- Binance sees a surge in long positions as traders react to potential U.S. interest rate cuts.

- BitMEX whales remain cautious, showing little movement while awaiting clearer rate cut signals.

- Arthur Hayes warns of risk asset drops but sees Ethereum’s potential in falling U.S. rates.

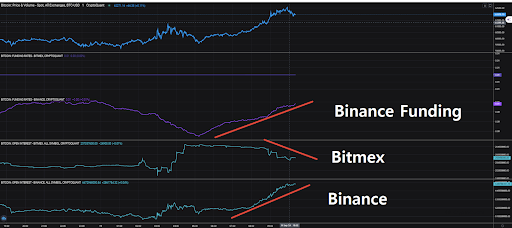

Binance’s open interest (OI) is climbing sharply as traders react to the latest news of U.S. Fed’s interest rate cuts by 50 bps. The platform’s funding rates and OI also increased, correlating with an upbeat market sentiment and renewed investor activity.

Meanwhile, BitMEX presents a different narrative, with whales selling or staying on the sidelines, waiting for clearer signals on how the rate cuts will play out.

Binance Traders Pile into Long Positions

The upward trend in Binance’s funding rates and OI shows a surge in long positions. This means that retail traders are becoming more optimistic about Bitcoin’s price movement in the short term. What’s more, Binance’s data reveals heightened activity and a possible buildup of late longs, likely driven by smaller investors anticipating a bullish turn following the rate cut news.

This trend is in stark contrast to BitMEX, where open interest remains relatively stable, with minor dips observed before its recent stabilization. BitMEX whales, who typically hold larger positions, seem to be exercising caution as they await more clarity on the rate cuts.

Whale Activity Shows Mixed Signals

Data on whale activity further highlights the market’s divided response. It’s worth noting that new whales and Binance traders continue to accumulate Bitcoin, adding to the market’s buying pressure. This increase in whale holdings suggests sustained confidence in the asset’s value, with recent transactions pointing towards a potential period of price growth.

On the flip side, long-term whale holders with assets over 155 days are keeping consistent upward balances, continuing their accumulation even with market corrections.

This could mean that while newer participants are driving the current price momentum, long-term holders remain steady in their belief in Bitcoin’s future prospects.

Hayes’ Cautious Outlook

BitMEX co-founder Arthur Hayes has shared a cautious outlook. Speaking at the Token2049 crypto event, Hayes voiced concerns about the U.S. Federal Reserve’s potential rate cuts. He highlighted the risk of sharp drops in risk assets, including crypto assets, if the cuts happen.

Read also: Arthur Hayes: ETH Bull Run to Start When Fed Cuts Rates Below 4%

Despite the skepticism , Hayes mentioned that if the U.S. Treasury rates were to fall below 4%, Ethereum could see a new bull run. Hayes was also concerned about the narrowing interest rate gap between the U.S. and Japan, which could strengthen the yen creating challenges for U.S.-yen carry trades.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.