on the day, confirming that institutional exposure was reduced rather than rotated.

Spot exchange data shows a similar pattern. Bitcoin recorded a net spot outflow of approximately $103.6 million on January 9, as coins moved onto exchanges during periods of price weakness. This behavior typically reflects distribution, not accumulation.

When ETF redemptions and spot flows align to the downside, rallies tend to fail quickly. That dynamic has been visible throughout the past week.

Outlook. Will Bitcoin Go Up?

Bitcoin is approaching a decisive inflection point.

- Bullish case: Buyers need a daily close above $92,500, followed by a reclaim of $95,100, to signal a shift in momentum. A sustained move above $97,200 would invalidate the current corrective structure and reopen the path toward the 200-day EMA near $100,000.

- Bearish case: A confirmed break below $90,000 would likely accelerate selling toward $86,900. Failure to hold that level exposes a deeper retracement toward $80,500.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.