- TAO’s sustained position above key Fibonacci supports strengthens its bullish outlook.

- Rising open interest near $253M indicates renewed trader confidence in TAO’s trend.

- Gradual inflows and stable liquidity highlight a cautious but strengthening accumulation phase.

Bittensor (TAO) is showing signs of a structured recovery as it continues to trade above crucial support levels. After hitting lows near $246 in October, TAO has formed a well-defined Fibonacci retracement structure that indicates renewed buying pressure and a bullish technical setup. The asset’s stability above short-term moving averages and renewed open interest suggest rising trader confidence and the potential for another upward move toward $500.

Consolidation Signals Strength

TAO is currently trading at $439.63, consolidating just above the 0.786 Fibonacci level at $428.87. This area has become an immediate support zone following a strong rebound from $362.33, which coincides with the 0.5 Fibonacci level. The price remains comfortably above the 20-day and 50-day exponential moving averages, signaling sustained bullish momentum.

Besides, the confluence of these supports near $418–$430 strengthens the short-term structure. The next key resistance sits between $460 and $478. A breakout above this zone could confirm a new leg higher toward $500–$520. However, a close below $400 would invalidate the current trend and expose TAO to a retest of the $362 support level.

Open Interest and Market Sentiment

Open interest in TAO futures reflects renewed speculative activity across exchanges. After beginning the year around $180 million, it peaked above $300 million in Q2 as traders increased leveraged positions.

Related: Ethereum Price Prediction: UK ETP Launch Sparks Optimism With Bulls Eyeing $4,500

Mid-year corrections led to temporary declines, but October data shows open interest rebounding to $253.24 million while TAO traded near $437. This rebound suggests that traders are positioning for another major price movement, signaling increasing confidence in the asset’s trajectory.

Moreover, the growing open interest aligns with the bullish technical picture, reinforcing expectations of sustained volatility and directional expansion in the coming weeks.

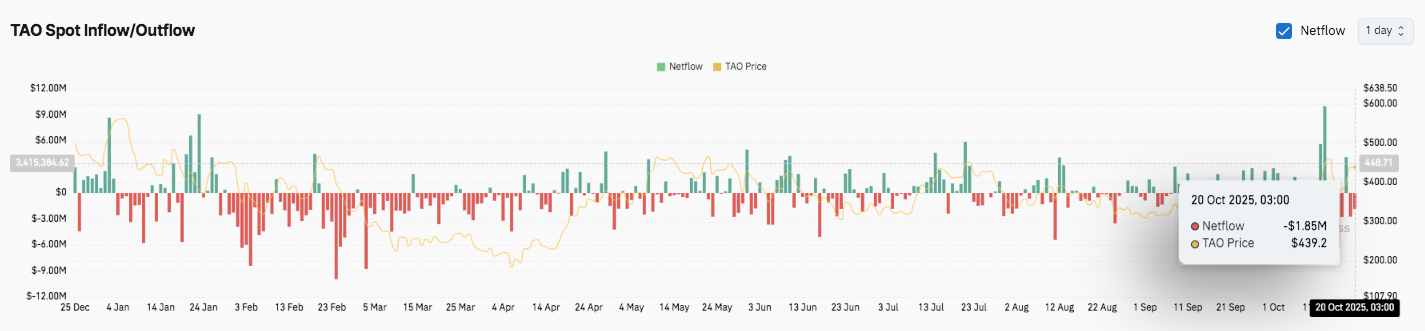

Inflows, Outflows, and Liquidity Trends

Market data reveals alternating inflows and outflows since early 2025. Heavy red bars between January and March reflected strong sell pressure, with outflows surpassing $9 million. Consequently, TAO’s price dipped during that period. However, inflows reappeared between June and September, providing stability around the $400 level.

On October 20, net outflows of $1.85 million indicated cautious sentiment among investors. Hence, while accumulation remains moderate, liquidity conditions suggest that buyers are gradually regaining control.

Technical Outlook for Bittensor (TAO) Price

Key levels remain well-defined as Bittensor trades in a bullish recovery structure after its October rebound.

- Upside levels: $460, $475, and $478.66 act as near-term resistance. A breakout above this zone could extend gains toward $500 and $520.

- Downside levels: $428.87 (0.786 Fib) serves as immediate support, followed by $400 (50 EMA) and $362.33 (0.5 Fib). A sustained drop below $400 may weaken the bullish setup and open a retest of the $362–$334 zone.

- Resistance ceiling: The $478.66 swing high remains the critical level to flip for medium-term momentum confirmation.

The current structure suggests TAO is consolidating within a rising channel, where each pullback finds support near the 20 EMA. This pattern reflects controlled accumulation and higher lows a sign of steady institutional demand.

Will Bittensor Break Toward $500?

TAO’s short-term direction depends on whether buyers can defend the $428–$418 range, which has repeatedly acted as a demand zone. If bullish momentum persists alongside rising open interest, a breakout toward $475 and $500 becomes increasingly likely. However, failure to hold above $400 would signal temporary exhaustion, potentially exposing TAO to a deeper retracement near $362.

Related: Solana Price Prediction: Traders Eye Key Breakout as Market Stabilizes

For now, Bittensor remains in a pivotal accumulation phase. The combination of growing leverage exposure and firm technical support levels keeps the broader outlook tilted toward a bullish continuation into late October.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.