- Bitcoin trades at $103,800, down 3% in 24 hours and 15% over the month.

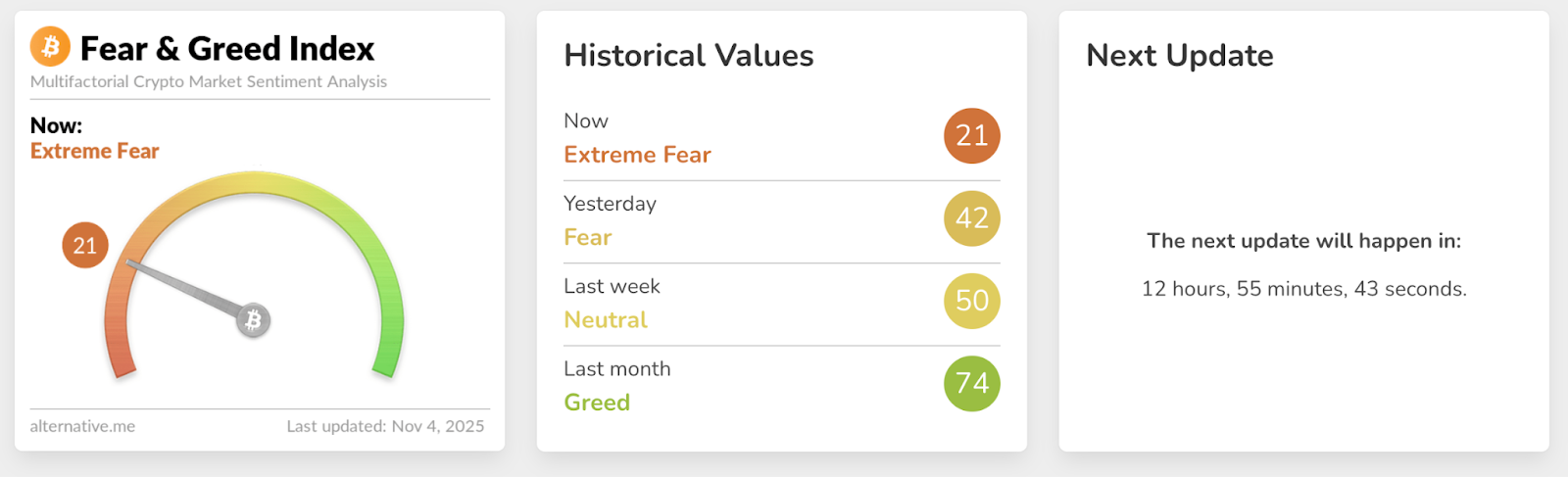

- Crypto Fear & Greed Index plunges to 21, indicating “extreme fear.”

- Fed’s cautious tone and ETF outflows trigger a broad sentiment decline.

Bitcoin market sentiment has plunged into “extreme fear” territory as prices slipped below $104,000 on Tuesday. The latest reading from Alternative’s Crypto Fear & Greed Index shows a score of 21, reflecting a sharp downturn in investor confidence.

Bitcoin is currently priced at $103,803, marking a 3% decline in the past day, a 9% weekly drop, and a 16% fall over the past month. The pullback has erased most of October’s gains and cooled the excitement that followed the earlier surge above $110,000.

Related: Crypto Fear and Greed Index Drops as Market Sentiment Cools Near Bitcoin $121K

Whale Transfers Fuel Sell-Off Concerns

Market anxiety deepened after two major Bitcoin holders moved more than $1.8 billion worth of BTC to exchanges, raising concerns of potential sell pressure. According to Lookonchain, trader “BitcoinOG (1011short)” sent about 13,000 BTC ($1.48 billion) to Kraken since October 1.

At the same time, early adopter Owen Gunden transferred 3,265 BTC ($364.5 million ) to the same exchange since October 21.

Large exchange inflows like these are often seen as signals that whales might be preparing to sell.

Fed Policy Shift Rattles Investor Confidence

Bitcoin’s slide also followed the Federal Reserve’s second rate cut of the year last Wednesday. Although the move initially boosted hopes for more liquidity, the Fed’s message that no additional cuts are planned for 2025 disappointed investors looking for a longer easing cycle.

The cautious tone weighed on risk assets, including crypto, as traders adjusted expectations for looser financial conditions. The Fed’s focus on keeping inflation under control has reduced appetite for speculative assets.

ETF Outflows Add Pressure

Institutional sentiment also weakened. Bitcoin ETFs saw $188 million in net outflows on Monday. Ethereum ETFs lost $135 million, pointing to cooling demand among professional investors. In contrast, Solana (SOL) products attracted $44.5 million in weekly inflows.

Fear & Greed Index Signals Extreme Anxiety

The Fear & Greed Index has plunged from “greed” (74) last month to “extreme fear” (21) this week. The index measures factors like volatility, trading volume, dominance, social media sentiment, and Google search trends to gauge overall market mood.

The rapid shift highlights how emotional the market has become following the recent sell-off. Historically, extreme fear levels have sometimes aligned with market bottoms, but analysts warn that sentiment alone isn’t a reliable signal for entry.

Historical Trends Offer Hope

Despite the current downturn, historical data shows Bitcoin often rebounds after steep declines. Since 2011, November has been Bitcoin’s strongest month, averaging a 37.5% gain.

Related: Bitcoin Price Prediction: Fed QT Pause And Trump–Xi Summit Put $118K In Play

Quarterly data also suggests room for recovery. After a modest +6.4% in Q3, Bitcoin’s Q4 2025 return sits at –8.4%, leaving potential for a rebound if sentiment steadies in the coming weeks.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.