- Bitcoin price has signaled midterm bullish sentiment amid recent correction fueled by market uncertainty.

- Whale institutional investors have slowed their BTC accumulation despite the cumulative robust fundamentals.

- The upcoming Federal Reserve’s interest rates decision will be a pivotal moment for BTC price.

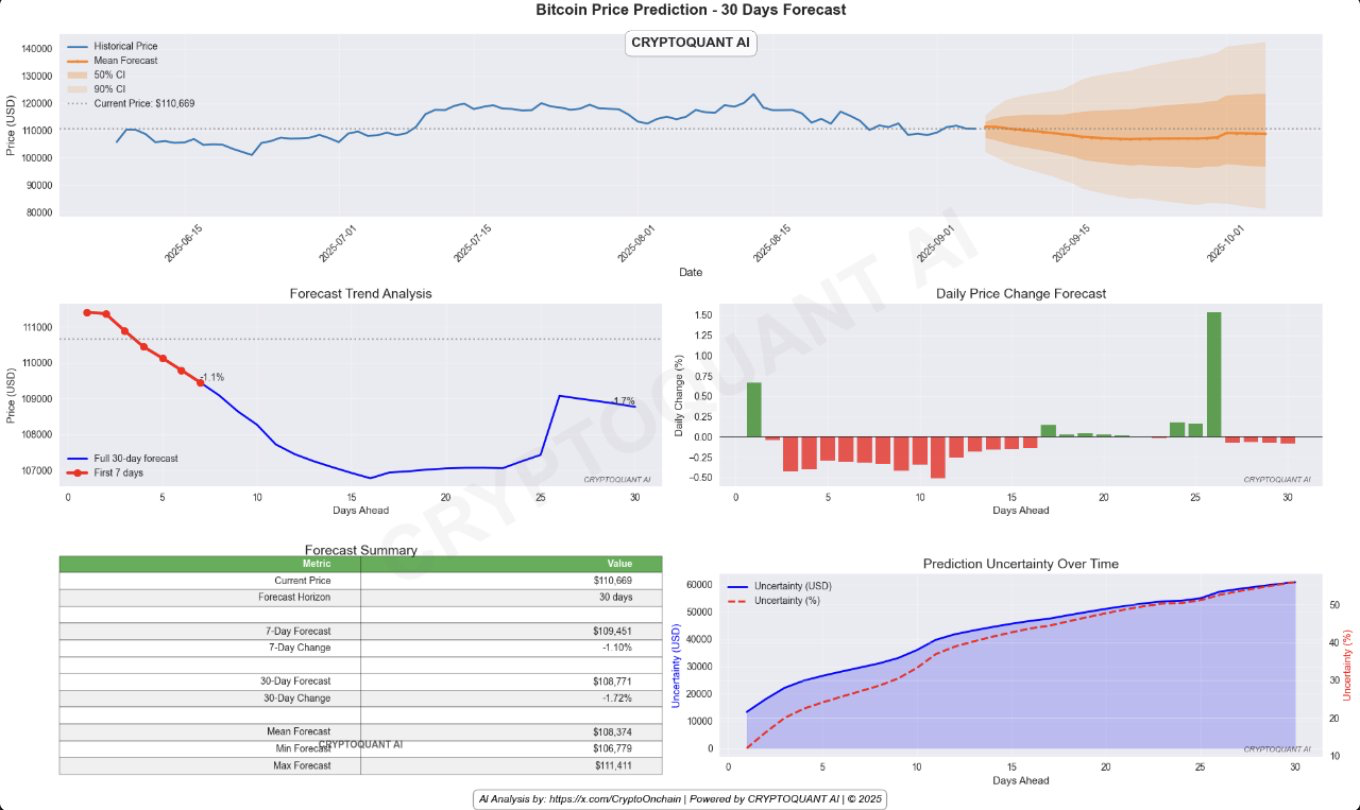

An advanced AI model from CryptoQuant is predicting a choppy and slightly bearish month for Bitcoin (BTC), forecasting a potential drop to $108,000 over the next 30 days. However, the model also signals a high probability of a major volatility spike at the end of the month, a period that coincides with the critical September 17 Fed rate decision.

It should be noted that Bitcoin (BTC) price has traded in the range between $107.5k and $120k since early July, 2025. Although heightened traders’ uncertainty for the midterm has fueled ongoing BTC price correction, Bitwise CIO Matt Hougan believes that the flagship coin should be trading above $150k.

Furthermore, Bitcoin has accumulated significant positive fundamentals, especially in the United States, but the macroeconomic uncertainty has surpassed its market price. As such, on-chain data shows a slow demand for Bitcoin from spot BTC ETFs, corporations, and individual whales in the past few days.

Related: Crypto Market in September: Rally Incoming or Red Month Again?

The 30-Day Forecast from CryptoQuant’s AI Model

CryptoQuant’s Temporal Fusion Transformer (TFT) model, which relies on advanced AI analysis, has a neutral-to-bearish outlook for Bitcoin for the remainder of September.

However, the TFT model predicted that there is a high chance that BTC price will experience a heightened volatility at the tail end of this month. Based on a conservative estimate, the TFT model predicted that Bitcoin price may record an overall decrease of 1.72% and drop to the support level around $108,771.

| Minimum Forecast | Mean Forecast | Max Forecast | |

| CryptoQuant’s TFT model | $106,779 | $108,374 | $111,411 |

Nonetheless, the TFT model cautioned crypto traders that Bitcoin price may experience a higher volatility triggered by sentiment change at the end of this month. Moreover, the fourth quarter of 2025 is expected to be bullish for Bitcoin, if on-chain data shows a renewed demand from whale institutional investors.

“The market is under slight selling pressure in the short term. However, the last week of September will be very crucial due to the high volatility potential,” CryptoQuant concluded .

What are the Top Factors Likely To Impact BTC Price in September?

Can BTC Price Mirror Gold Price Action?

Yes. Bitcoin price has over the years followed Gold breakout. During the past four weeks, Gold price has rallied on high demand from institutional investors and central banks to reach a new all-time high of about $3,618 on Monday, September 8, 2025.

According to JPMorgan’s analysts, Bitcoin price is undervalued relative to Gold, thus likely to rally towards $126k soon. Moreover, Bitcoin has gained significant regulatory clarity and is now globally accepted as digital gold.

Federal Reserve Rate Decision

The main event for this month will be the Federal Reserve’s interest rates decision on September 17. Last week’s weak labor market data increased the odds of a Fed rate cut by 25 bps.

With the heightened pressure on the Federal Reserve by the Executive Branch led by President Donald Trump, a possible rate cut will trigger bullish sentiment for BTC and the wider crypto market.

Related: Bitcoin Price Prediction: Analysts Eye $113K Rebound As CME Gap Anchors Support

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.