- BNB’s market cap has surpassed that of UBS bank, currently ranked 148 most valuable company.

- Binance CEO has signaled a more bullish outlook for BNB amid the ongoing altcoin breakout.

- BNB price is well-positioned to hit $1000 in the near term, but remains overbought in the short term.

Binance’s co-founder Changpeng Zhao (CZ) says banks should begin adopting BNB, arguing that integration would strengthen both balance sheets and user reach. His comments came as BNB’s market capitalization climbed past Swiss lender UBS, hitting $130.7 billion compared with UBS’s $129 billion. That milestone places BNB at the 148th spot among the world’s most valuable companies.

“As a small community member, I am happy to help any bank integrate,” CZ wrote on X, celebrating BNB’s growth alongside the Binance community.

Why CZ Says Banks Should Integrate BNB

CZ’s message coincides with a broader altcoin breakout. He has used his platform to promote BNB and related projects, including PancakeSwap and Trust Wallet, pointing to the token’s growing utility in decentralized applications.

For banks, adopting BNB could provide three advantages:

- On- and off-ramp efficiency: Seamless investor flows in a regulated manner.

- Balance sheet strength: Holding an appreciating digital asset.

- Organic user capture: Attracting Binance’s retail and institutional community.

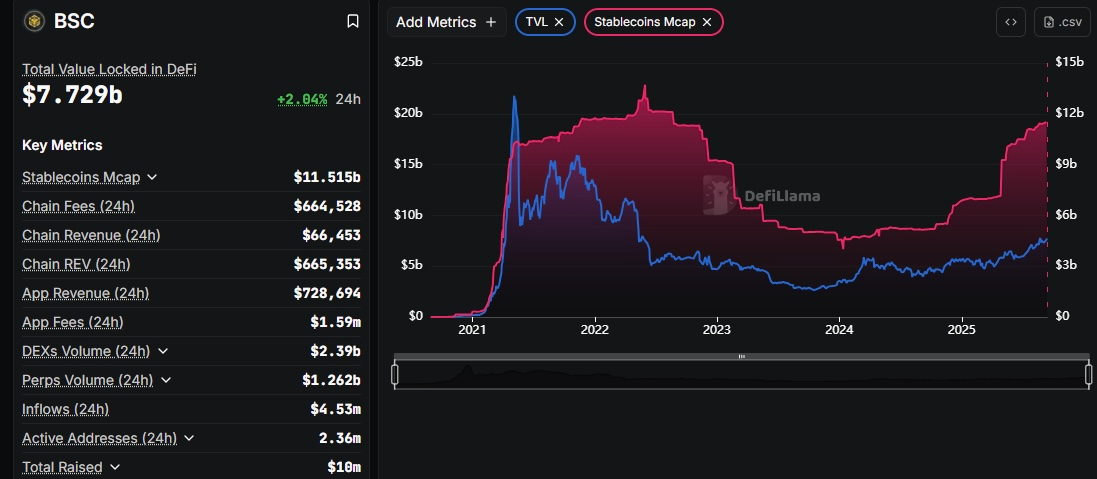

The BNB Chain currently shows $7.7 billion in total value locked (TVL) and $11.5 billion in stablecoin capitalization, according to DefiLlama, key fundamentals CZ says make the asset suitable for institutional rails.

Public Firms Already Using BNB

Several listed firms have already adopted BNB for treasury management purposes. For instance, BNB Network Company (NASDAQ: BNC) purchased 200k BNBs last month. Other publicly traded companies that have implemented BNB treasury management include Nano Labs (Nasdaq: NA), Windtree Therapeutics (Nasdaq: WINT), and Liminatus Pharma (Nasdaq: LIMN).

Meanwhile, REX-Osprey filed for the second spot BNB ETF application with the U.S. SEC.

Related: REX-Osprey Files for Second-Ever BNB Staking ETF, Helps in BNB’s 3% Rebound

How Far Can BNB Price Rally in the Coming Weeks?

Are the Bulls Wavering?

From a technical analysis standpoint, the BNB price has broken out to its possible euphoric phase of the 2025 bull rally. Following its 10% rally during the past 7 days, the BNB price has successfully broken out of a rising logarithmic resistance trendline.

In the daily timeframe, BNB’s Relative Strength Index (RSI) has rallied to above the 70 level, thus entering overbought levels. A bull signal has also been made by the daily MACD indicator, whereby the MACD line has crossed above the signal line while hovering above the zero line.

As such, it is safe to assume that the BNB bulls are in control.

What’s Crypto Analyst Expecting for the Midterm Target?

According to crypto analyst Ali Martinez, the BNB price is well-positioned to rally above $1000 and reach a midterm target of about $1,300.

The crypto analyst noted that the BNB price has consistently closed above the 2021 all-time high of around $660, and converted it to a support level.

Related: How BNB’s Utility, Institutional Backing, and Price Discovery are Fueling its Rally

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.