- BlackRock sold Ethereum for the second time in a week, pushing ETH below the $4,000 mark.

- Ethereum ETFs saw over $351 million in net outflows in two days this week.

- More than 420,000 ETH have been withdrawn from exchanges, signaling strong long-term accumulation.

Ethereum is going through a tense market environment after back-to-back days of heavy institutional outflows and a sharp dip below $4,000. BlackRock sold ETH for the second time in seven days, while exchange-traded funds shed more than $315 million in just two sessions.

Short-term sentiment turned defensive, but on-chain flows suggest long-term buyers are quietly accumulating supply.

$315 Million ETF Exodus in 48 Hours

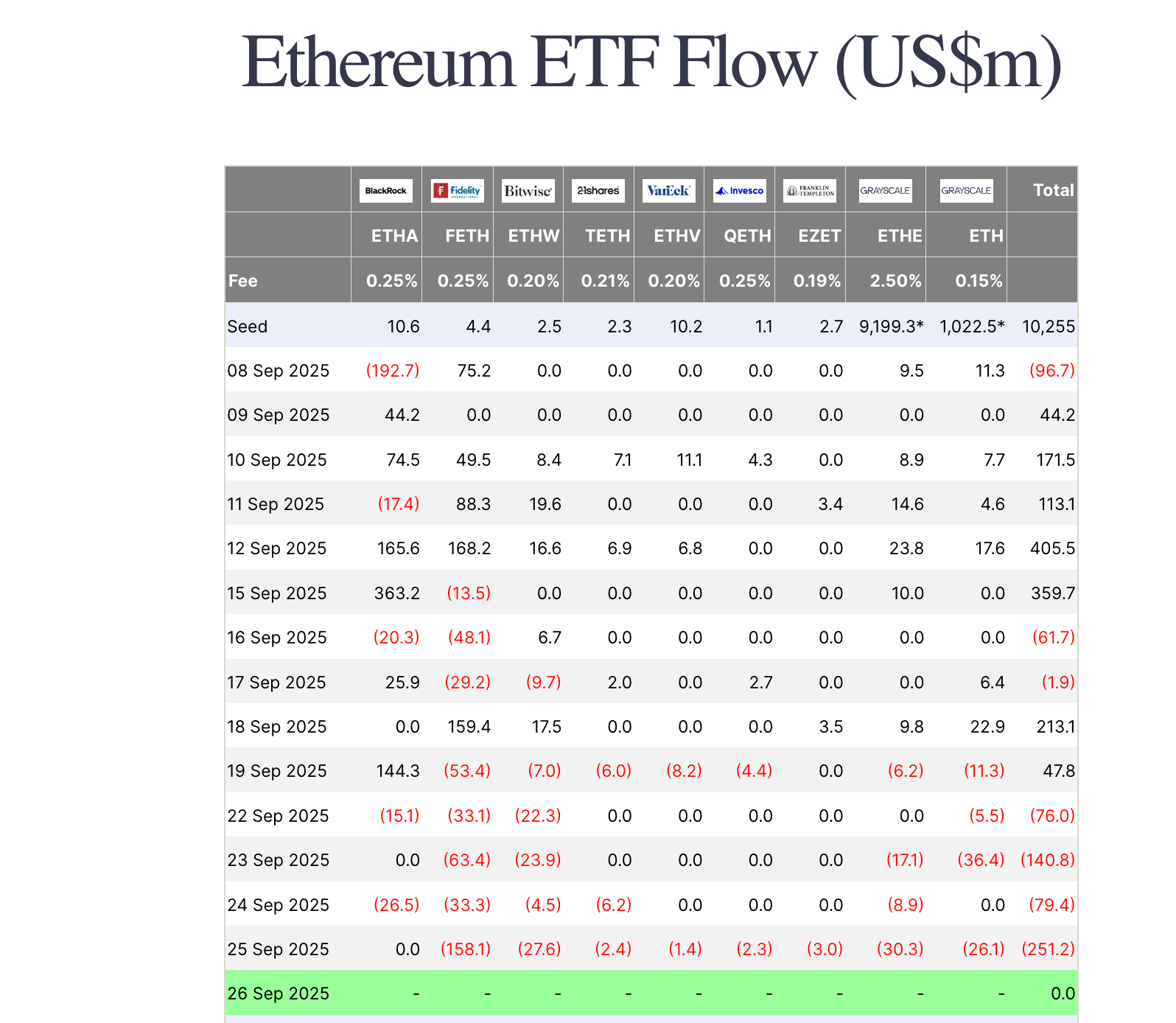

Ethereum exchange-traded funds (ETFs) recorded significant capital outflows between September 24 and 25.

- September 24: $79.4 million in redemptions

- September 25: $251.2 million in withdrawals, marking a sharper sell-off

This two-day total of more than $315 million extends a four-day streak of heavy redemptions, reversing the bullish momentum that followed the Federal Reserve’s recent 25 bps rate cut. For context, outflows earlier in the week totaled $76 million on Monday and $140.8 million on Tuesday.

Among the notable losses:

- Fidelity’s FETH: $63.4 million pulled on September 23, with more redemptions the following day.

- Grayscale’s ETHE: $8.9 million withdrawn on September 24 and another $30.3 million on September 25.

- Bitwise ETHW: $4.5 million in redemptions on September 24, followed by $27.6 million on September 25.

BlackRock’s ETH Sell-off Stoke Anxiety

A Binance Square trader highlighted that BlackRock, the world’s largest asset manager, sold Ethereum for the second time in a week. BlackRock’s Ethereum ETF offloaded about $15 million in ETH on September 22 and another $26.5 million on September 24.

Interestingly, while BlackRock paused sales on Thursday, Ethereum ETFs overall still saw $251 million in outflows that day as other asset managers continued selling.

ETH Price Pulled Under $4,000

The wave of redemptions pressured the market, with Ethereum briefly slipping to $3,829 earlier today before recovering slightly. Over the same period, more than $870 million in altcoin liquidations were recorded, including about $280 million in ETH positions.

Market caution deepened after Fed Chair Jerome Powell signaled “no rush” for further rate cuts, muting the positive effect of the recent policy move. At press time, Ethereum trades near $3,923.

On-Chain Data Shows Long-Term Accumulation

Despite slowing ETF inflows, with a negative $140 million flow for September compared with a positive $3.8 billion in August, on-chain data paints a more constructive picture. Roughly 420,000 ETH were withdrawn from exchanges this week, pushing exchange balances to nine-year lows.

Related: Ethereum Nears $4,000 Base While Exchange Balances Slide to 14.8 Million ETH

CoinW CSO Nassar Achkar observed that this reflects a growing shift toward long-term holding among institutional investors. He suggests that large holders may be buying the dip and positioning for a potential supply shock.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.