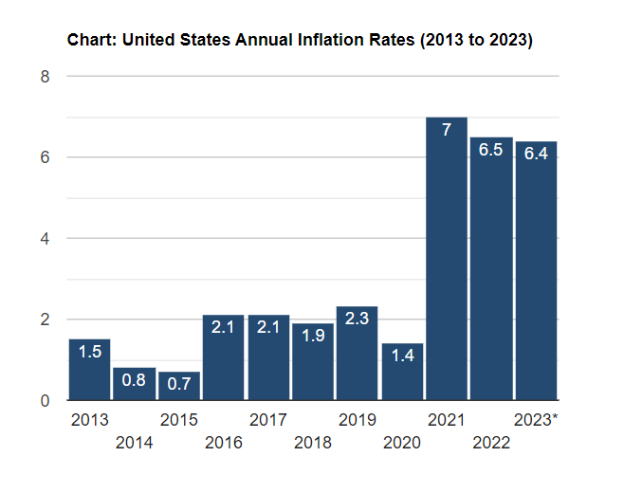

- The inflation rate of US dollars is 3.57 times greater than that of bitcoin.

- The current inflation rate of BTC is 1.8% while that of USD is 6.4%.

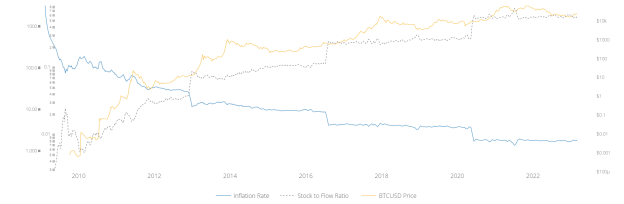

- The inflation rate of BTC is on a steady pace of decline since its inception.

The inflation rate of the leading cryptocurrency bitcoin has fallen by at least three times when compared to the rate of United States Dollars (USD).

Notably, the current inflation rate of BTC is around 1.8%. Since the inception of the coin in 2009, the inflation rate stands on a steady pace of decline.

Comparatively, the annual inflation rate of the US dollar in 2023 is 6.4%, indicating that the inflation rate of US dollars is 3.57 times greater than that of bitcoin.

Usually, the BTC inflation rate falls after every four years during the halving event; the next halving event is expected to occur in May 2024. While in 2011, the inflation rate of BTC was 50%, it was brought down to almost 12% after the first halving in 2012. In the second halving in 2016, it dropped to 4-5%.

During the previous halving, the value of BTC has increased, currently reaching a price of $22,438, indicating that after each halving the price of the coin increases, resulting in the fallen inflation rate.

Significantly, the current inflation rate is at a level far below the US Federal Reserve’s monetary inflation rate target of 2%.

Nick Timiraos, the Chief Economics Correspondent of the Wall Street Journal commented that the higher inflation target would help implement better monetary policies, stating:

Central banks probably won’t want to redefine their inflation target higher, but if they can get inflation down to 3% over the next year or two, they should live with that.

Interestingly, bitcoin’s deflationary model is the key factor for the falling inflation rate of the coin. The rate is dependent on the reward system for the miners, which is divided by half during each halving event.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.