- Bitcoin risks confirming a macro breakdown if it fails to reclaim the 50‑week EMA.

- Social dominance has spiked to four-month highs as per Santiment.

- Analysts expect heightened volatility next week.

Bitcoin (BTC) is facing an unusually volatile week ahead, according to market analysts, after spending the weekend in a tight consolidation around the CME close. The low-volatility coiling has allowed liquidity to build on both sides of the order book, setting the stage for a significant price move.

Prominent analyst Daan Crypto Trades noted that Bitcoin has “plenty of fuel for a relief rally” which could arrive as soon as next week. He advised his followers on X to maintain caution and prepare for a sharp increase in volatility.

Related: Death Cross Hits Bitcoin, but Bulls Say Bottom May Be In

Weekly Structure Under Threat

The weekly chart shared by Rekt Capital shows that Bitcoin is now on the verge of closing below the 50‑week EMA, a level that has acted as a backbone for bullish structure throughout the year.

A failure to hold this support would confirm a macro trend breakdown. According to Rekt Capital, Bitcoin’s next major directional move will be determined by whether this 50-week EMA holds or breaks.

On lower timeframes, however, the price is clinging to the CME close. Bitcoin repeatedly tapped the $94,000 region over the weekend but failed to attract follow-through buyers, signaling deep hesitation across the market.

The lack of follow‑through shows hesitation across the market, as the Fear and Greed Index hit “Extreme Fear” at 17, CoinMarketCap data shows.

Social Dominance Surges as Fear Peaks

On-chain analytics firm Santiment revealed that Bitcoin’s social dominance spiked to a four-month high during Friday’s dip below $95,000 as retail investors panicked. Historically, such extreme spikes in social dominance accompany emotional capitulation phases, which often precede sharp price reversals.

While not a guaranteed bottom signal, the combination of rising fear and social dominance alongside repeated retests of $94K could possibly mark BTC’s bottom for this pullback.

Bitcoin currently trades at $95K, down almost 1% in the past 24 hours and 11% in the past 30 days. It remains below the 50-day EMA at $107K and 100-day EMA at $109K. In order to resume the uptrend, BTC needs to reclaim these levels.

On‑Chain Flows Reveal Panic Sellers and Quiet Accumulators

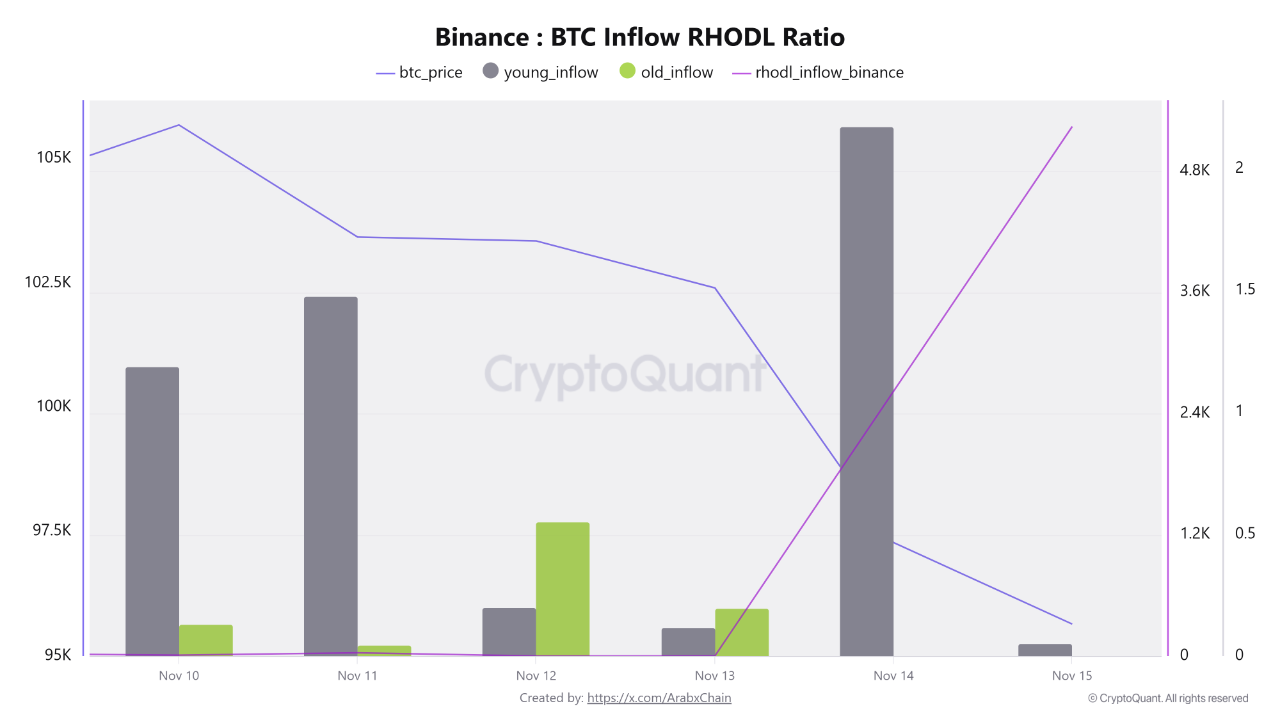

As per CryptoQuant analysts, exchange inflows on Binance surged from 5.5K BTC to nearly 15K BTC on November 14. The RHODL inflow metric shows that this pressure is almost entirely driven by newer coins, while older holdings remain largely untouched.

Also, OTC desk balances have climbed to roughly 156,000 BTC, the highest in months. Accumulator demand has also surged to a record 352,000 BTC. Historically, such redistribution phases could result in potential reversals.

Related: Bitcoin Drops to 6-Month Low Amid Mixed Signals

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.