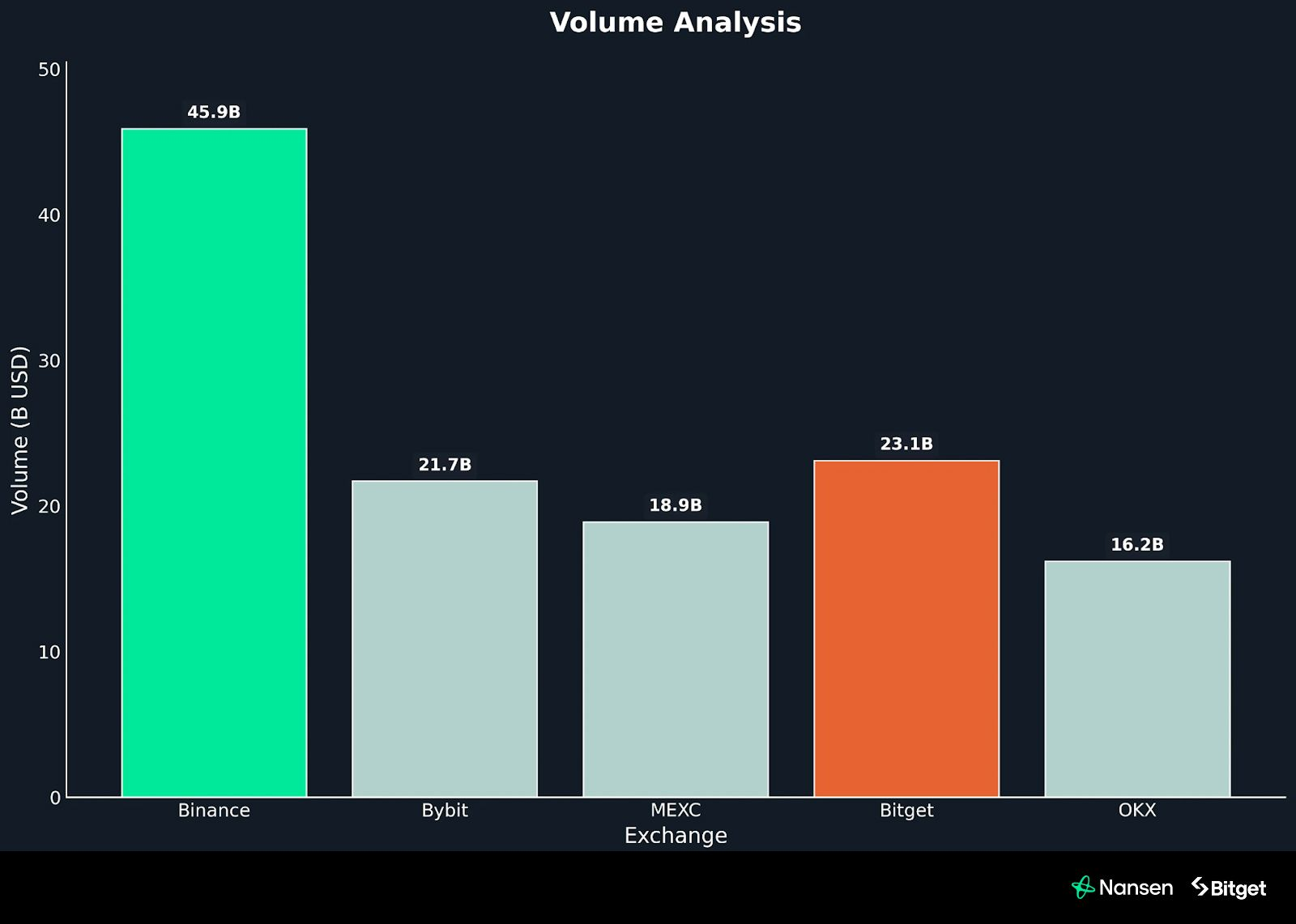

- Bitget ranks second globally with $23.1 billion in trading volume.

- Institutional spot and futures activity surged through 2025.

- The exchange has expanded its services to cater to large-scale clients, offering enhanced liquidity and lending options.

A new analysis from Bitget and Nansen shows the crypto exchange is quickly becoming a key hub for institutional traders. The report, published on Tuesday, shows Bitget’s trading volume reached $23.1 billion this year, making it the second-largest exchange globally, just behind Binance.

This growth signals a sharp rise in institutional involvement, with professional funds and market makers driving liquidity in both spot and derivatives markets. This shift represents a major step in the crypto market’s evolution toward a more institution-driven structure.

Related: AI-Focused Common (COMMON) Goes Live on Bitget With $36 Million in Token Rewards

Institutional Trading Surges Across Bitget Markets

Bitget’s spot market volume from institutional traders jumped from 39.4% at the start of 2025 to 72.6% by July, according to Nansen’s data. In futures markets, institutional participation grew from just 3% to 56.6% over the same period.

These changes have improved liquidity and execution quality on Bitget. The exchange saw deeper order books and tighter bid-ask spreads across major pairs like BTC/USDT, ETH/USDT, and SOL/USDT, even during volatile periods.

Bitget’s liquidity metrics back this up, with an Amihud Illiquidity Ratio of 0.0014 and a Roll Spread Estimate of 9.02 basis points, similar to Bybit and OKX.

These figures show that transactions can be executed efficiently without major price fluctuations, an essential factor for institutional funds.

Big Funds Driving On-chain Activity

The study also tracked on-chain flows from 31 institutional funds on Bitget between January and September 2025. Five of these funds, Laser Digital, Fenbushi Capital, Asteroid Capital, LD Capital, and Hashed, accounted for over 95% of all positive net inflows.

Laser Digital led with $2.6 million in net deposits, while Fenbushi Capital had a 100% net efficiency ratio, meaning it deposited without withdrawing. This concentration highlights both growing institutional confidence in Bitget’s infrastructure and the potential for more diverse institutional involvement.

Liquidity, Custody, and Lending Drive Institutional Growth

Bitget has expanded its services to support larger institutional clients. Its loan program offers up to $10 million in USDT-backed lending with up to 5x leverage, flexible repayment terms, and no forced liquidations for qualified borrowers.

The exchange has also enhanced its custody options, integrating with providers like Fireblocks, Copper, and OSL. These developments reflect a broader industry trend where institutions prioritize transparent custody, low execution costs, and reliable liquidity over speculative trading.

Institutional Adoption Defines 2025 Market

The report highlights Bitget’s growth as part of a broader market shift. Institutions now account for nearly 80% of total trading volume on centralized exchanges. Additionally, U.S. spot Bitcoin ETFs hold $153 billion in assets, led by BlackRock’s iShares Bitcoin Trust with $88 billion.

Analysts predict institutional holdings could reach 4.2 million BTC by 2026, making up roughly one-fifth of the total supply. Regulatory changes, like the repeal of SAB 121 in the U.S. and Europe’s MiCA framework, are also strengthening institutional trust in the crypto market.

Bitget’s Universal Exchange Vision

Bitget’s CEO, Gracy Chen, described liquidity as “the heartbeat of any market.” The exchange’s transition to a Universal Exchange (UEX) model aims to unite centralized and decentralized finance, offering deep liquidity, institutional-grade trading tools, and tokenized asset access in one platform.

In the first half of 2025, Bitget averaged $750 billion in monthly trading volume, with derivatives making up about 90%. Spot market activity grew by 32% in May alone, and institutional accounts nearly doubled during the ETF launch period earlier in the year.

Related: Bitget GetAgent Project Review: AI-Powered Trading Assistant Revolutionizes DeFi Experience

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.