- Bitcoin’s market cap has reached approximately $1.25 trillion, reflecting strong consumer interest in the cryptocurrency.

- Technical indicators show promise, with the RSI at 62.39 and a bullish MACD crossover signaling potential price increases.

- Despite mixed market sentiment, predictions suggest Bitcoin’s price could range from $59,669.95 to $63,318.98 in December 2024.

U.S. Congressman Warren Davidson has strongly condemned SEC Chair Gary Gensler, arguing that the SEC intentionally obstructs the ability to hold Bitcoin. Davidson pointed out the huge consumer interest in Bitcoin, stating it totals over a trillion dollars just for Bitcoin.

His comments show growing frustrations within the community on regulatory oversight. As Bitcoin experiences significant price movements, this criticism highlights the tension between lawmakers and regulatory bodies, especially as Bitcoin’s market strength becomes more and more clear.

Bitcoin Price and Market Performance

Bitcoin trades at $63,513.17, reflecting a 5.10% increase in the last 24 hours. Its trading volume hit $46.95 billion and the current market cap is around $1.25 trillion, with a circulating supply of 19,756,240 BTC. Also, Bitcoin has typically underperformed in September. But, it has risen over 8% this month, leading to bullish sentiments for Q4.

Read also: Whale Activity Surges Post-Fed Rate Cut: Bitcoin, Stablecoins, Altcoins Surge

Technical Indicators Look Positive

The Relative Strength Index (RSI) is currently at 62.39, showing bullish momentum. This level suggests that Bitcoin hasn’t entered overbought territory yet. Plus, the Moving Average Convergence Divergence (MACD) indicates a bullish crossover, with the MACD line at 722 and the signal line at 466. This crossover signals an upward trend in Bitcoin’s price.

Mixed Market Sentiment and Future Projections

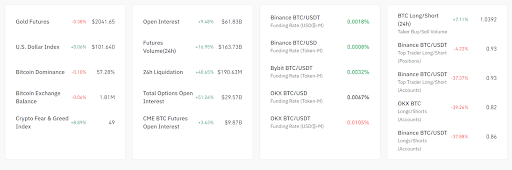

Market sentiment seems mixed across different assets. While gold futures dipped slightly, the U.S. Dollar Index increased by 0.06%. Also, Bitcoin dominance fell to 57.28%. Exchange balances decreased by 0.06%, showing reduced Bitcoin activity. The Crypto Fear & Greed Index has gone up to 49, suggesting neutral market sentiment.

In the futures market, open interest rose by 9.48% to $61.83 billion, with volume going up by 16.95%. Additionally, liquidations surged by 40.65%, pointing to heightened volatility. Despite bearish positioning on platforms like Binance and OKX, rising fear and greed scores suggest a possible shift toward neutrality.

Changellyblog predicts Bitcoin’s price range for December 2024. They forecast a maximum trading value around $63,318.98 and a minimum of $59,669.95. The average cost for December is projected at $61,494.47. These predictions highlight the continued interest in Bitcoin amidst changing market conditions.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.