- Bitcoin has corrected 20% from its all-time high, now testing the critical $98.2k-$100k support zone.

- On-chain data shows record-high accumulation and a “local bottom” signal as leveraged traders were flushed out.

- The bullish thesis relies on macro support from the Federal Reserve’s anticipated Quantitative Easing (QE).

Bitcoin (BTC) is testing trader sentiment after a five-week correction phase. The flagship cryptocurrency has declined approximately 20% from its recent all-time high, driven primarily by a cascade of long-trader liquidations.

Key Midterm Targets for Bitcoin Price

BTC Bull Case: A Critical Support Test

The Bitcoin price has retested and rebounded a crucial support level in the past few days. After teasing below $100k earlier this week for the first time since June this year, the BTC price is potentially forming a reversal pattern.

In the daily and weekly timeframe, the BTC/USD pair has retested a crucial trendline, which acted as a resistance level in 2024 but turned into a support level in 2025. As such, BTC price is well-poised to rebound towards a new all-time high (ATH) in the near term.

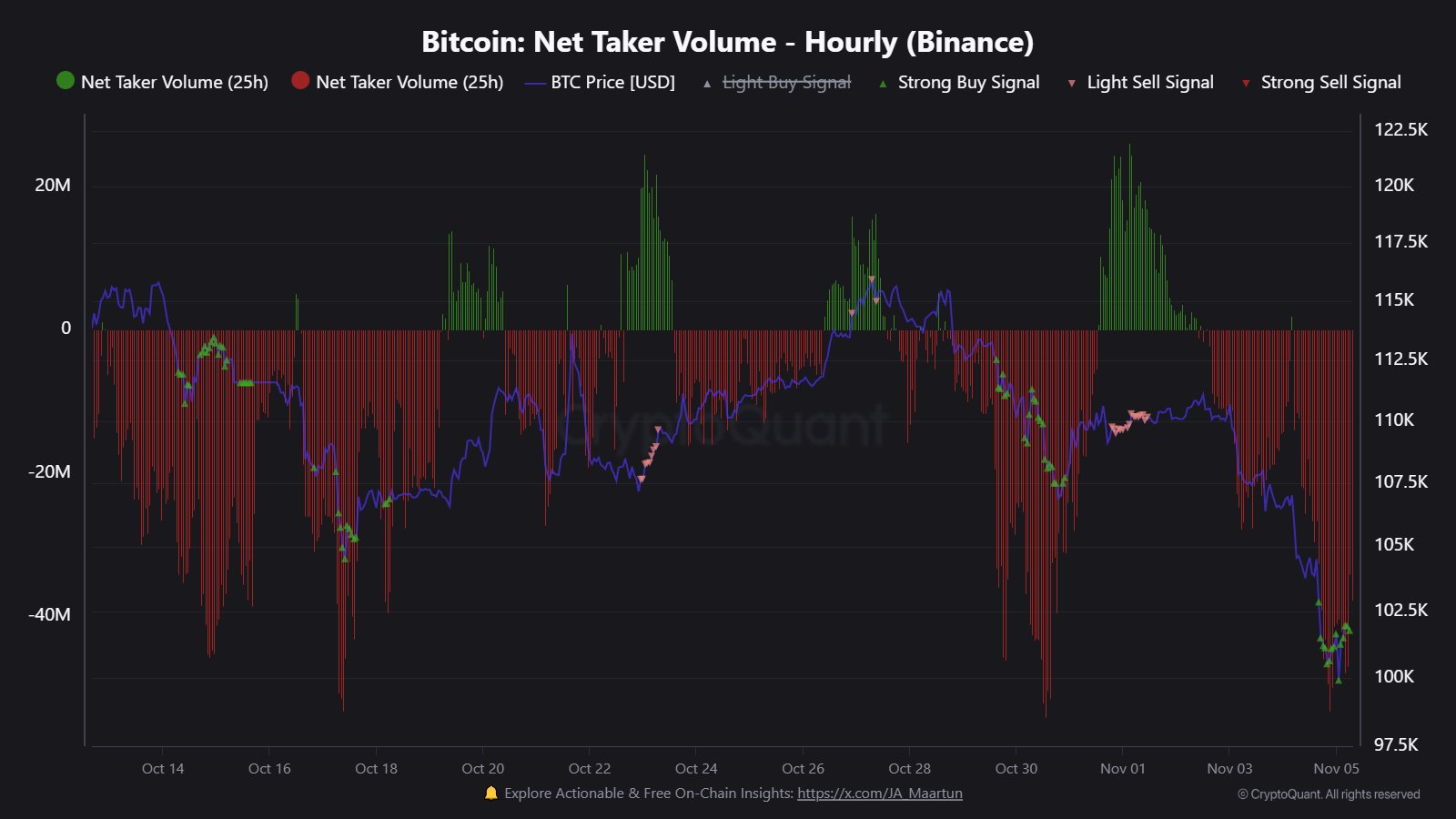

Notably, BTC price must regain the 200-day Simple Moving Average (SMA) to confirm a rally beyond $130 in the coming weeks. The bullish thesis for Bitcoin is bolstered by CryptoQuant’s Net Taker Volume, which just hit negative 53 million and a deep negative print indicates aggressive selling that precedes a local bottom.

BTC Bear Case: $98.2K Must Hold

However, the slow capital flow to Bitcoin, as observed by the spot BTC exchange-traded funds (ETFs) and the Digital Asset Treasuries (DATs), may weigh down on midterm bullish sentiment. According to Aksel Kibar, a popular market chartist, it is paramount for the BTC/USD pair not to close below the support level around $98.2k.

Furthermore, Kibar noted that his midterm target of $141.3k will be invalidated if the flagship coin falls below $98.2k in the coming weeks.

Why Favor Bullish Thesis Ahead for BTC?

Fed rate cuts ahead of its anticipated QE

Bitcoin’s bullish thesis is bolstered by the ongoing Fed’s monetary policy changes. Notably, the Fed has already initiated two rate cuts in 2025, and Kalshi traders are anticipating more rate cuts in the coming months.

Bitcoin liquidity is expected to improve in the coming weeks as the Federal Reserve kicks off its Quantitative Easing (QE) amid rising global money supply. Moreover, the Gold price has potentially topped out and institutional capital rotation is underway.

Renewed spot Demand after a series of heavy liquidations of leveraged traders

The midterm bullish sentiment for BTC price is bolstered by the renewed spot demand after the recent crypto deleveraging.

CryptoQuant also noted:

“In less than two months, the monthly average has more than doubled, increasing from 130,000 to 262,000 BTC, demonstrating that this trend is accelerating,”

According to CryptoQuant’s market data analysis, the addresses accumulating Bitcoin are at record levels.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.