- Bitcoin has shown a 0.73 correlation with the iShares Expanded Tech-Software ETF (IGV).

- Shared short-term, risk-on traders have pulled BTC into the same selloff.

- Market data shows risk-off conditions, with BTC below key moving averages.

Bitcoin’s price action has closely tracked the iShares Expanded Tech‑Software ETF (IGV) for more than five years. The current 30‑day correlation stands at 0.73, stronger than Bitcoin’s correlation with the Nasdaq‑100. During the latest selloff, Bitcoin and software equities moved almost tick-for-tick.

Gold correlation has faded to near zero. Bitcoin failed to act as a hedge or defensive asset, instead tracking the sell-off in high-multiple software and growth stocks as risk appetite faded.

The Investor Base Is the Link

According to Strike CEO Jack Mallers, Bitcoin has been treated by markets as a software stock, not as hard money. The reason is simple, i.e., the same short‑term, risk‑seeking traders hold both. “Same holders. Same liquidity. Same forced-selling dynamics,” argued Mallers.

Software, SaaS, cloud names, and mega‑cap growth stocks turned bearish as capital rotated away from buyback‑driven models. AI spending has turned software from a cash generator into a capital‑heavy business.

US policy is also pushing capital toward infrastructure, energy, and domestic production. As multiples compress in software, Bitcoin has been pulled into a similar bearish storm.

Technicals Point to a Repricing Phase

CryptoQuant data shows Bitcoin trading below key moving averages. Price has fallen toward the $70,000 area, below the 50‑day moving average near $87,000 and well under the 200‑day moving average around $102,000.

The price Z‑Score sits near ‑1.6, and Bitcoin is now trading below its medium‑term statistical mean. Historically, this zone aligns with reduced leverage, capital preservation behavior, and base formation.

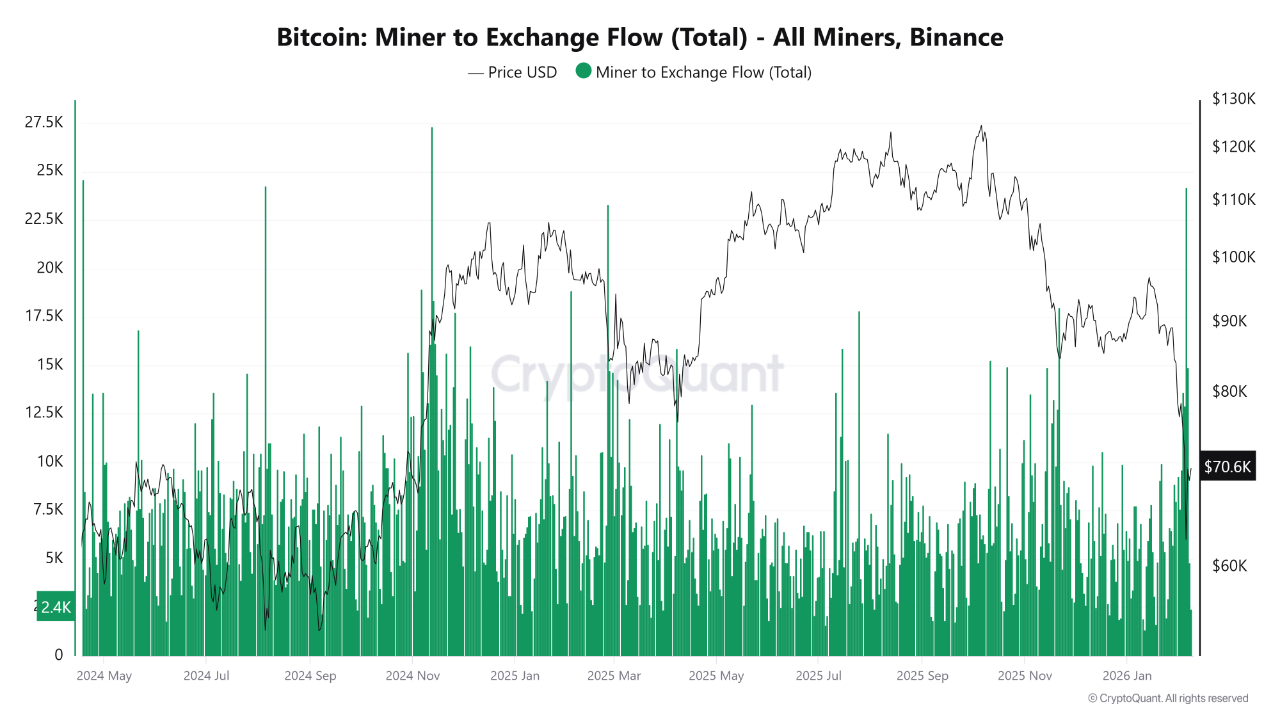

Miner activity has surged to its highest level since 2024. Since early February, more than 90,000 BTC has flowed from miners into Binance, including a single‑day deposit exceeding 24,000 BTC.

Also, Glassnode data shows Bitcoin rebounding from deeply oversold levels, with the 14‑day RSI lifting toward its lower statistical band. Spot volume has expanded, but activity remains reactive. Spot CVD stays negative, confirming continued sell‑side pressure.

However, Mallers believes that the market has misunderstood Bitcoin. BTC does not need earnings, margins, buybacks, or capex; software companies do. The current correction indicates how markets have misclassified Bitcoin for years.

As leveraged, momentum‑driven software capital exits, what remains is a slower, harder base of long‑term holders. Mallers sees Bitcoin rocketing to its real valuation in the near future.

Related: Bitcoin Steadies Around $70,000 After Violent Sell-Off Shakes Market Confidence

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.