- Bitcoin price today holds near $113,800 with buyers defending $112K support as volatility compression tightens.

- Fed policy decision on ending QT could inject liquidity, with a dovish outcome seen as bullish for Bitcoin.

- Trump–Xi summit may add momentum, with progress on trade talks potentially lifting BTC toward $118K targets.

Bitcoin price today trades near $113,800, showing mild weakness after a brief rebound from last week’s correction. The market remains on edge ahead of Wednesday’s Federal Reserve policy decision and the Trump–Xi summit, both of which could dictate near-term liquidity trends across risk assets.

Buyers Defend $112K Zone As Compression Tightens

On the daily chart, Bitcoin price action continues to hover around the 20, 50, and 100 EMA cluster between $112,400 and $112,800, a zone that has acted as a critical pivot since early October. The lower Bollinger Band near $111,600 aligns with horizontal support, marking the base of this consolidation.

The 200-day EMA sits near $108,300, reinforcing the broader uptrend structure. A sustained close above $114,500 would confirm a break from the short-term descending trendline and expose the upper Bollinger Band around $118,600. On the downside, a drop below $111,600 could trigger retests toward $108,000, where buyers previously stepped in aggressively.

This compression phase has narrowed volatility, with traders positioning for a breakout once macro catalysts settle. For now, Bitcoin price volatility remains muted but primed for expansion as major liquidity events unfold midweek.

Fed QT Pause Could Reignite Risk Appetite

The upcoming Federal Reserve meeting is the key macro event this week. According to JPMorgan Chase & Co. (NYSE: JPM) and Goldman Sachs Group Inc. (NYSE: GS), policymakers are likely to end quantitative tightening (QT), effectively stopping balance-sheet runoff.

If confirmed, that decision would inject fresh dollar liquidity into the system, supporting equities and crypto assets alike. Bitcoin has historically shown strong correlation to liquidity cycles, and an end to QT could trigger renewed demand across both spot and derivatives markets.

Conversely, if the Fed maintains QT or tempers expectations for rate cuts, liquidity conditions could tighten again, pressuring speculative assets. Traders will also watch Chair Jerome Powell’s tone closely for signs of how long the policy pause might last.

Related: Dogecoin Price Prediction: Market Braces For Breakout With $812M Options Spike

In this context, Bitcoin price prediction remains tied to macro liquidity sentiment. A dovish outcome would likely reinforce bids above $112K, while a hawkish stance could drag the market back toward $108K support.

Trump–Xi Summit Adds Geopolitical Dimension

Beyond monetary policy, the Trump–Xi summit adds another layer to this week’s volatility. Reports from U.S. Treasury officials describe “very positive” progress, with both leaders nearing a trade truce extension.

An agreement would likely lift global risk sentiment, weaken the dollar, and enhance flows toward alternative assets like Bitcoin. Historically, periods of reduced geopolitical friction have coincided with stronger crypto performance, as investors rotate toward higher-yielding assets.

If talks stall or rhetoric turns negative, risk appetite could fade quickly, favoring safe-haven demand for the dollar and reducing speculative interest in crypto. This dynamic makes Thursday’s meeting a potential inflection point for near-term Bitcoin price action.

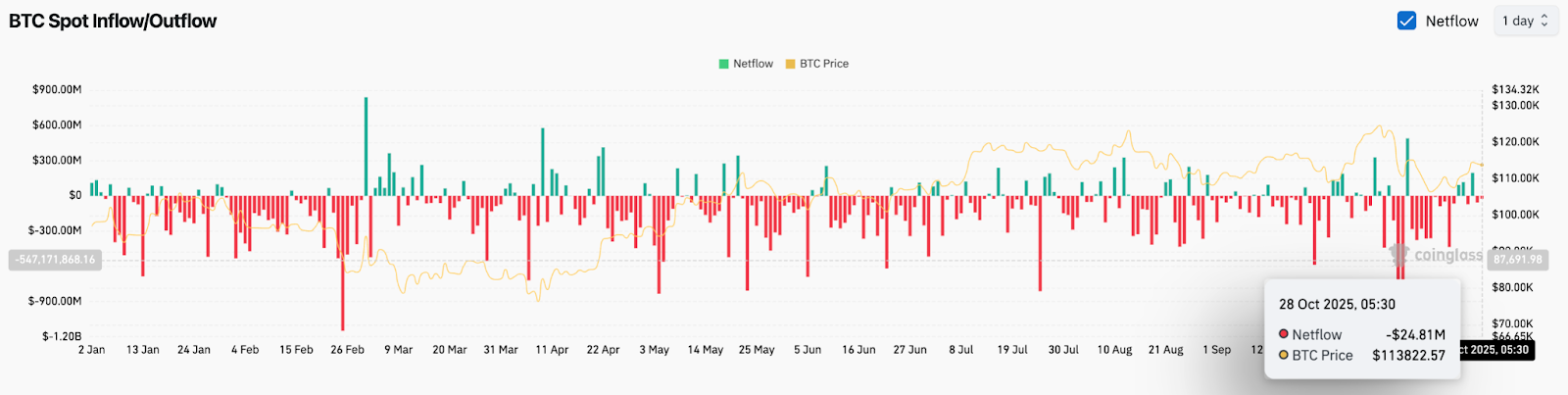

Exchange Flows Show Modest Outflows

According to Coinglass data, spot exchange netflows on October 28 totaled roughly –$24.8 million, indicating mild BTC outflows from exchanges. While not large, the shift suggests holders are gradually moving coins to storage, a sign of improving confidence after last week’s panic drop.

Over the past month, outflows have consistently outweighed inflows, totaling more than $500 million. This steady withdrawal pattern supports a constructive backdrop, as reduced supply on exchanges often precedes price stabilization or gradual recovery phases.

Still, overall sentiment remains cautious. Funding rates and open interest have yet to pick up, reflecting traders’ reluctance to add leverage ahead of the Fed decision. A meaningful return of inflows to long positions would be needed to confirm a shift in near-term momentum.

Outlook: Will Bitcoin Go Up?

The short-term Bitcoin price outlook hinges on liquidity cues from the Federal Reserve and the outcome of the Trump–Xi summit. A dovish QT pause combined with positive trade headlines could drive BTC toward $118,000, marking a resumption of the broader uptrend.

If policymakers delay liquidity easing or the summit disappoints, Bitcoin could revisit $108,000 before buyers reassert control.

For now, Bitcoin price prediction remains cautiously bullish above $112,000. Traders are watching for confirmation of a breakout or rejection from the compression zone that has defined October’s trade. A decisive move in either direction this week could set the tone for November’s volatility.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.