- Bitcoin outperforms altcoins as dominance strengthens amid shifting market sentiment

- Fear and Greed Index at 19 signals extreme fear despite Bitcoin’s price recovery

- Crypto market cap at $2.66T highlights resilience despite recent volatility

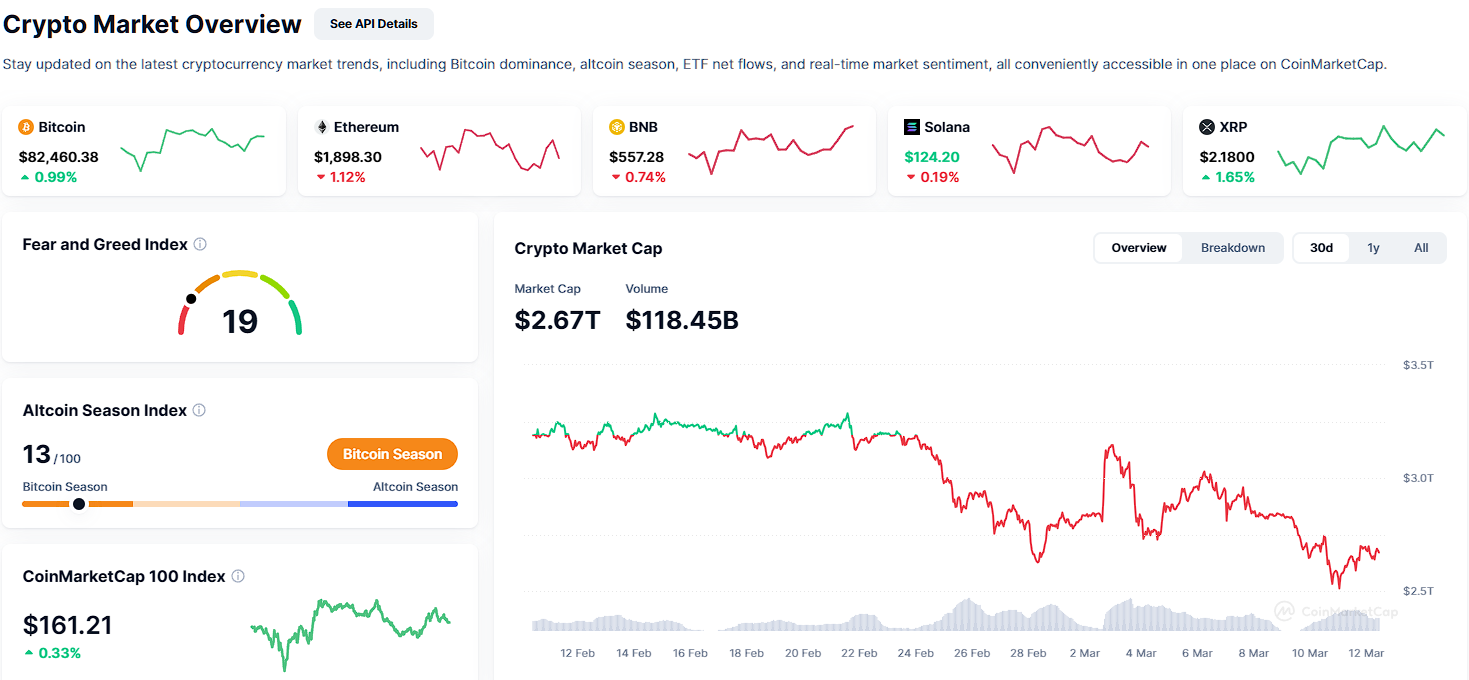

Bitcoin recaptures the $82,000 level as the cryptocurrency market adjusts to a more cautious sentiment. The recent rally follows a period of uncertainty, with Bitcoin now trading at $82,428.32, a 2.45% increase. Even so, market participants remain cautious, as various indicators reflect mixed investor confidence.

Market Performance Overview

Ethereum (ETH) saw a modest rise, currently priced at $1,912.68, a 0.33% gain. Meanwhile, Binance Coin (BNB) rose by 0.95% to $555.28. On the other hand, Solana (SOL) has slipped slightly to $123.32, down 0.16%. In contrast, XRP surged by 4.01%, reaching $2.1859, showing strong momentum among some altcoins.

The overall market movement suggests that Bitcoin remains dominant, significantly outperforming many alternative cryptocurrencies. This trend is reflected in recent data from the Altcoin Season Index, which stands at 13/100, confirming a Bitcoin Season. This metric indicates that altcoins are currently underperforming relative to Bitcoin.

Extreme Fear Still Grips Investor Sentiment

The Fear and Greed Index currently sits at 19, signaling extreme fear among investors. This level indicates a cautious or risk-averse approach as traders remain uncertain about the market’s short-term direction. Generally, extreme fear suggests potential buying opportunities, while extreme greed could indicate a market peak.

Additionally, the CoinMarketCap 100 Index, which tracks the top 100 cryptocurrencies, has risen to $160.59. This represents a 1.66% increase, pointing to a moderate recovery in the broader crypto market. But, the recent price action suggests traders remain hesitant about taking on more riskier assets.

Crypto Market Cap and Volatility

The total cryptocurrency market capitalization currently stands at $2.66 trillion, with a trading volume of $117.92 billion.

Related: Bitcoin Whale Alert: Strategy’s 499K BTC Hoard – Paper Losses Mount

This shows continued investor activity despite the ups and downs in sentiment. The market trend graph over the past 30 days shows volatility, with notable declines in early March. Red segments indicate downtrends, while green segments reflect recovery phases.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.