- Bitcoin price today trades near $104,100, struggling below the short-term EMA cluster amid weak recovery attempts.

- Spot outflows of $56.25 million signal mild distribution, while open interest rose 0.52 percent as futures volume dropped.

- Fed’s divided stance on a December rate cut keeps risk sentiment fragile, with key support seen at $102,900–$100,000.

Bitcoin price today trades near $104,100, struggling to regain momentum after repeated rejections from the short-term EMA cluster and the mid-range Fibonacci zone. Despite a mild recovery, technical and flow data point to lingering bearish pressure as uncertainty over a potential December Federal Reserve rate cut keeps risk sentiment fragile.

Spot Outflows Confirm Weak Risk Appetite

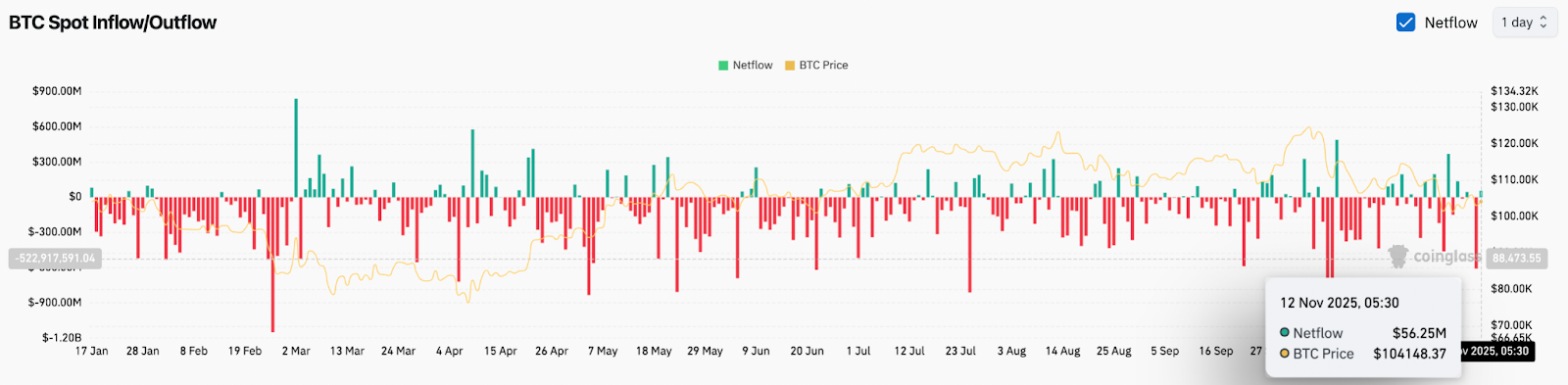

Data from Coinglass shows $56.25 million in net inflows to exchanges on November 12, suggesting mild distribution as traders moved Bitcoin back into circulation rather than accumulation.

This continues a broader trend of net outflows alternating with small inflows over recent weeks, indicating that market conviction remains weak.

Open Interest Rises As Futures Volume Drops

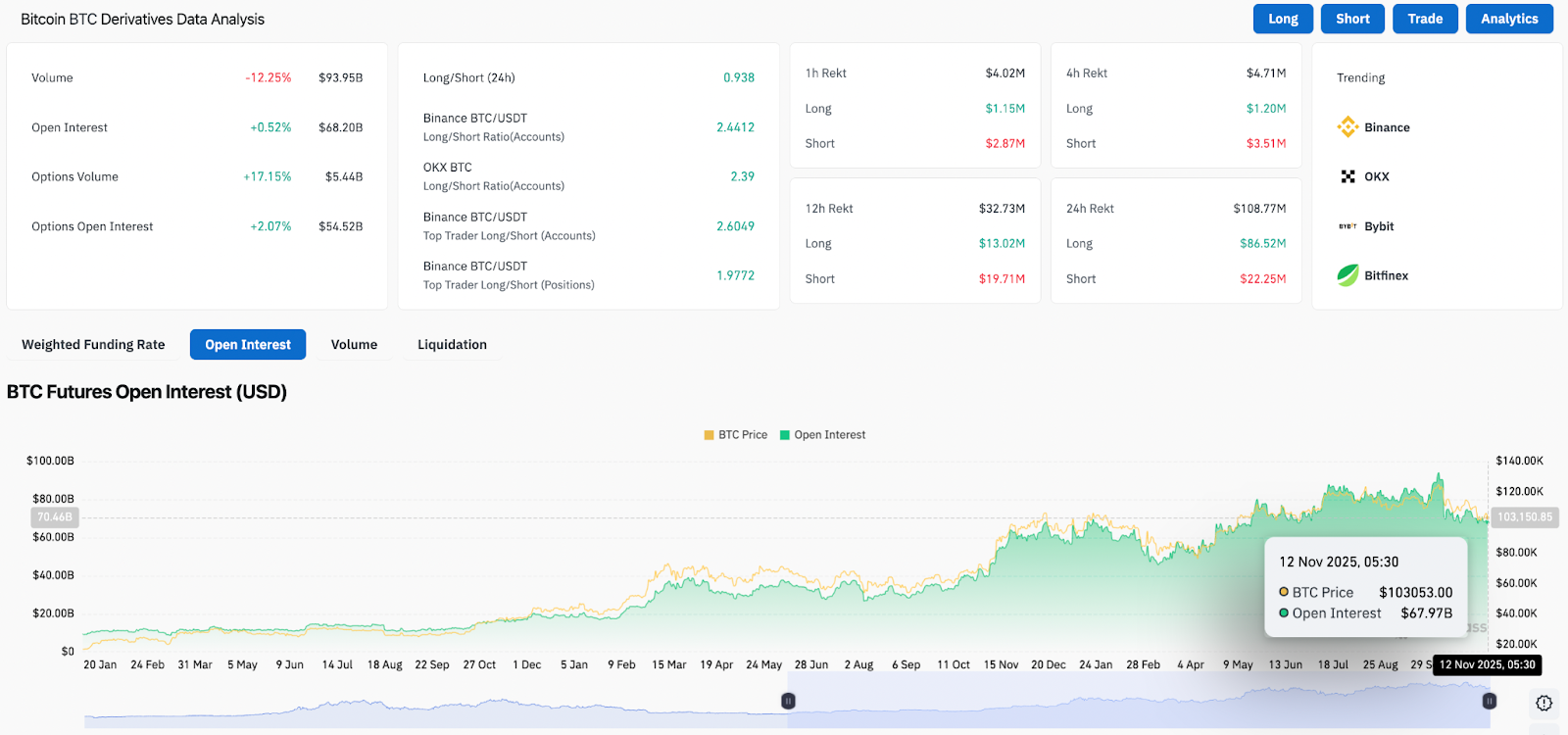

Derivatives data highlights a subtle but meaningful shift in trader behavior. Total open interest rose 0.52% to $68.2 billion, while futures trading volume dropped 12.25% to $93.95 billion.

This divergence suggests new positions are being opened with lower conviction, possibly representing defensive hedges rather than outright longs.

The long/short ratio across major exchanges like Binance and OKX remains above 2.3, showing a continued bullish skew. However, with over $108 million in 24-hour liquidations—most of them long positions—the leverage buildup remains a vulnerability if price slips below short-term support.

If this imbalance persists, another wave of forced liquidations could accelerate downside momentum toward the next visible demand zone.

Bitcoin Faces EMA Rejection And Channel Resistance

On the 4-hour chart, Bitcoin remains trapped inside a well-defined descending channel that has guided price action since early October.

Price currently trades just below the 20-, 50-, 100-, and 200-EMA cluster, ranging between $104,000 and $108,500.

Each recent rally into this zone has faced rejection, confirming it as a strong ceiling that must be cleared to shift the short-term structure.

Fibonacci retracement levels reinforce this view. Bitcoin’s rejection near the 0.382 level ($105,449) and repeated failures around the 0.5 zone ($107,490) show sellers defending with precision.

Immediate support lies at $102,924 (0.236 retracement), followed by the psychological $100,000 mark, while deeper demand may emerge near $98,850—the lower boundary of the descending channel.

The RSI sits in a neutral zone, reflecting indecision, while momentum remains flat. Until a breakout occurs above $107,500, the setup favors consolidation or a retest of lower support levels.

Macro Pressure: Rate-Cut Divide Limits Upside

The Federal Reserve’s split over a December rate cut has injected fresh uncertainty into risk markets.

According to the CME FedWatch Tool, traders now assign a 66.9% probability of a rate cut at the December 9–10 meeting, down from prior expectations of near certainty.

Fed Chair Jerome Powell’s recent remarks that a cut “is not a done deal” further tempered optimism.

Analysts like Min Jung of Presto Research caution that even if a cut is confirmed, much of the optimism “may already be priced in,” implying limited near-term upside for Bitcoin unless liquidity conditions improve meaningfully.

Outlook: Will Bitcoin Go Up?

Bitcoin remains at a crossroads.

- Bullish case: A decisive close above $107,500, backed by rising volume and improved spot flows, could trigger a move toward $110,000–$112,400, aligning with the upper Fibonacci and channel resistance zone.

- Bearish case: Failure to hold $102,900–$104,000 could send price toward $98,800, where the next demand pocket aligns with the lower channel boundary.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.