- Bitcoin trades near $90K as bulls defend support amid tight range and mixed signals.

- Futures open interest rises, showing higher leveraged risk while spot outflows persist.

- Institutional accumulation accelerates, adding 10,624 BTC and boosting long-term confidence.

Bitcoin trades near $90,350 as traders weigh mixed signals from derivatives activity, spot flows, and major institutional accumulation. The market shows hesitation after several attempts to reclaim early resistance levels, yet the broader structure hints at growing momentum beneath the surface.

Price Structure Remains Tight as Bulls Defend Support

Bitcoin continues to trade between $89,200 and $92,700 during a period of compressed volatility. The range sits beneath a cluster of short-term EMAs that capped every recent bounce.

Besides that, the 0.382 Fibonacci retracement near $94,379 still acts as the first major hurdle. A close above this level would signal stronger momentum. However, a failure to defend $89,179 could expose the market to a deeper retracement toward the mid-$80,000 zone.

Moreover, the 0.5 and 0.618 Fibonacci levels remain important higher targets. These zones sit at $98,583 and $102,786 and often define trend confirmation points in recovery phases. Traders note that the structure still attempts to form a higher low, though confirmation depends on a clean break above $92,700.

Derivatives Positioning Expands While Spot Flows Show Caution

Bitcoin futures open interest continues to rise and reflects increased confidence among leveraged traders. Activity climbed through the year and surged above $60 billion in November before easing slightly to $57.6 billion.

Related: Terra Classic (LUNC) Price Prediction: Market Reactions Strengthen…

The steady expansion shows strengthening participation and higher exposure to directional risk. However, the recent dip hints at selective profit-taking as price stalled near $90,600.

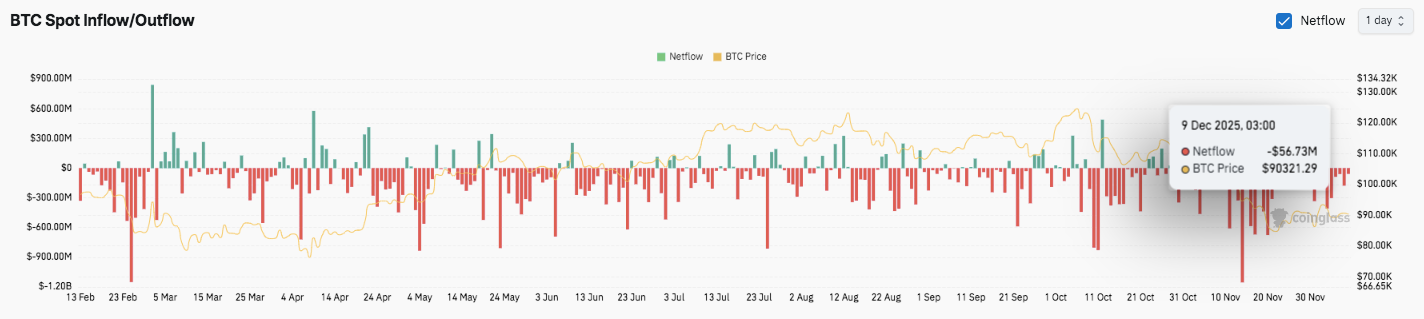

Spot flows tell a different story. Persistent outflows dominated recent months and signaled caution among long-term holders. Outflows reached $56.7 million on December 9 and maintained a bearish tilt across several weeks. Hence, investors continue to react defensively during each consolidation.

Institutions Scale Up Acquisitions as Market Awaits Breakout

A major institutional strategy deployed $963 million into Bitcoin this week. The firm added 10,624 BTC at an average price near $90,615.

Consequently, its total holdings now stand at 660,624 BTC. This position signals long-term conviction and strengthens the narrative around institutional balance-sheet adoption. Additionally, the purchase supports a growing shift toward credit-based digital banking models.

Technical Outlook for Bitcoin Price

Key levels remain clearly defined as Bitcoin trades inside a tightening range near $90,000.

Upside levels include $91,700, $92,700, and the 0.382 Fib at $94,379, which forms the first major hurdle for any recovery attempt. A breakout above that zone could extend toward the 0.5 Fib at $98,583 and later the 0.618 Fib at $102,786.

Related: Cardano Price Prediction: Channel Ceiling Rejects Bulls Again…

Downside levels start at $89,179, which serves as immediate trend support. Further support sits at $88,630 on the Bollinger mid-band. A breakdown below these two levels exposes the deeper range toward $80,772, which marks the cycle low and critical invalidation point.

The broader structure shows Bitcoin compressing between the $89,200 support region and the $92,700 EMA cluster. This setup signals a volatility expansion ahead, similar to previous pre-breakout periods.

A decisive close above $92,700 would flip short-term momentum and shift focus to the $94,379–$98,583 resistance band. Failure to reclaim $92,700 leaves Bitcoin vulnerable to continued choppy movement with weakening support strength.

Will Bitcoin Break Higher?

Bitcoin’s next direction depends on whether buyers can defend the $89,179 support and build enough momentum to challenge the 0.382 Fib at $94,379. Stronger inflows and rising open interest may support a push higher if market sentiment stabilizes. A clean move through $94,379 could reestablish the medium-term uptrend and open the path toward $98,583 and $102,786.

A breakdown below $89,179, however, risks losing the current accumulation zone and exposes Bitcoin to the mid-$80,000 region. For now, Bitcoin sits in a pivotal zone where futures demand, spot flows, and EMA alignment will decide the next major leg.

Related: Shiba Inu Price Prediction: Sellers Defend Trendline As Whale Activity Signals Volatility Ahead

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.