- BlackRock Expands BUIDL Fund to Five New Blockchains, Enhancing Accessibility

- BUIDL’s Cross-Chain Expansion Drives Innovation and Access for Blockchain Developers

- Diverse Blockchain Integrations Enable Broader Investor Access to On-Chain Yields

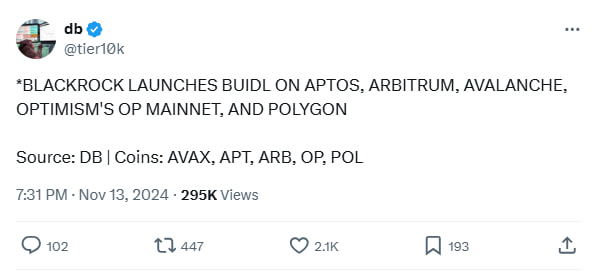

BlackRock is expanding its crypto footprint by launching new share classes of the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) on five different blockchain ecosystems: Aptos, Arbitrum, Avalanche, Optimism’s OP Mainnet, and Polygon. The fund’s initial debut on Ethereum in March 2024 was already a strategic step to strengthen BlackRock’s role in the growing tokenization market.

By integrating these diverse chains, BUIDL will offer increased accessibility and utility for investors, decentralized organizations, and blockchain-native firms. This expansion not only highlights BlackRock’s commitment to innovation but also allows developers and users to leverage BUIDL’s offerings across leading blockchain ecosystems.

Enhanced Accessibility Across Multiple Blockchains

Each of the selected blockchains has unique strengths that contribute to the BUIDL ecosystem.

Aptos, a next-generation Layer 1 blockchain, uses advanced technology and the Move programming language to ensure enhanced performance and safety for users.

Arbitrum, a prominent Ethereum Layer 2 solution, provides low-cost and fast transactions through Optimistic Rollup technology, which makes it a popular choice for developers. Also, Avalanche, known for its high-speed, low-fee network, is designed for scalable tokenized assets and institutional use cases.

Polygon PoS offers seamless EVM compatibility and innovative features like account abstraction, catering to millions of daily active users and developers. Meanwhile, Optimism’s OP Mainnet contributes through its Superchain, which unifies multiple blockchains with shared governance and security.

This interconnected system supports high-profile projects, which helps Ethereum move to broader internet-scale applications. These integrations will improve the overall user experience and extend BUIDL’s operational reach.

Advantages for Investors and Developers

When BlackRock extends BUIDL to these blockchains, it will give a broader range of investors and developers the ability to engage with its tokenized fund in their preferred ecosystems.

The fund offers on-chain yield, 24/7 peer-to-peer transfers, and on-chain dividend accrual and distribution. This expanded access will benefit decentralized autonomous organizations (DAOs) and digital asset-focused firms that require more flexible financial products. Furthermore, the integration with these blockchains will create new opportunities for developers to build blockchain-based financial products and services.

Read also: BlackRock BTC ETF Captures $1B in a Week as Market Cap Hits $63B

With BNY acting as the fund administrator and custodian, there will be a seamless bridge between traditional finance and blockchain-based systems. This partnership will lead to the secure and efficient deployment of BUIDL across the new platforms.

Each blockchain integration has its own management fee structure. Aptos and Avalanche investors will have a 20 bps fee, while Arbitrum, Optimism, and Ethereum will have a 50 bps fee. Also, organizations like the Aptos Foundation, Avalanche (BVI), Inc., and Polygon Labs BD Investments (Cayman) Ltd. make quarterly payments to BlackRock, which are determined by the average value of the shares for the quarter.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.