- Bitcoin price today trades near $106,900, with buyers holding $105K–$104K support.

- On-chain flows show minor inflows after $1.6B in outflows earlier this week.

- Polymarket odds place a 38% probability on Bitcoin ending October under $100K.

Bitcoin price today is consolidating near $106,900, with buyers attempting to hold the $105,000–$104,000 support range after a volatile week. The move comes after BTC briefly broke below its 200-day EMA cluster, prompting speculation over whether the correction is ending or just beginning.

Bitcoin Price Tests Multi-Month Support

BTC remains trapped between the $108,000 and $113,000 EMAs, with sellers defending the upper range.

The chart shows a break below the long-term ascending trendline from April, placing short-term bias in favor of consolidation or a potential retest of the $104,000 liquidity zone.

The 20-day EMA sits at $113,719, while the 50-day EMA is at $114,463, both above the current price, confirming resistance overhead. The 200-day EMA near $108,063 is acting as the key pivot — regaining this level would be crucial to restore bullish momentum.

The RSI on the daily chart is at 35.9, suggesting near-term oversold conditions but no confirmed reversal yet. Momentum has flattened, while MACD readings continue to favor sellers.

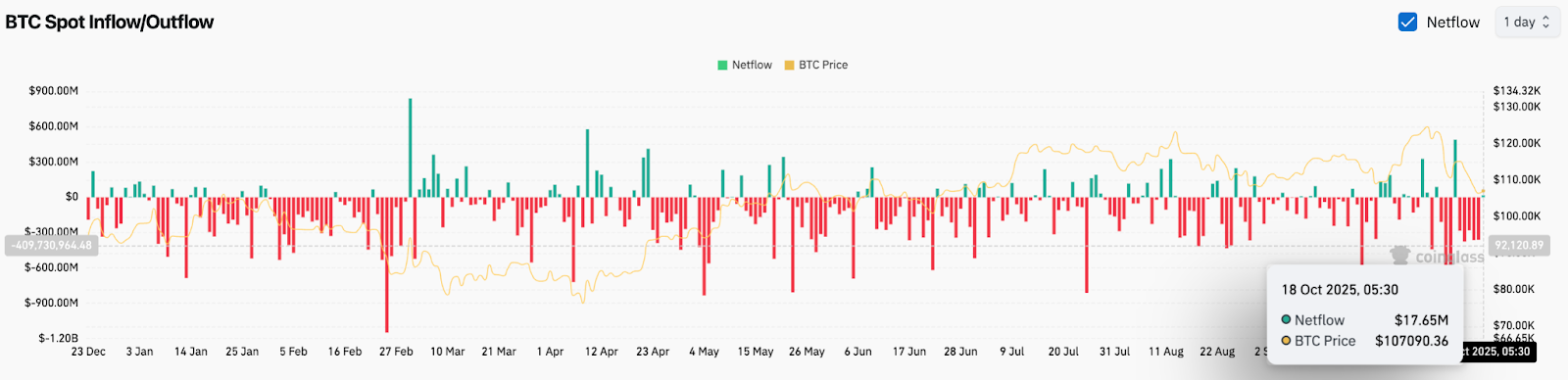

On-Chain Flows Show Minor Relief After Heavy Outflows

After nearly $1.6 billion in net outflows over the past five days, Coinglass data shows a modest $17.6 million net inflow on October 18, signaling the first positive day in a week.

However, this inflow is too small to indicate meaningful accumulation, and broader flow trends remain negative.

Traders are cautiously rebuilding exposure, but persistent outflows since early October reveal continued profit-taking and reduced institutional demand. Until sustained inflows reappear, the market may remain defensive despite technical stabilization.

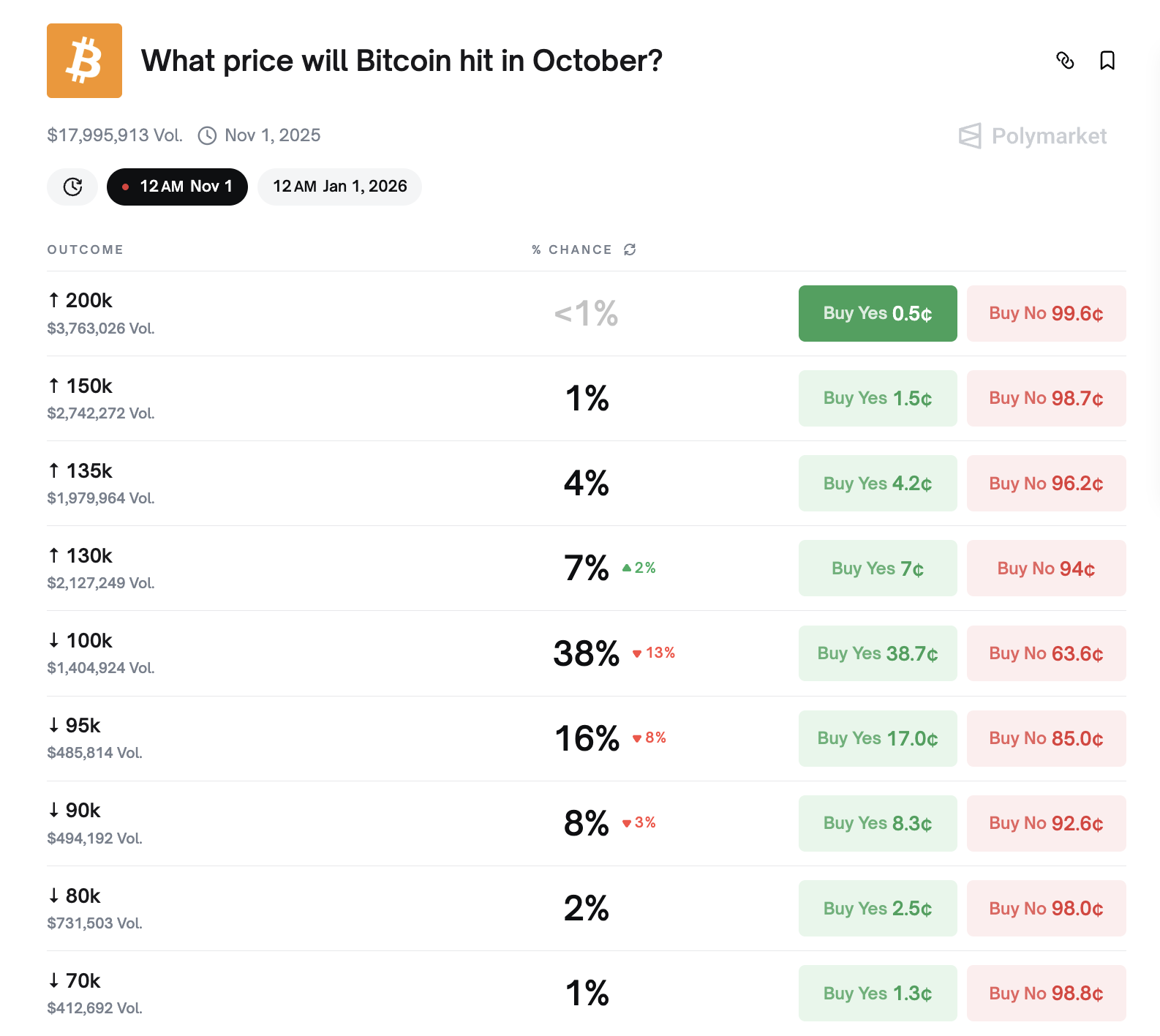

Polymarket Traders Shift Focus To $100K Scenario

Prediction market data from Polymarket highlights a bearish bias among speculators. The highest probability event now places 38% odds that Bitcoin finishes October below $100,000, while only 7% of bets favor a rise above $130,000.

Less than 1% of traders expect Bitcoin to hit $150,000–$200,000 this month, underscoring diminished enthusiasm after recent volatility.

The shift shows how sentiment has swung sharply from greed to caution within weeks, aligning with technical weakness across the charts.

Technical Outlook For Bitcoin Price

Bitcoin’s immediate roadmap depends on whether bulls can reclaim the $108,000–$113,000 zone.

- Upside targets: A daily close above $113,000 could open the path to $118,000 and $126,000, where previous highs cluster.

- Downside risks: Failure to hold $105,000 could expose deeper support near $100,000–$98,000, followed by $92,000 as the next major liquidity pocket.

- Indicators: RSI near 36 points to oversold conditions, suggesting room for a short-term bounce, though EMAs remain tilted downward, keeping mid-term bias cautious.

Outlook: Will Bitcoin Go Up?

Bitcoin’s path forward hinges on reclaiming lost EMA levels while avoiding a decisive breakdown below $104,000. The mild inflows hint that capitulation may be easing, but conviction remains weak.

If BTC closes above $108,000 and builds momentum above $113,000, traders could see a relief rally toward $118,000–$120,000. On the other hand, if selling resumes, the $100,000 level remains the most likely magnet — a view echoed by both technical signals and market betting trends.

For now, Bitcoin stays in a fragile equilibrium, where macro pressure, ETF flows, and sentiment dynamics will determine whether October ends with recovery or a deeper correction.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.