- Bitcoin stabilizes around $70K after extreme volatility last week.

- ETF inflows signal dip-buying as institutions step in despite lingering market uncertainty.

- Analysts eye $60K support and $73K–$75K resistance to confirm the next major trend.

Bitcoin is stabilizing around $70,000 after one of its most volatile weeks in months. However, traders and analysts remain divided on whether the worst of the sell-off is truly over. At press time, the world’s largest cryptocurrency is holding around $70,700.

The calm marked a sharp contrast to last week’s extreme swings, which saw Bitcoin plunge to $60,000 on Thursday evening, its lowest level since October 2024. However, as of today, BTC has since rebounded to a high of $72,206 from last week’s lows.

Market Stabilizes, but Uncertainty Lingers

Market participants describe the current environment as cautiously optimistic rather than outright bullish. According to Orbit Markets co-founder Caroline Mauron, crypto markets have stabilized, but uncertainty remains over whether a durable bottom has formed.

Analysts widely point to the $60,000 level as a critical downside support. On the upside, a sustained break above the $73,000–$75,000 zone could confirm a trend reversal. A move beyond that range could open the door toward $81,000.

Bitcoin has also managed to hold above its 200-week moving average near $58,000, a key level during market stress, after rebounding just before testing it on Friday.

ETF Inflows Hint at Dip-Buying Appetite

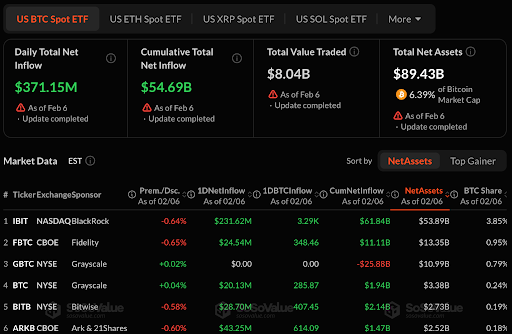

Despite lingering caution, institutional demand has not disappeared. U.S. spot Bitcoin exchange-traded funds recorded $371 million in net inflows on February 6 as investors stepped in following the sharp correction.

BlackRock’s spot Bitcoin ETF alone attracted more than $231 million in inflows on Friday after earlier outflows during the volatile week.

Bitwise CEO Hunter Horsley said the pullback below $70,000 has given institutions “a new crack at the apple,” with buyers seeing price levels they previously believed were permanently out of reach.

Bear Market Debate Intensifies

Meanwhile, some analysts believe Bitcoin’s recent price action mirrors the early stages of the 2022 bear market. Analyst BitBull compared current charts to those of that period and argued that full capitulation may not have occurred yet. The analyst calls for a potential “real bottom” below $50,000 if history repeats.

Meanwhile, other commentators note that while similarities exist, markets rarely follow past cycles perfectly. Bitcoin is currently trading within a long-term support range between $58,000 and $68,000, an area that previously acted as both support and breakdown territory during prior downturns.

What Comes Next?

For now, Bitcoin remains caught between improving spot demand and deeply cautious derivatives positioning. Analysts believe sustained strength above $75,000 would significantly shift sentiment, while a break below $60,000 could reignite fears of a deeper macro low.

Related: Bitcoin Price Prediction: BTC Holds $68K As Bitwise Says 54% Drop Echoes

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.