- Gold hits $3,782.98, up 44% YTD, nearing $3,800 as investors seek safe-haven assets.

- Deutsche Bank says Bitcoin mirrors gold’s adoption, volatility easing with regulation.

- Gold lags M2-adjusted highs, while Bitcoin sets new records against money supply growth.

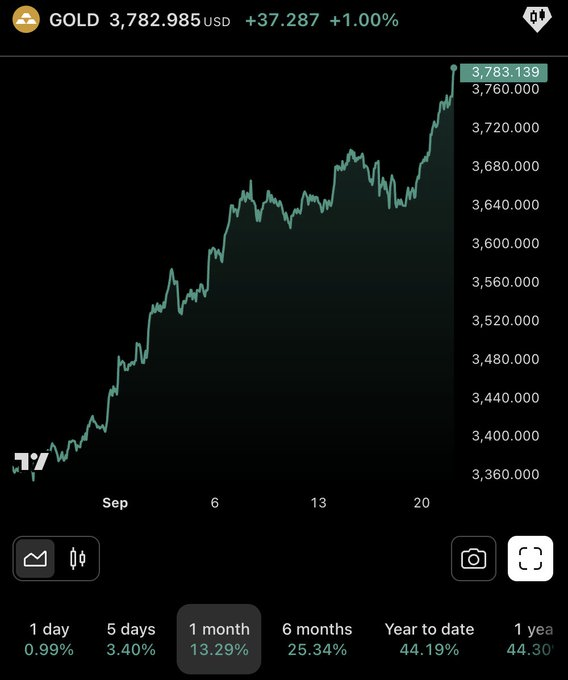

Gold surged to $3,782.98 per ounce on September 23, up 1% on the day and more than 13% this month. Year-to-date, the metal has gained 44%, putting it among 2025’s best-performing assets. Breakouts above resistance at $3,720 confirmed strong buyer momentum as traders targeted the next milestone at $3,800.

Performance metrics across time frames underscore the strength of the rally: gold rose 3.4% in the past week, 25.34% in the past six months, and is nearly matching its full-year gain rate of 44.3%.

Macro Forces Driving the Rally

The surge reflects investor demand for safety amid inflation pressures, currency weakness, and geopolitical risks. Those conditions continue to drive institutional flows into the metal. Market watchers now look at $3,800 as the level that could attract even more inflows.

Related: Bitcoin vs. Gold: BTC Loses Ground as Central Banks Drive Gold to Record Highs

The debate around gold’s practicality also surfaced in the public sphere. Changpeng Zhao (CZ) noted on X that carrying and verifying physical gold is cumbersome, drawing comparisons with the portability of digital assets. Analyst Lark Davis added that gold’s momentum could serve as a precursor to Bitcoin’s next major move.

Bitcoin and Gold: Parallel Adoption Stories

Deutsche Bank’s Report

A Deutsche Bank Research Institute paper, “Bitcoin vs Gold: The Future of Central Bank Reserves by 2030,” argued Bitcoin is tracking gold’s early adoption curve. The report said regulation and rising institutional use are gradually reducing Bitcoin’s volatility, much as gold stabilized as a reserve asset through the 20th century.

The bank contrasted gold’s lag on an M2-adjusted basis with Bitcoin’s stronger performance against money supply growth. Gold has yet to exceed its inflation-adjusted peaks from 1980 and 2011, while Bitcoin has consistently set new records relative to U.S. M2 growth.

Related: Digital Gold vs. Real Gold: Bitcoin’s Volatile Rally Closes In on $3.5K+ Gold

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.