- Bitwise CEO says Solana’s shorter unstaking period favors ETF issuers over Ethereum.

- SEC will decide on multiple Solana and Ethereum ETF applications in October.

- SOL trades above $222 with a potential breakout to $300.

Bitwise CEO Hunter Horsley said Solana could gain an advantage over Ethereum in the race to launch staking exchange-traded funds, citing its faster unstaking process. His comments come as the U.S. SEC prepares to decide on several ETF applications this month.

Bitwise CEO Highlights Solana’s ETF Advantage

Speaking at Token2049 in Singapore, Horsley mentioned that Solana’s shorter unstaking period makes it easier for ETF issuers to meet redemption requests. Ethereum’s withdrawal queue, by comparison, has grown significantly, creating long delays for investors.

“It’s a huge problem,” Horsley said, stressing that ETFs must be capable of returning assets within a very short period.

Related: Solana Price Prediction: SOL Price Consolidates Within Rising Channel

Liquidity Challenge for Ethereum ETFs

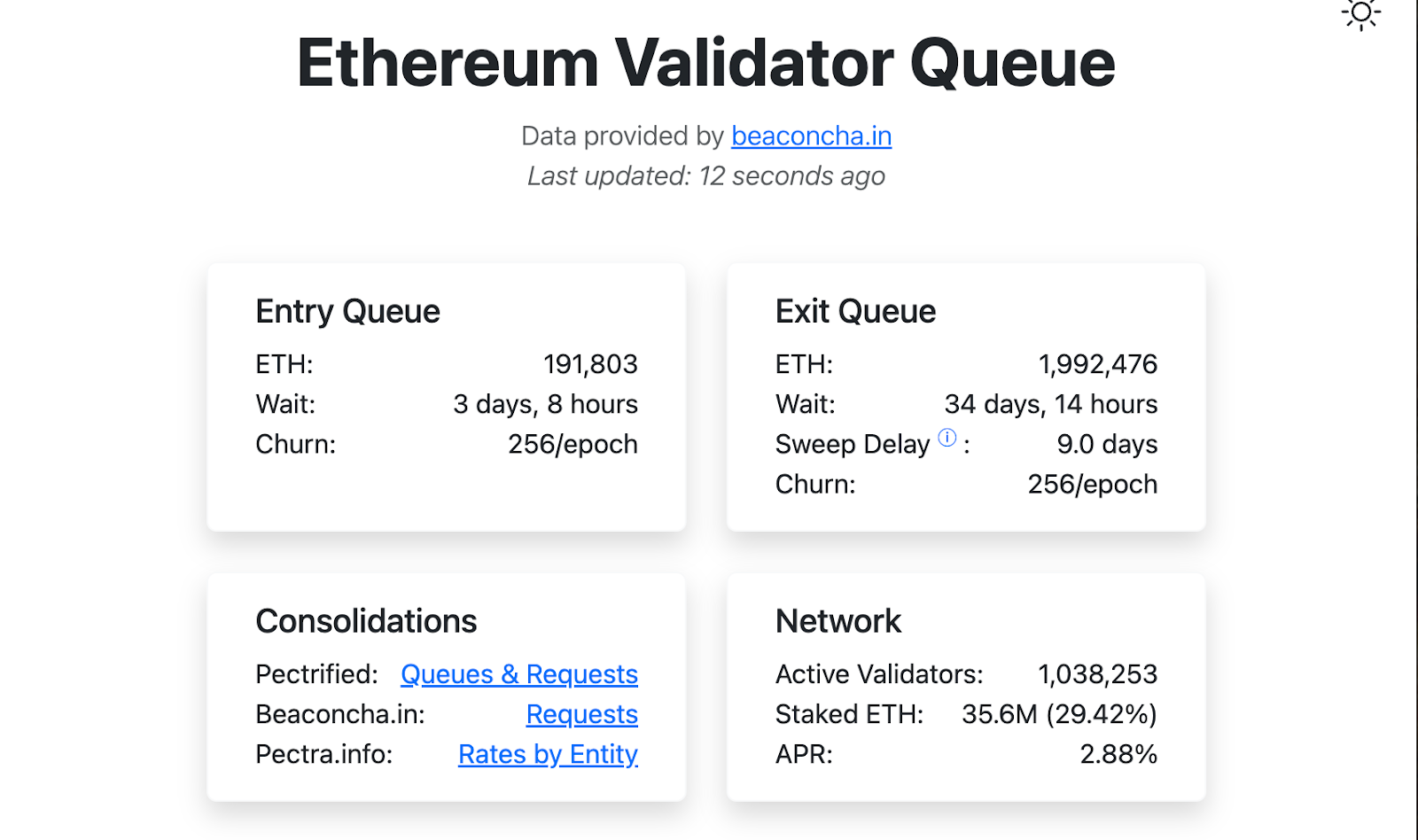

On-chain data shows Ethereum’s staking system currently faces an average entry wait of about three days and an exit queue of roughly 34 days, with more than 2 million tokens awaiting withdrawal.

However, Solana’s exit period is much faster, which Horsley argues makes it more suitable for regulated funds that require quick liquidity.

Ethereum-based products have worked around this issue through credit facilities and liquid staking tokens such as stETH. Yet, Horsley noted these options add costs and face capacity constraints.

SEC ETF Decisions This October

The SEC is reviewing ETF applications from major asset managers, including Bitwise, Fidelity, Franklin Templeton, Grayscale, and VanEck.

Decisions on Ethereum staking ETFs have already been delayed until late October, while Solana ETF proposals are also awaiting review. The ongoing U.S. government shutdown has raised concerns about further delays in approvals.

Horsley’s comments come as institutional interest in Solana continues to grow. Multiple issuers filed amended S-1 documents in recent weeks to include staking provisions in their pending ETF applications.

SOL Price Builds Momentum Ahead of SEC’s ETF Rulings

Solana is trading at $225, up 3.9% in the past 24 hours, and has increased its weekly gains to 11.3%. Technical indicators suggest steady buying pressure, with the Relative Strength Index at 59.

Immediate support lies between $200 and $206, while resistance levels stand at $230 and $250. Analysts note that approval of a Solana ETF could accelerate gains, with price targets above $300 by year-end.

Related: Solana Price Prediction: Can SOL Sustain Momentum Above $200?

Meanwhile, Ethereum remains close to its all-time high, trading at $4,381, a 2.3% increase over the past day. Solana has more ground to recover, sitting 34% below its January top of $295. Institutional wallets have been active in recent weeks, adding to Solana positions during price dips and helping maintain momentum.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.