- Bitcoin is coiling between rising short-term support and descending resistance, signaling compression rather than a confirmed trend.

- Buyers continue to defend the $89,500–$90,000 area, while sellers cap upside below $95,100 Supertrend resistance.

- Spot selling pressure has eased, increasing the odds of a decisive breakout or breakdown early this week.

Bitcoin price today trades near $91,300 as the market moves into Jan 5 locked inside a tightening structure. Buyers are defending a rising short-term trendline, while sellers continue to cap upside below a descending resistance line that has defined price action since November. The result is compression, not momentum, with direction likely decided early this week as U.S. markets reopen.

Compression Tightens As Trendlines Converge

On the daily chart, Bitcoin continues to coil inside a narrowing wedge. The lower boundary has been rising since the mid-December low near $80,500, while the upper boundary slopes down from the November breakdown zone. Price is now pressing into the apex of that structure.

Bitcoin trades below the 100-day EMA near $96,750 and the 200-day EMA around $100,300, keeping the higher-timeframe structure defensive. The 20-day EMA at $88,900 and 50-day EMA at $91,500 are acting as near-term balance levels rather than trend drivers.

Supertrend on the daily chart remains bearish, sitting near $95,100, reinforcing the idea that sellers still control broader momentum. Until that level is reclaimed, upside attempts remain corrective.

Short-Term Charts Show Buyers Active But Constrained

Lower timeframes tell a more constructive story. On the 30-minute chart, Bitcoin has respected a clean rising trendline through the weekend. Each dip toward $89,500 to $90,000 has attracted bids, forming higher lows and keeping price elevated.

Momentum indicators reflect that stabilization. RSI has held above 60, suggesting strength without entering exhaustion territory. MACD remains positive but has started to flatten, showing that upside momentum is slowing rather than accelerating.

Price is currently consolidating just below $91,500, a level that has repeatedly stalled advances over the past 24 hours. A clean break above this zone would expose $92,000 to $92,500, where sellers have previously stepped in.

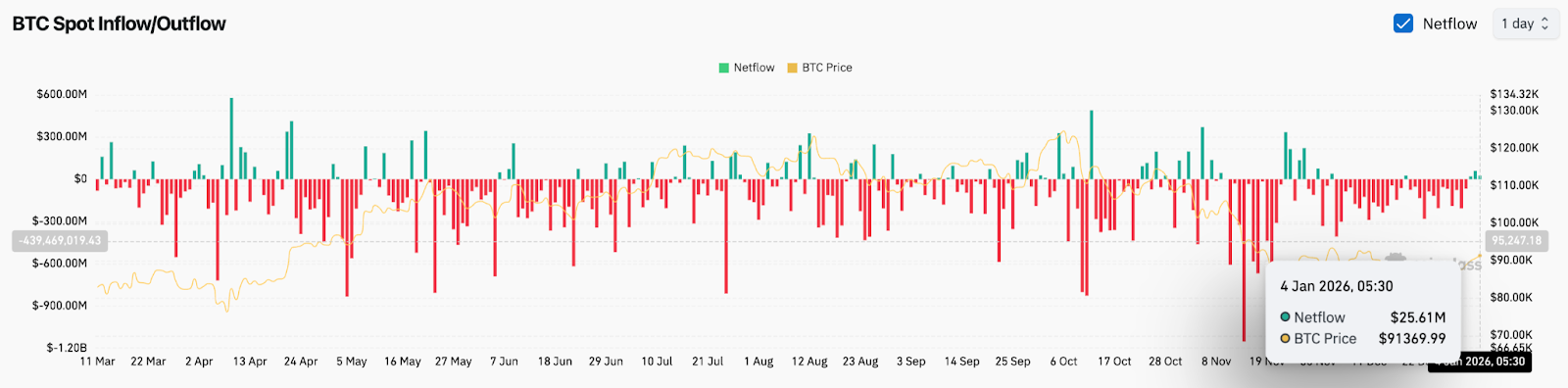

Spot Flows Stabilize After Heavy Distribution

Spot exchange data shows selling pressure has eased compared to late November and early December. While netflows remain negative on a broader lookback, the most recent session recorded a modest $25.6 million net inflow, suggesting that aggressive distribution has paused.

During the November breakdown, daily outflows regularly exceeded $300 million, coinciding with sharp downside extensions. The absence of similar flow pressure over the past several sessions helps explain why Bitcoin has held its ground despite technical weakness.

Geopolitical Shock Fails To Break Structure

Bitcoin’s muted response to weekend geopolitical headlines stood out. News surrounding U.S. airstrikes in Caracas and the capture of Venezuelan President Nicolás Maduro sparked intense debate online, yet risk assets showed little immediate reaction.

Historically, sudden geopolitical shocks have triggered abrupt drawdowns across risk markets, including crypto. This time, price held firm. Bitcoin remained above its short-term support levels, suggesting that forced selling was limited.

Some analysts see that resilience as constructive. Others caution that the calm may not last. With institutional players largely sidelined over the weekend, reaction flows could still emerge once traditional markets reopen.

Outlook. Will Bitcoin Go Up?

Bitcoin is compressing, not trending. That balance will break soon.

- Bullish case: A strong close above $95,100 flips Supertrend, breaks the descending trendline, and signals renewed upside toward the 100-day EMA.

- Bearish case: A daily close below $89,500 breaks rising support and opens the door to a deeper move toward $86,500 and below.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.