- CryptoCon predicted the bullish tendency of the leading cryptocurrency Bitcoin.

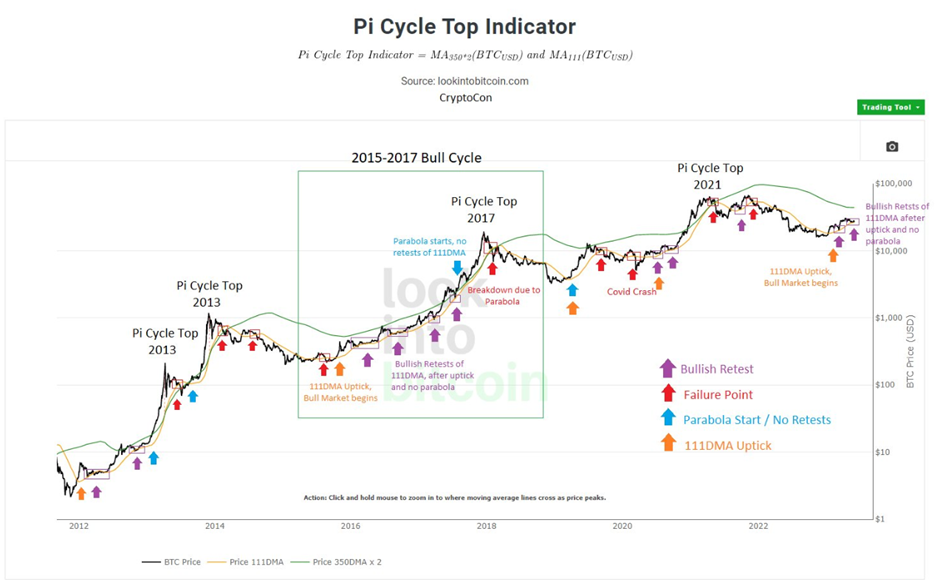

- Using the Pi Cycle Top Indicator, he asserted that a bullish tendency is ahead, though it would take some time.

- The analyst pointed out that the bullish retest of the Yellow 111DMA is a healthy and natural sign of a sustainable bullish trend.

The Bitcoin technical analyst CryptoCon predicted the bullish trend of the leading cryptocurrency Bitcoin, pointing out that the Yellow 111DMA in the Pi Cycle Top Indicator has begun to “uptick”. The indicator has identified that BTC “continues to retest the line as support”, which the analyst spotted as a signal of a substantial hike.

On June 2, CryptoCon shared a Twitter thread offering explanations for his bullish beliefs on BTC:

In the tweet, the analyst provided a clear picture of his predictions regarding the much-anticipated bullish track of the cryptocurrency, with the support of the Pi Cycle Top Indicator. He asserted that though the bounce is slow, the final reach would be bullish.

The analyst brought forward solace for the crypto enthusiasts and traders who are anxious about a bearish Bitcoin market, by asserting the bullish retest of the Yellow 111DMA, which is “healthy, and normal for a sustained bullish trend”. He pinpointed that “it’s only a matter of time before Bitcoin starts to take off”.

Further, CryptoCon detailed his “successful” journey with Bitcoin, positing that he has managed it by using “long-term data”. With his scrupulous understanding of BTC, he bought all his coins for an amount below 10k in a period between 2018 to 2020 and sold them for 54k in April 2021. Later he re-acquired his collection for just 16.5k.

At press time, as per the data of CoinMarketCap, BTC was traded at $27,205.94, with a 24-hour trading volume of $12,234,233,334. The current price of the cryptocurrency shows a surge of 0.19% in the last 24 hours.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.