- Bitcoin’s historical October gains suggest potential for a strong “Uptober” rally.

- Whale selling and slowed institutional activity hint at short-term market fragility.

- Technical strength shows buy-the-dip conditions, supporting a push toward new highs.

As October begins, Bitcoin straddles two narratives. The seasonal optimism, the so-called Uptober, leans on historical performance and technical strength.

On the other hand, concerns about hidden fragility and whale behavior have some warning that a reset is imminent. The next few weeks may decide whether October becomes another “Uptober” or turns into the dreaded “Rektober.”

1. The Bull Case: Seasonality and Technical Momentum

CryptoCapo noted that September acted as a transitional phase for Bitcoin and broader markets. He cautioned that beneath the calm surface, fragility remains widespread.

According to him, the market appears designed to flush out excess before building higher, making a reset likely in the short term. He emphasized the need for investors to seek truth rather than cling to bullish narratives, even if the outlook is uncomfortable.

Related: Bitcoin Hashrate Hits Record 1.2 ZH/s, BTC Eyes $114K Breakout

Historical Trends Favor Uptober

In contrast, CryptosRus highlighted Bitcoin’s strong seasonal history, stressing that October has produced gains in 10 of the last 12 years. Notable rallies include surges of nearly 60% in 2013 and close to 48% in 2017.

With September ending in modest green territory, he views current conditions as a healthy launchpad. Although he acknowledged that macro shocks could disrupt patterns, he leaned toward a bullish October fueled by Bitcoin’s resilience during doubt.

2. The Bear Case: Whales, Weakness, and Hidden Risk

SalsaTekila provided further nuance, pointing out that whales sold over 130,000 BTC across August and September. At the same time, major institutional buyers such as Michael Saylor’s firm slowed their activity.

Institutional capital, which animated many earlier rallies, seems less active now. The slowdown among major buyers adds to the risk narrative that October might see a reset rather than a surge.

He believes this anomaly could set the stage for a rally pushing toward $180,000 in the coming months, with short-term support holding near $112,000.

3. Balanced View: This October Could Be Decisive

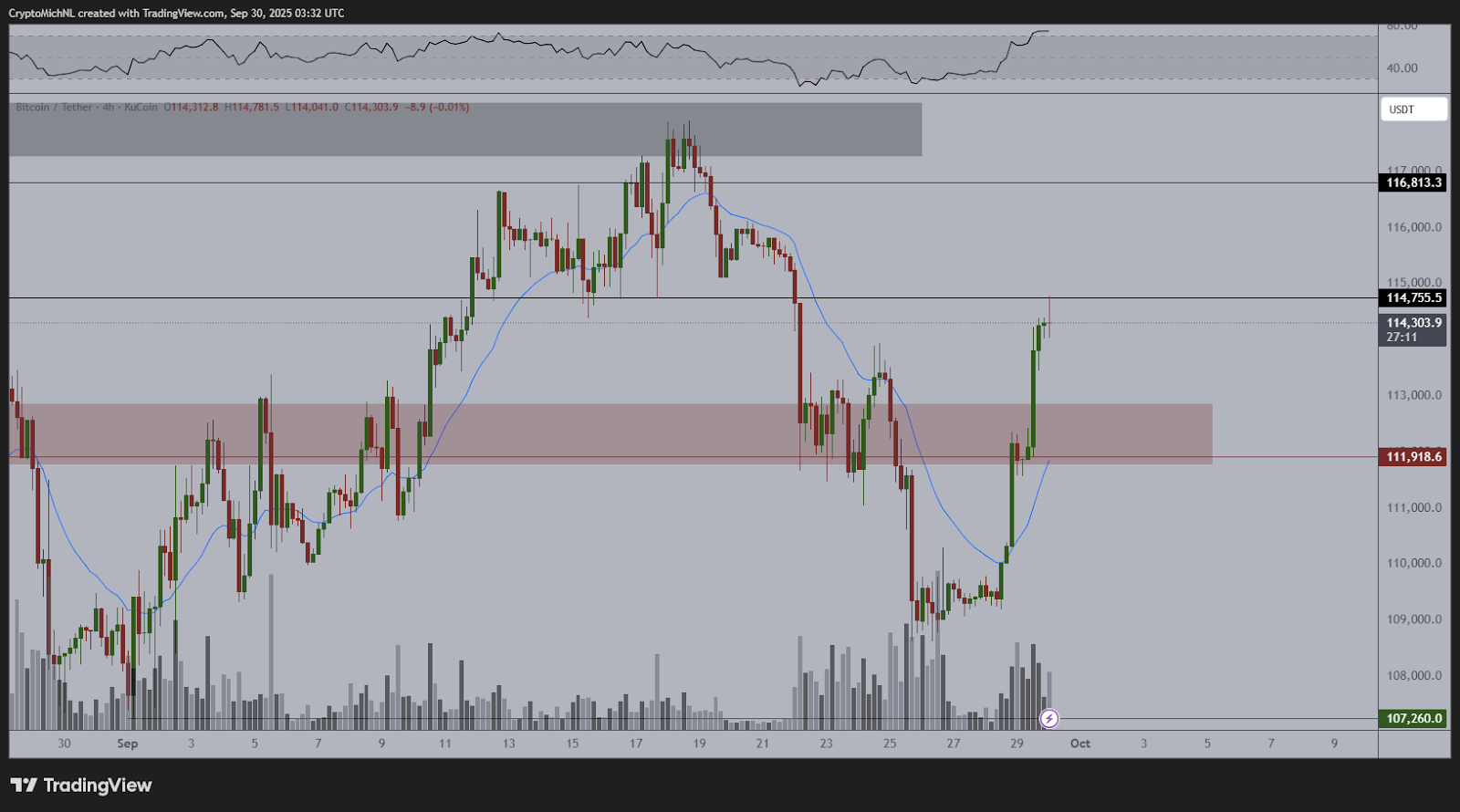

Michaël van de Poppe observed that Bitcoin broke a key resistance at $111,900, flipping it into support as prices reached $114,755. He noted that while a short-term pullback toward $113,000 is possible, the broader setup looks favorable. According to him, buy-the-dip conditions dominate, with a potential run toward new all-time highs in October if support zones remain intact.

Related: Bitcoin Price Prediction: BTC Holds $111K As Traders Eye $115K Liquidation Trigger

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.