- Bitwise has partnered with Proficio Capital to launch a new ETF dubbed BPRO.

- The BPRO will trade on the NYSE, offering investors an efficient tool to counter currency debasement.

- BPRO keeps at least 25% in gold, with the rest split across Bitcoin and other metals.

Bitwise Asset Management has partnered with Proficio Capital Partners to launch the Bitwise Proficio Currency Debasement ETF (NYSE: BPRO). The BPRO is touted as the missing tool in modern portfolio management since it helps investors counter the infinite and fast-rising global money supply.

Bitwise and Proficio Capital Unveil BPRO to Counter Inflation

According to the announcement, the BPRO ETF is a basket of time-tested hard assets. Furthermore, the two firms intend to help investors counter the declining purchasing power of fiat currencies with the help of Bitcoin (BTC), Gold (XAU), Silver (XAG), precious metals, and mining equities.

The Chief Investment Officer (CIO) at Bitwise, Matt Hougan, stated that BPRO will play a crucial role in protecting wealth. Moreover, investors have relied on stocks and bonds to counter currency debasement, which has failed in recent years due to the sharp upsurge in global money supply.

“By combining the historical scarcity of gold with the modern, digital scarcity of bitcoin, BPRO offers a powerful new way to hedge against the persistent decline of fiat currency. We believe this ‘hard asset’ approach is the missing piece for the modern portfolio,” Hougan stated.

In order to ensure the long term prosperity of BPRO, Bitwise announced that it will actively manage it to adjust its holdings in accordance with the market conditions. According to Bob Haber, CIO at Proficio, BPRO will catalyze the mainstream adoption of Gold through tokenization since this financial instrument remains a ghost in modern portfolios.

“BPRO represents the evolution of our wealth preservation mission, shifting between precious metals and digital stores of value to help provide a flexible shield,” Haber stated.

What’s the Bigger Market Picture?

The BPRO will seek to invest a minimum of 25% in gold at any time. The holders of the BPRO ETF will get the remaining 75% exposed to other precious metals in addition to Bitcoin.

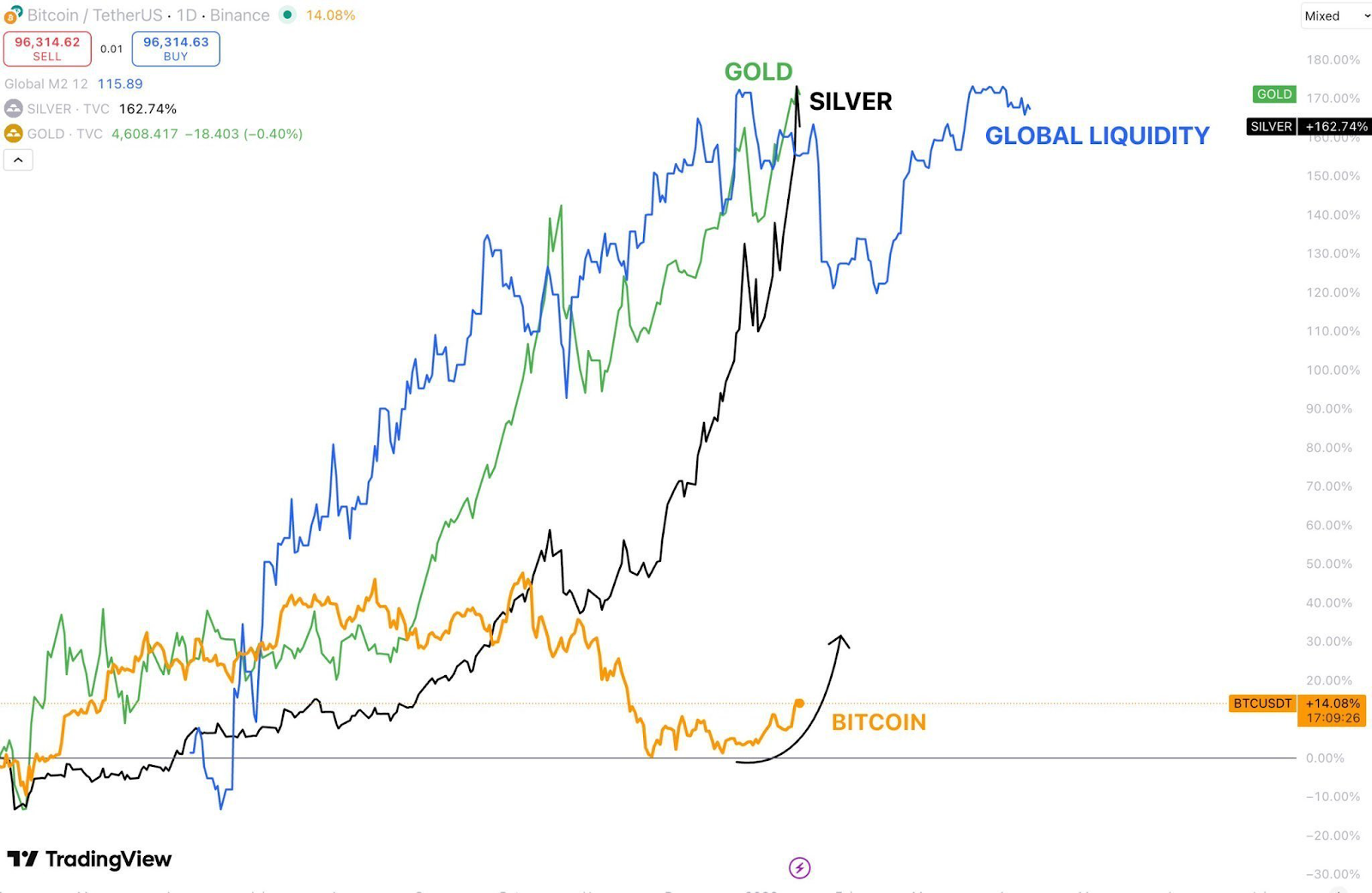

With the global rising demand for precious metals and Bitcoin on the rise, BPRO is well-positioned to protect investors’ wealth. Notably, the gold price has more than doubled in the past two years to trade at about $4,946 per ounce at press time.

Similarly, Silver price has more than doubled in the past two years to enter its parabolic bull phase. During the past 24 hours, Silver price surged 2.6% to trade at about $98.66 per ounce at press time.

Meanwhile, Bitcoin price has lagged behind the precious metal’s-led bull market, amid the ongoing uptick in global money supply.

Related: Gold Hits All-Time High While Bitcoin Lags in Safe-Haven Debate

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.