- Bitcoin is digital gold; Ethereum runs smart contracts; XRP settles cross-border payments.

- They don’t compete: BTC stores value, ETH builds apps, XRP moves value between networks.

- Three-layer crypto stack: BTC reserve, ETH programmable markets, XRP fast settlement.

The “which coin wins” debate treats every blockchain like it solves the same job. It doesn’t. Analysts, enthusiasts, and investors are throwing fresh takes across social feeds, but a growing chorus of voices, including expert Vincent Van Code, insists the question itself is misleading.

“Bitcoin, Ethereum, and XRP — they were never meant to compete. Each was built to solve a different problem. The market just lumps them together because they share the same type of “database” i.e. blockchain,” he said.

Bitcoin (BTC): The Immutable Digital Gold

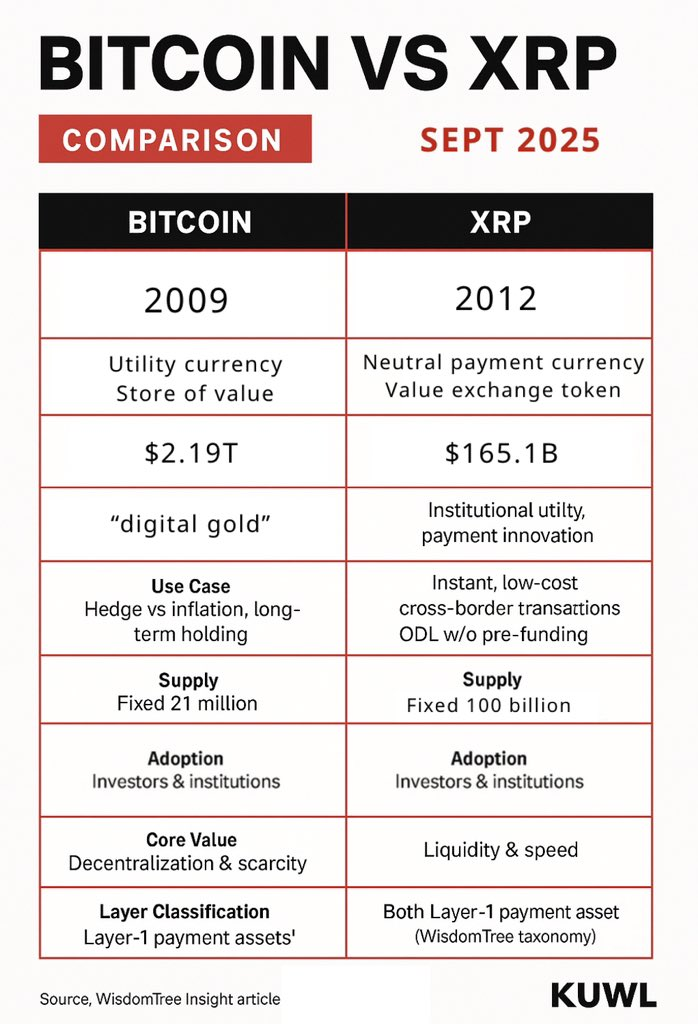

Bitcoin’s story begins in 2009 with the mysterious Satoshi Nakamoto. Its mission is simple: a decentralized store of value. Bitcoin removes middlemen, ignores governments, and doesn’t run on smart contracts. Its blockchain is slow by design, predictable, and secure.

- Purpose: Preserve value, hedge against inflation.

- Market Cap: ~$2.19 trillion (~50% of total crypto market).

- Use Case: Digital gold for investors and institutions.

- Core Feature: Decentralization and immutability.

Bitcoin is not trying to run decentralized apps or settle payments instantly. It exists to be incorruptible money, a baseline layer for the digital economy.

Related: Raoul Pal Predicts Bitcoin Peak in 2026 Despite Debt Shift

Ethereum (ETH): The Decentralized Computer

If Bitcoin is gold, Ethereum is the programmable universe. Launched in 2015, Ethereum transformed blockchain into a platform, enabling smart contracts, NFTs, and DeFi. Its blockchain is the foundation for a new digital infrastructure, not a replacement for money, but for the systems money moves through.

- Purpose: Digital infrastructure and programmable economy.

- Market Cap: ~$470 billion.

- Use Case: Smart contracts, NFTs, DeFi protocols.

- Core Feature: Decentralized, programmable, highly versatile.

Ethereum is the experimental layer that succeeded spectacularly, turning code into money-moving ecosystems. Where Bitcoin preserves value, Ethereum creates it.

XRP Ledger (XRP): The Institutional Bridge

XRP, often misunderstood in retail circles, was launched in 2012 with a laser focus on fast, compliant, institutional-grade settlement. Integrated into Ripple’s On-Demand Liquidity service, XRP moves money across currencies without pre-funding, targeting the backbone of global finance.

- Purpose: Value transfer across networks and currencies.

- Market Cap: ~$165 billion.

- Use Case: Cross-border payments, liquidity, ISO-compliant settlement.

- Core Feature: Speed, efficiency, and interoperability.

Analyst Rob explains it succinctly: “Bitcoin stores value, Ethereum builds ecosystems, XRP moves value between them. Think SWIFT replacement, not DeFi playground.” According to these experts, the mistake is seeing these tokens as rivals. They don’t compete; they complement each other, forming a three-layer foundation for a digital financial future.

The next decade may well see these three pillars working in tandem — Bitcoin as the bedrock, Ethereum as the platform, and XRP as the bridge. In a world where speed, efficiency, and programmability matter, this layered approach may be the blueprint for the future of money.

Related: XRP Crowd Sentiment Collapses to Extreme Low: Historic Buy Opportunity Ahead?

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.