- BNB Chain’s full RWA stack positions it as a leader in large-scale tokenization

- BNB price surge past $1,000 signals strong momentum despite overbought conditions

- Rising open interest and CZ speculation fuel optimism for further BNB upside

BNB Chain has stepped out front in the race to tokenize real-world assets. From gold to treasuries to equities, the network is putting its full stack to work. The build-out covers compliant issuance, secondary liquidity, and DeFi integration inside one ecosystem.

Complete RWA Ecosystem

The architecture integrates three core layers. The BNB Smart Chain handles secure execution with low fees and real-time finality. OpBNB powers high-throughput rollups, while Greenfield provides decentralized data storage.

Together, these layers allow the platform to host several RWA projects already leading the market.

Related: BNB Market Cap Tops UBS, Price Targets Stretch to $1000–$1300 in Bull Cycle

BNB Price Clears $1,000 With Momentum Intact

BNB currently trades at $1,002.66, showing a 5.22% increase in 24 hours and an 11.75% gain over the past week. The token’s market capitalization has reached nearly $140 billion, supported by a circulating supply of 140 million coins.

Technical indicators reveal a bullish setup. The MACD line remains above the signal line, reflecting strong upward momentum. However, the RSI at 77 points toward overbought conditions. This may suggest a short-term consolidation before another push higher.

Popular crypto analyst Ali Martinez has projected that BNB could climb toward $1,300 if it sustains a breakout beyond $1,000. He believes current market conditions, combined with institutional demand for RWAs, support this scenario.

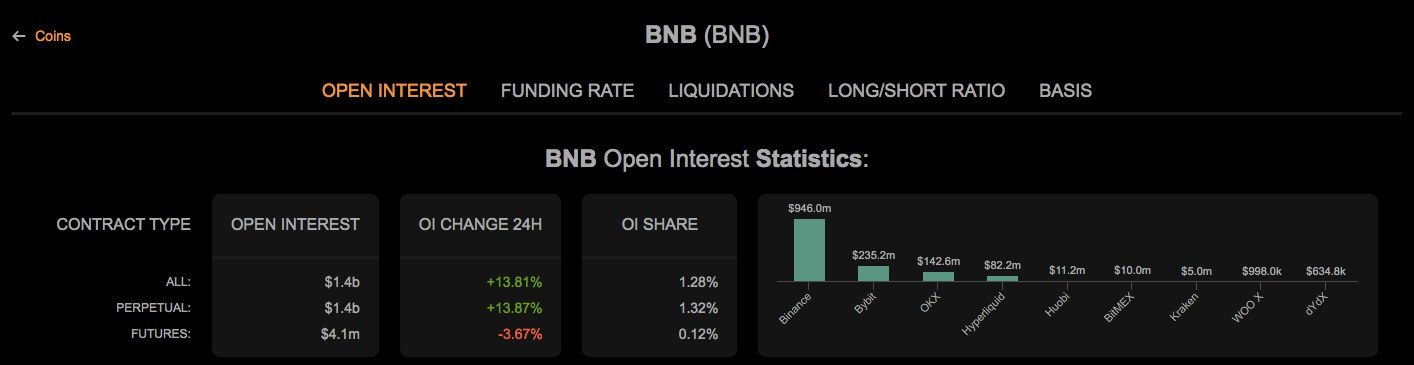

Derivatives Data Show Surge in Speculation

Derivatives data confirm strong interest in BNB. Open interest has surged to $1.4 billion, up nearly 14% in one day. Binance leads the market with $946 million in open contracts, followed by Bybit and OKX. This sharp rise signals heightened speculative activity around the asset’s latest rally.

Meanwhile, speculation is swirling around founder Changpeng Zhao, who recently adjusted his online profile to suggest a closer association with Binance. While regulatory restrictions still apply, talk of his potential return has added further excitement around the token’s trajectory.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.