- Bitcoin traded near $105,000 on October 17 with volume up about 36%, pointing to active repositioning.

- Technical analysts mapped a possible retest of $88,000 to $90,000 before any push toward new highs.

- A weekly close above $125,000 would invalidate the downside map and reopen the path to records.

Bitcoin traded around $105,000 on October 17 after a 5% daily drop and an 8% weekly slide. Turnover rose roughly 36% across major venues, suggesting traders rotated risk rather than exiting outright.

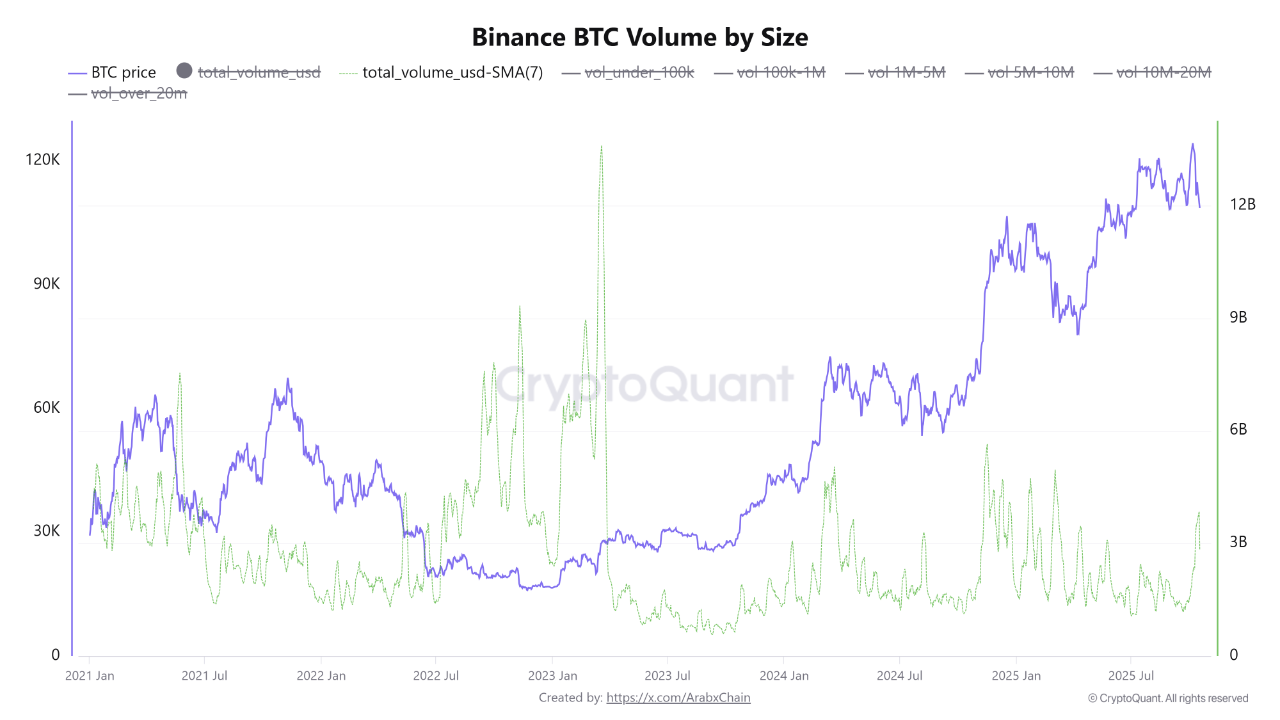

Binance data showed the seven-day average volume near its highest level since March, now hovering around $3.68 billion, which aligns with a reaccumulation read when price softens and activity builds. The setup places the next directional decision at the $100,000 to $105,000 zone as traders track how bids absorb supply.

Related: $4.0T Market, $1.8T Perps, $5.1T Spot: Q3 2025 Sets New Crypto Highs

Performance snapshot and key levels into Q4

The weekly chart retains an ascending channel that has guided the uptrend since early 2023. Resistance clusters near $124,000 to $125,000. Primary support sits at $100,000 with a mapped risk zone at $88,000 to $90,000 along the lower channel boundary.

Analysts frame $88,000 as a scenario, not a call, anchored to mid-trend mean reversion and prior demand nodes. That map changes if spot reclaims $112,000 and closes the week above $125,000, which would reassert momentum and set up a run at fresh highs.

BTC Price Analysis: Between Support and Resistance

Levels

At present, Bitcoin sits close to the mid-range of this channel, resting near the 20-week moving average. The RSI is at 47.7, indicating neutral momentum, while the MACD histogram suggests fading bullish strength but no confirmed reversal yet. The Chaikin Money Flow (CMF) remains slightly positive, showing steady inflows into the market.

A break below $102,000 increases the probability of a sweep toward $88,000 to $90,000 where the lower channel, lower Bollinger band, and prior acceptance converge. Holding above $105,000 keeps $112,000 and then $124,000 in play as recovery targets.

Momentum

Weekly RSI hovered near 48, a neutral read that neither confirms breakdown nor trend resumption. The MACD histogram softened but has not printed a decisive bearish cross on the weekly frame. That combination fits a consolidation tape where momentum cools while structure stays intact.

Liquidity and on-chain data

Exchange reserves remain near cycle lows, which limits immediate sell-side supply and supports a reaccumulation interpretation when volume rises into weakness. Funding rates eased and open interest contracted from recent peaks, reducing the risk of disorderly liquidation moves while keeping room for a squeeze if spot lifts through $112,000.

ETF net flows have slowed, but spot venues show steady taker activity that helped absorb downside without disorder.

Macro drivers

Macro liquidity tightened this week as U.S. short-term funding costs rose, which weighed on risk assets. Futures positioning normalized after earlier leverage buildups, removing some fuel from fast moves in either direction.

With supply on exchanges constrained and longer-term holders steady, the path into Q4 depends on whether buyers defend $100,000 on dips and press through $112,000 on strength.

Related: Altcoin Shakeout Ahead? Arthur Hayes Backs Tokens With Real Demand

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.