- Bitcoin on-chain activity reached $37.4 billion, the highest in seven months.

- The spike in on-chain transactions coincided with whale movements after months of dormancy.

- The whale accumulated $681M in BTC over the last few months at higher values.

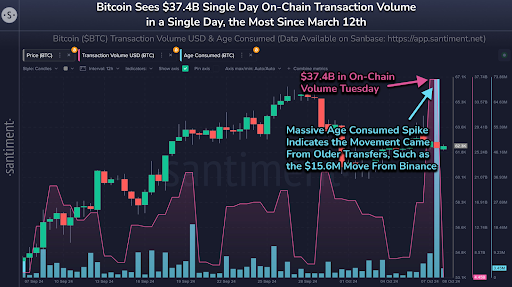

Even though Bitcoin is facing bearish pressure affecting its price, recent whale activities suggest a promising outlook for the market. On Tuesday, Bitcoin’s network saw a significant surge in on-chain transaction volume, reaching $37.4 billion—the highest level in seven months, according to blockchain analytics platform Santiment.

This spike happened at the same time as movements of dormant Bitcoin by whales. For example, one whale took 250 BTC, worth approximately $15.6 million, off the Binance exchange on Tuesday.

This particular whale had been inactive for six months, and the withdrawal was executed one hour before Lookonchain’s report. The reactivation of these dormant coins has fueled speculation about Bitcoin’s near-term market behavior.

According to Lookonchain, this whale had previously accumulated a substantial sum—10,158 BTC, worth $681 million—between March 14 and April 13 of this year, at an average price of $67,026 per BTC. With Bitcoin currently priced at around $62,402, this whale is facing an unrealized loss of approximately $46 million on those holdings.

History Suggests Stagnant Bitcoin Reactivation is a Positive Sign

Market participants watch whale movements closely because they can often show shifts in market dynamics. The reactivation of dormant BTC could mean that large holders are getting ready for future price movements. Santiment’s analysis says that in the past, the movement of stagnant Bitcoin back into circulation has been a bullish sign for future price increases.

Despite the impressive $37.4 billion in on-chain transactions driven by whale activity, Bitcoin’s price fell from an intraday high of $63,174 to $61,843. This bearish performance also impacted the broader altcoin market, with many altcoins remaining in the red. As of the latest update, Bitcoin’s price has stabilized around the $62,000 range, trading at $62,396—a slight gain of 0.05%.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.