- Bitcoin tested $120,000 as Uptober kicked off and macro risk stayed in focus.

- ETH, SOL, and XRP advanced while traders watched for a decisive BTC breakout.

- Total crypto value hovered near $4.1T with BTC’s cap rivaling Amazon’s size.

Bitcoin led risk appetite on October 2, pressing toward $120,000 and setting a seven-week high as traders weighed fresh seasonality and the first U.S. government shutdown since 2018 to 2019. Spot BTC traded near $118,500 to $119,400 during the session, with the intraday high just under $119,400.

With October historically one of Bitcoin’s strongest months, posting gains in 10 of the past 12 years, the market appears set for what traders have long dubbed “Uptober.”

Bitcoin Leads Uptober Rally

This rally has helped push total crypto market capitalization up 3.5% to $4.16 trillion, while Bitcoin’s market cap now stands at $2.37 trillion, overtaking Amazon.

Analysts suggest that a mix of macroeconomic uncertainty and favorable seasonality is fueling the rally. US job openings rose marginally in August while hiring slowed, signaling persistent labor market fragility.

Meanwhile, the US government saw its first shutdown on October 1 after negotiations between the two sides failed and a budget was not passed. The delay in funding approval has put 750,000 federal employees in a tricky position.

Altcoins Gain, But Bitcoin Dominance Holds

While Bitcoin continues to dominate market direction, altcoins are beginning to show signs of life. Ether climbed over 5% in the past day to $4,390, its highest since late September, while Solana surged almost 8% and XRP gained 5%.

The question now is whether these altcoins will sustain momentum or if Bitcoin’s dominance will continue to overshadow their performance in the short term.

Related: Crypto Cycle Topped in 2025 or Still Bullish? ETF and Macro Viewpoints

What Do Analysts Say?

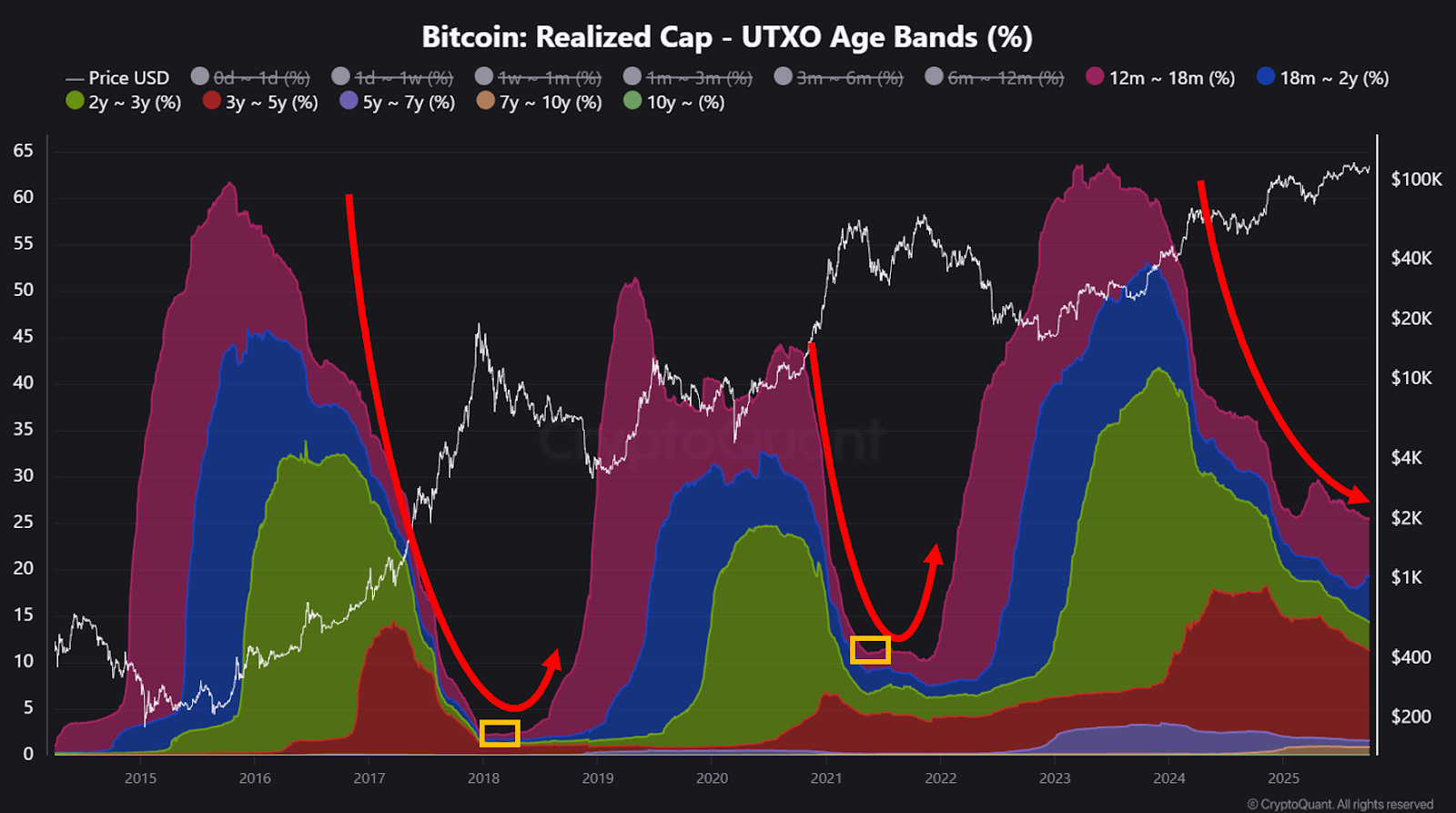

Market analysts remain divided. According to Crypto Dan, the current cycle shows parallels with previous bull runs, where long-term holders eventually began to offload Bitcoin as liquidity rotated into the market.

However, he noted that the share of BTC held for more than a year is only gradually declining, suggesting the cycle has not yet peaked.

“The current market is progressing slowly within the bull cycle, but there are no signs of an imminent end. In fact, a strong upward move may be just around the corner,” he said.

The Road Ahead for ETH, XRP, and SOL

Prominent analyst Ali Martinez highlighted that long-term holders are accumulating, with more than 3,800 BTC purchased over the past month.

Altcoin Vector described the shift as a “healthy reset” for altcoins rather than a capitulation event, stating that flows are rotating back into Bitcoin for now.

For Ethereum, XRP, and Solana, this creates a mixed near-term outlook. Their recent gains suggest that traders are willing to chase opportunities outside Bitcoin, but with BTC dominance breaking out of its range, capital could remain concentrated in the flagship crypto until a clearer breakout above $120,000 is confirmed.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.