- Bitcoin has skyrocketed more than 9% in the past week.

- Whenever September is green, Q4 will be green, said Lark Davis.

- In the 2020 cycle, Bitcoin turned bullish 161 days after the halving.

Bitcoin’s dominance in the digital asset market remained unchallenged as it surged massively since the start of September, even with a few dips along the way. The cryptocurrency is back at the $64,000 mark, and short-term gains look promising. So much so, analysts are even drawing comparisons to the 2020 bull run.

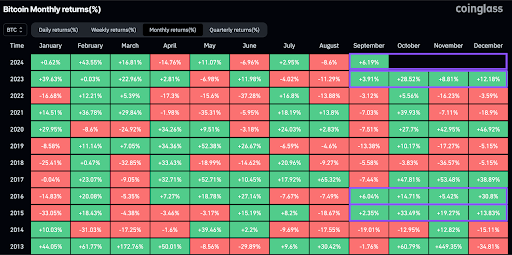

Lark Davis, a well-known YouTuber and crypto analyst, tweeted, “Whenever September is green, Q4 has been extremely bullish for Bitcoin.” He included a chart showing Bitcoin’s past performance in September and Q4, suggesting good times are ahead.

And in another X post, Rekt Capital pointed out that it has been 161 days since the Bitcoin halving. He reminded followers that during the 2020 bull run, BTC saw a massive surge 161 days after the halving, hitting an all-time high of $69,000 in November 2021.

Read also: Government Bitcoin Rankings: US Tops List, Bhutan and El Salvador Active

In the current cycle, Bitcoin made its all-time high at $73,750 in March following the approval of spot Bitcoin exchange-traded funds (ETFs) in the United States in January. According to the data from CoinMarketCap, BTC is trading at $64,022.38, up 1.44% in the past 24 hours, 9.52% in the past week, and 0.04% in the last 30 days.

Bitcoin Price Analysis Points to Further Gains

The Bitcoin price analysis shows immense bullish potential for the cryptocurrency amid a skyrocketing market. If the leading digital asset is successful in holding above $64,000, there is a strong possibility of higher highs in the near future.

The chart below shows Bitcoin has formed seven consecutive bullish candles, and buying volumes are increasing. This suggests the rally could continue in the short term.

The Relative Strength Index (RSI) reads a value of 64.25 which means that the bulls are overall in control of the Bitcoin price action and the gradient of the line suggests that higher prices are possible as well.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.